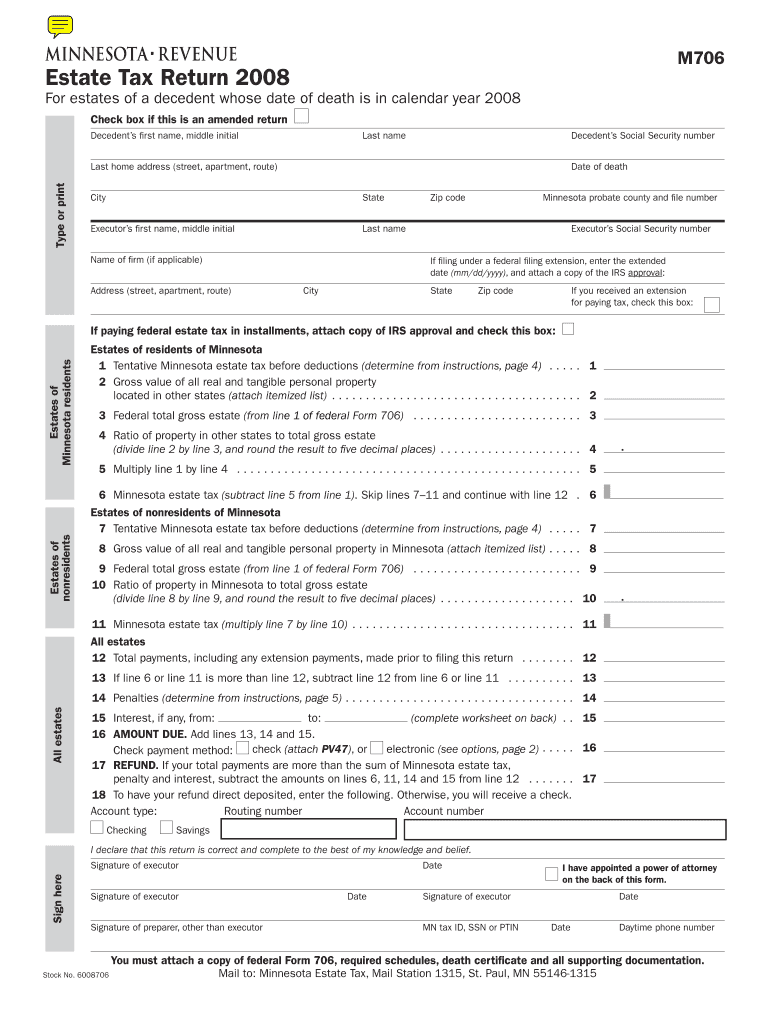

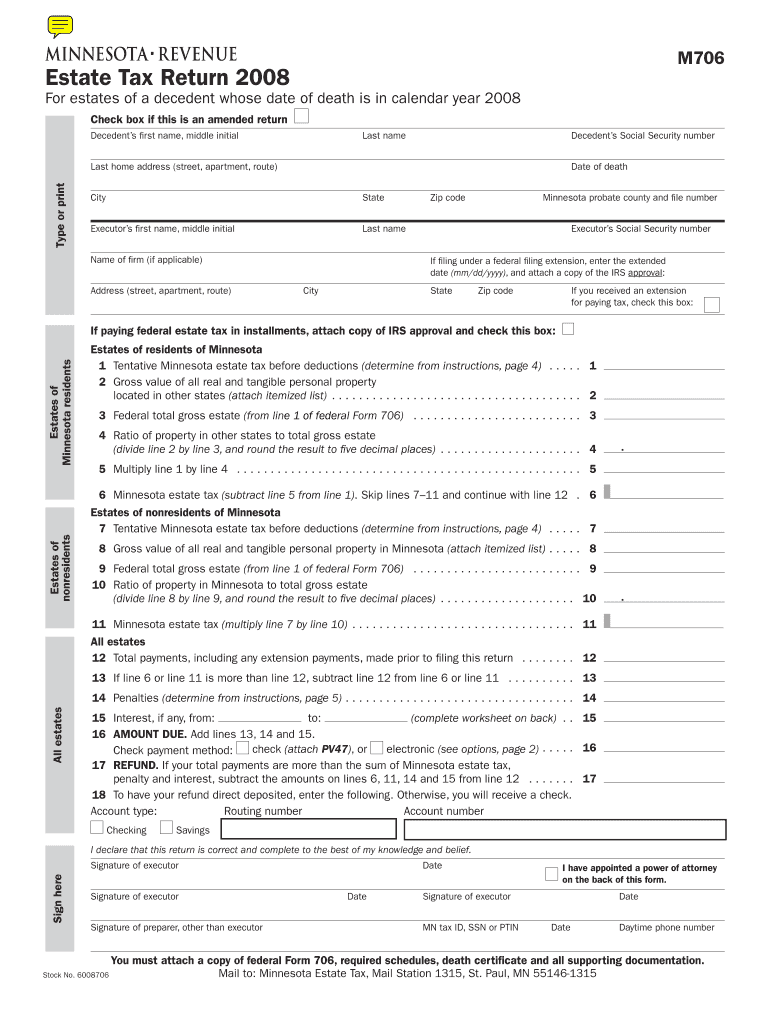

Get the free Estate Tax Return 2008

Show details

This document is an estate tax return form used to report and calculate estate taxes for decedents who passed away in 2008. It includes detailed instructions for filing, payment schedules, and relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate tax return 2008

Edit your estate tax return 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate tax return 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate tax return 2008 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit estate tax return 2008. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate tax return 2008

How to fill out Estate Tax Return 2008

01

Gather all relevant financial documents including wills, trusts, and estate-related assets.

02

Calculate the total value of the estate, including property, investments, and debts.

03

Obtain the appropriate Form 706 for the 2008 Estate Tax Return.

04

Complete the form by filling in the decedent's information, including name, date of death, and Social Security number.

05

List all assets, their valuations, and debts on the estate.

06

Apply any available deductions and credits, such as the marital deduction or charitable contributions.

07

Calculate the estate tax liability based on the totals provided.

08

Sign and date the completed return, ensuring all required attachments are included.

09

File the return by the due date, which typically is nine months after the date of death.

Who needs Estate Tax Return 2008?

01

Any individual or entity with an estate valued above the federal estate tax exemption threshold for 2008, which was $2 million.

02

Executors of estates responsible for settling the affairs of deceased individuals.

03

Beneficiaries who may need to understand tax implications for large estates.

Fill

form

: Try Risk Free

People Also Ask about

What is the three year lookback rule for estate tax?

Under §2035(a), certain gifts made within three years of the donor's death are included in the donor's gross estate. This rule minimizes the incentive for a decedent to transfer property shortly before death and thereby reduce federal estate taxes.

What does the IRS consider an estate?

What is included in the estate? The gross estate of the decedent consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 706 PDF).

What triggers an estate tax return?

An estate tax return, also known as IRS Form 706, is required when the total value of the decedent's estate exceeds the federal estate tax exemption. In 2023, for example, if the total value of the estate is more than $12.92 million, an estate tax return must be filed.

What happened in 2010 with the estate tax?

There was no estate tax in 2010. The 2010 tax laws limited the capital gains step-up in cost basis to assets with appreciation of less than $1.3 million, or $4.3 million for inheriting spouses. The 2011 tax law, enacted in December 2010, reinstated the estate tax, with an exemption of $5 million per person.

How much can you inherit without paying federal taxes?

Federal Inheritance Tax While California does not impose an inheritance tax, the federal government does have an estate tax that applies to large estates. For 2024, the federal estate tax exemption is $12.92 million per individual.

What triggers estate tax?

In 2025, federal estate tax is levied on individuals having assets with a fair market value of $13.99 million or greater at their death. Some states also charge an estate or inheritance tax separate from the federal estate tax (more on state estate tax below).

What was the estate tax in 2008?

MAXIMUM ESTATE TAX RATES (1916–2022) In effect from September 9, 1916, to March 2, 191710% of net estate in excess of $5 million Estates of decedents dying in 2007 and 2008 45% of excess over $2 million3 Estates of decedents dying in 2009 45% of excess over $3.5 million34 more rows

What goes into an estate tax return?

That would include real estate, the bank accounts, stocks and bonds accounts, closely held investments, insurance, retirement accounts, really anything the decedent owned. Even tangible personal property would be included on the return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Estate Tax Return 2008?

The Estate Tax Return 2008 is a tax form used to report the estate taxes owed on the transfer of an individual's estate after their death, specifically applicable for estates with values exceeding the federal exemption limit for that year.

Who is required to file Estate Tax Return 2008?

The executor or personal representative of an estate is required to file the Estate Tax Return 2008 if the gross estate exceeds the exemption threshold established by the Internal Revenue Service (IRS) for the year 2008.

How to fill out Estate Tax Return 2008?

To fill out the Estate Tax Return 2008, the executor must gather necessary financial records, calculate the gross estate value, determine deductible expenses, and complete the form (Form 706) by providing detailed information about the deceased's assets, liabilities, and applicable deductions.

What is the purpose of Estate Tax Return 2008?

The purpose of the Estate Tax Return 2008 is to ensure that the federal government accurately assesses and collects the estate tax liability owed on the deceased individual's estate, in compliance with tax laws.

What information must be reported on Estate Tax Return 2008?

The information that must be reported on the Estate Tax Return 2008 includes a comprehensive list of the decedent's assets, debts, expenses, deductions, and the total gross estate value, along with the calculation of any applicable estate tax owed.

Fill out your estate tax return 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Tax Return 2008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.