MN DoR M4 2008 free printable template

Show details

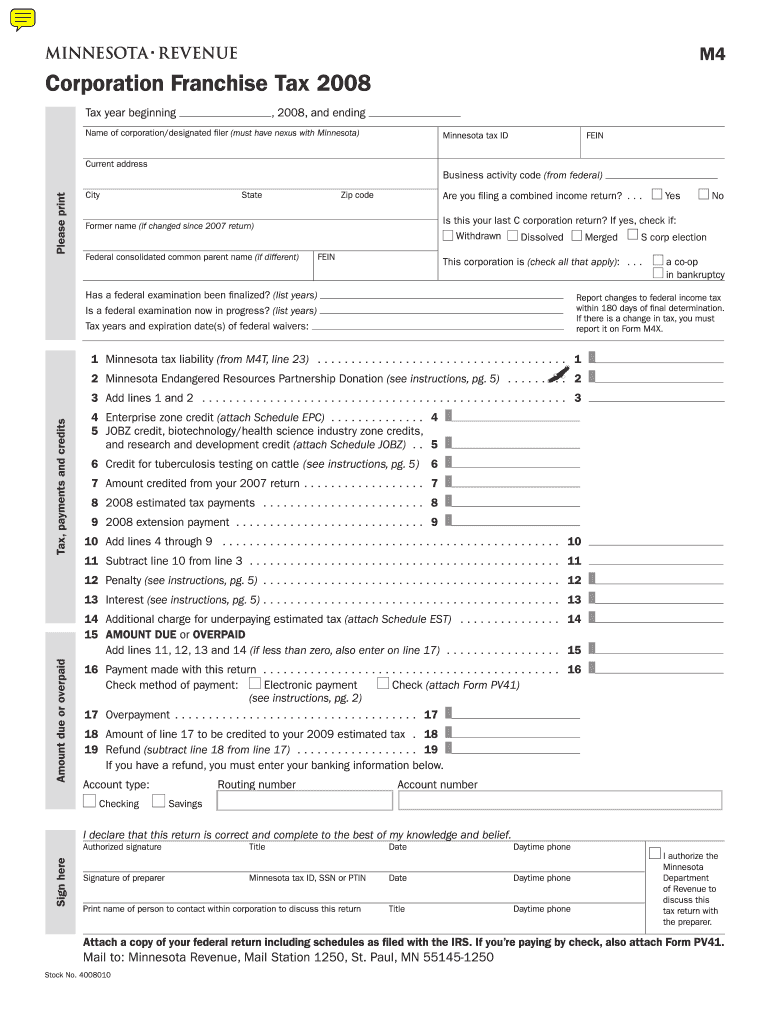

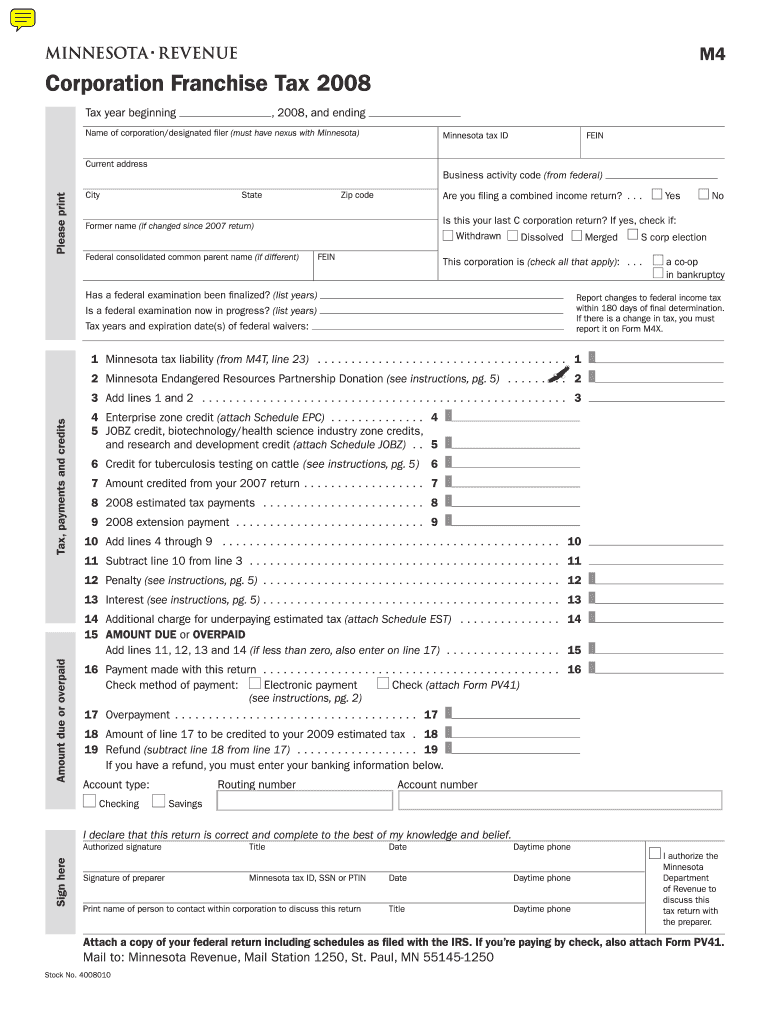

M4 Corporation Franchise Tax 2008 Tax year beginning, 2008, and ending Minnesota tax ID VEIN -- Current address City State Zip code Name of corporation/designated filer (must have nexus with Minnesota)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2008 m4 corporation franchise

Edit your 2008 m4 corporation franchise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008 m4 corporation franchise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008 m4 corporation franchise online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2008 m4 corporation franchise. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR M4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2008 m4 corporation franchise

How to fill out MN DoR M4

01

Download the MN DoR M4 form from the official Minnesota Department of Revenue website.

02

Carefully read the instructions provided with the form to understand the filing requirements.

03

Fill in your personal information including your name, address, and Social Security number.

04

Enter your income information accurately, ensuring all amounts reflect your taxable income.

05

Document any deductions or credits you are claiming; be sure to have supporting documentation if required.

06

Review all entries for accuracy before submitting the form.

07

Sign and date the form at the bottom.

08

Submit the completed form following the instructions for mailing or online filing.

Who needs MN DoR M4?

01

Individuals or businesses required to report certain types of income for tax purposes in Minnesota.

02

Taxpayers who need to claim specific deductions or credits related to their income.

03

Any person or entity that receives taxable income in Minnesota and is subject to state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the corporate tax rate in Mississippi?

Mississippi has a flat 5.00 percent individual income tax. Mississippi also has a 4.00 to 5.00 percent corporate income tax rate. Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent.

What are corporate franchise taxes?

A corporate franchise tax is a tax imposed by a state on corporations, LLCs, and partnerships. This tax is assessed to these companies for the privilege of either doing business in the state or incorporating their business in that state. Like income taxes, typically franchise taxes are assessed annually.

What is the corporate franchise tax for Minnesota?

A flat tax rate of 9.8 percent applies to Minnesota taxable income. Many corporations operate in more than one state. Under the U.S. Constitution, a state can legally tax only the income of a business that is “fairly apportioned” to its activity in the state.

Where do I mail my Minnesota m4 form?

Mail to: Minnesota Revenue, Mail Station 1250, St. Paul, MN 55145-1250 I declare that this return is correct and complete to the best of my knowledge and belief. Tax, P a yments and Credits Amount Due or Overpaid 1 Minnesota tax liability (from M4T, line 23) .

Does Minnesota require combined filing?

Minnesota is considering becoming the only state to mandate that companies use worldwide combined reporting. If adopted, this would mean that Minnesota can tax far more activity, including a great deal of activity that takes place exclusively abroad.

What is the difference between franchise and corporate tax?

Two major taxes that may apply to your business are corporate income taxes and franchise taxes. The difference lies in what exactly is being taxed -- income taxes apply to profit, while franchise taxes do not -- and who's doing the taxing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2008 m4 corporation franchise?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 2008 m4 corporation franchise and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute 2008 m4 corporation franchise online?

pdfFiller has made it simple to fill out and eSign 2008 m4 corporation franchise. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the 2008 m4 corporation franchise electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 2008 m4 corporation franchise in seconds.

What is MN DoR M4?

MN DoR M4 is a form used for reporting and remitting various taxes to the Minnesota Department of Revenue.

Who is required to file MN DoR M4?

Businesses and individuals who have tax obligations such as sales tax, use tax, or other specific taxes in Minnesota are required to file MN DoR M4.

How to fill out MN DoR M4?

To fill out MN DoR M4, you must provide your business information, report your taxable sales, calculate the tax owed, and submit the form along with payment to the Minnesota Department of Revenue.

What is the purpose of MN DoR M4?

The purpose of MN DoR M4 is to ensure compliance with state tax laws by collecting information on taxable activities and facilitating the payment of taxes owed.

What information must be reported on MN DoR M4?

The information reported on MN DoR M4 includes business identification details, total sales amounts, exempt sales, taxable sales, and the total tax due for the reporting period.

Fill out your 2008 m4 corporation franchise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008 m4 Corporation Franchise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.