Get the free Employer Transit Pass Credit 2008

Show details

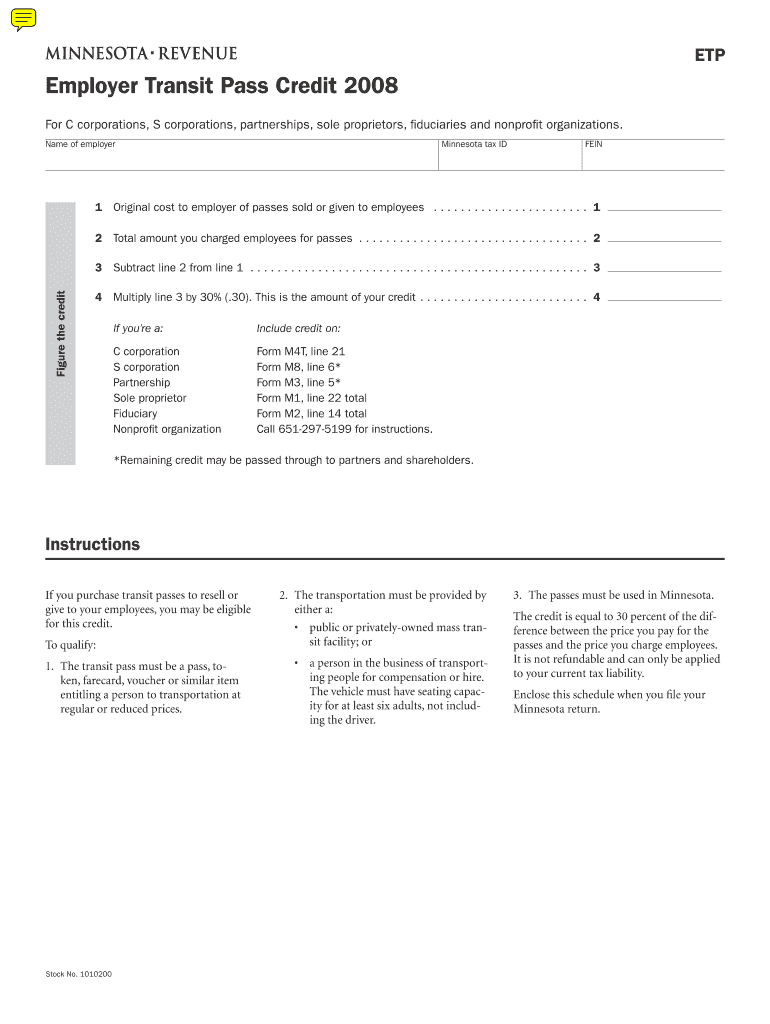

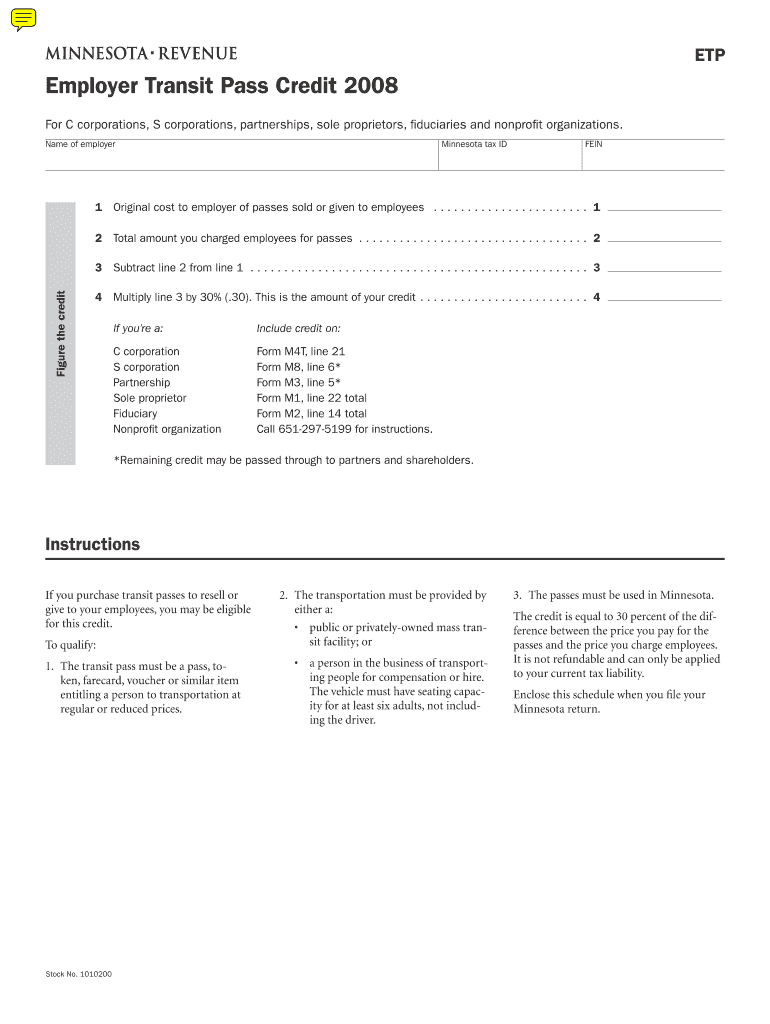

A tax credit form for employers in Minnesota purchasing transit passes for employees, detailing eligibility and calculation methods.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer transit pass credit

Edit your employer transit pass credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer transit pass credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer transit pass credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employer transit pass credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer transit pass credit

How to fill out Employer Transit Pass Credit 2008

01

Obtain the Employer Transit Pass Credit 2008 form from the relevant tax authority.

02

Fill in your employer's information, including name, address, and tax identification number.

03

Indicate the total amount of transit passes purchased on behalf of employees.

04

Provide details of the employees who received transit passes, including their names and the number of passes issued.

05

Calculate the credit amount based on the eligible expenses.

06

Sign and date the form to certify its accuracy.

07

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs Employer Transit Pass Credit 2008?

01

Employers who provide transit passes to their employees as part of an employee benefit program.

02

Employers looking to claim credits for the costs associated with the purchase of transit passes.

Fill

form

: Try Risk Free

People Also Ask about

What is the unsafe conditions commuting rule?

The unsafe conditions commuting rule applies if the employee would ordinarily walk or use public transportation and you only allow the employee to use the vehicle for commuting.

What are employer paid transportation benefits?

Commuter benefits are fringe benefits that cover an employee's transportation-related expenses with pre-tax dollars. Transportation benefits are exempt from income tax withholding, Social Security and Medicare (FICA) taxes, and federal unemployment tax.

Can employees deduct a monthly maximum of $130 for employer subsidized transit passes in 2016?

For 2016, the monthly exclusion under both §132(f)(2)(A) (the aggregate of transportation in a commuter highway vehicle and any transit pass) and § 132(f)(2)(B) (qualified parking) is $255. Section 132(a)(5) provides that any fringe benefit that is a qualified transportation fringe is excluded from gross income.

What is the employer transit pass credit in Minnesota?

The credit is equal to 30% of the difference between the price you pay for the passes and the price you charge employees. It is not refundable and can only be applied to your current tax liability. Enclose this schedule when you file your Minnesota return.

What are the IRS rules for relocation 50 miles?

The distance test is met when the new official station is at least 50 miles further from the employee's current residence than the old official station is from the same residence.

What is the IRS commuter rule?

ing to the IRS, any expenses related to commuting between your home and regular workplace are generally considered personal and nondeductible. Commuting is an everyday activity that is not considered a business expense.

How many miles is considered commuting?

A typical example of commuting miles is an employee's daily drive from their workplace and then back home again. While running to the store for office supplies over the course of a workday counts toward business mileage, a worker's 20-mile daily commute remains a personal expense, and won't qualify for deductions.

What does IRS consider commuting distance?

Commuting miles are not tax deductible, and the IRS defines them as: Driving from home to a permanent workplace. Driving from home to your second workplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer Transit Pass Credit 2008?

Employer Transit Pass Credit 2008 is a tax incentive that allows employers to claim a credit for providing transit passes to their employees, aimed at promoting the use of public transportation.

Who is required to file Employer Transit Pass Credit 2008?

Employers who provide transit passes to their employees and wish to claim the credit are required to file Employer Transit Pass Credit 2008.

How to fill out Employer Transit Pass Credit 2008?

To fill out Employer Transit Pass Credit 2008, employers need to complete the appropriate tax forms detailing the number of transit passes provided, the total cost incurred, and any other required financial information.

What is the purpose of Employer Transit Pass Credit 2008?

The purpose of Employer Transit Pass Credit 2008 is to encourage employers to support public transit usage by providing financial incentives for the distribution of transit passes to employees.

What information must be reported on Employer Transit Pass Credit 2008?

The information that must be reported includes the total number of transit passes issued, the cost of those passes, and the specific details of the employees who received them.

Fill out your employer transit pass credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Transit Pass Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.