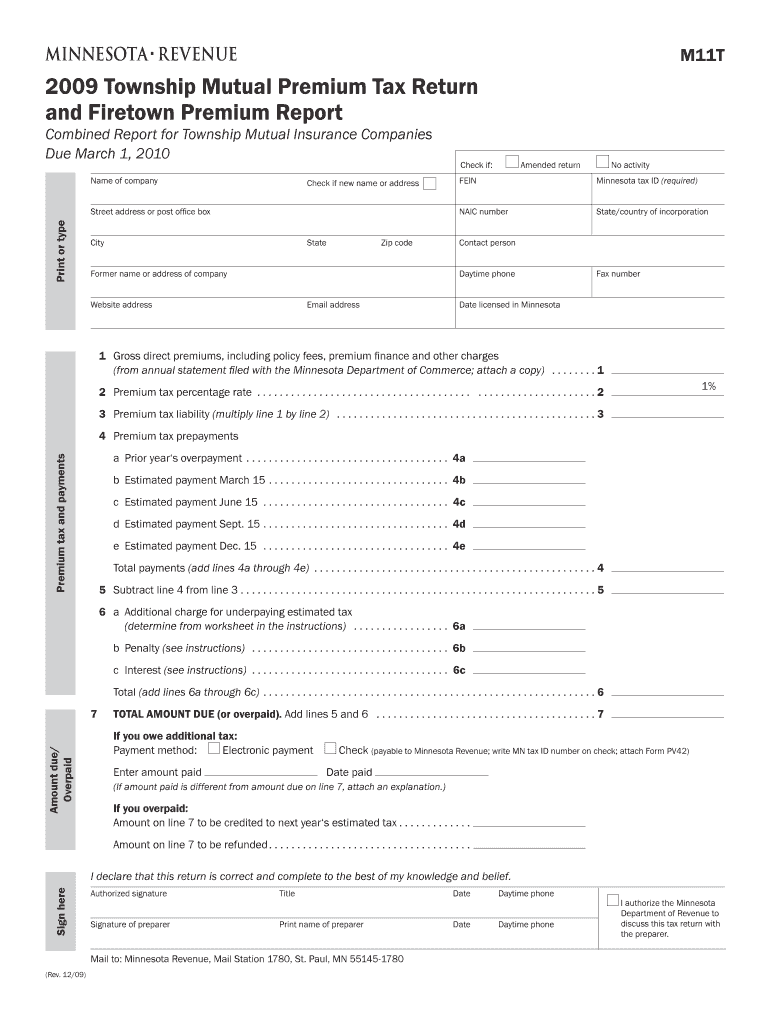

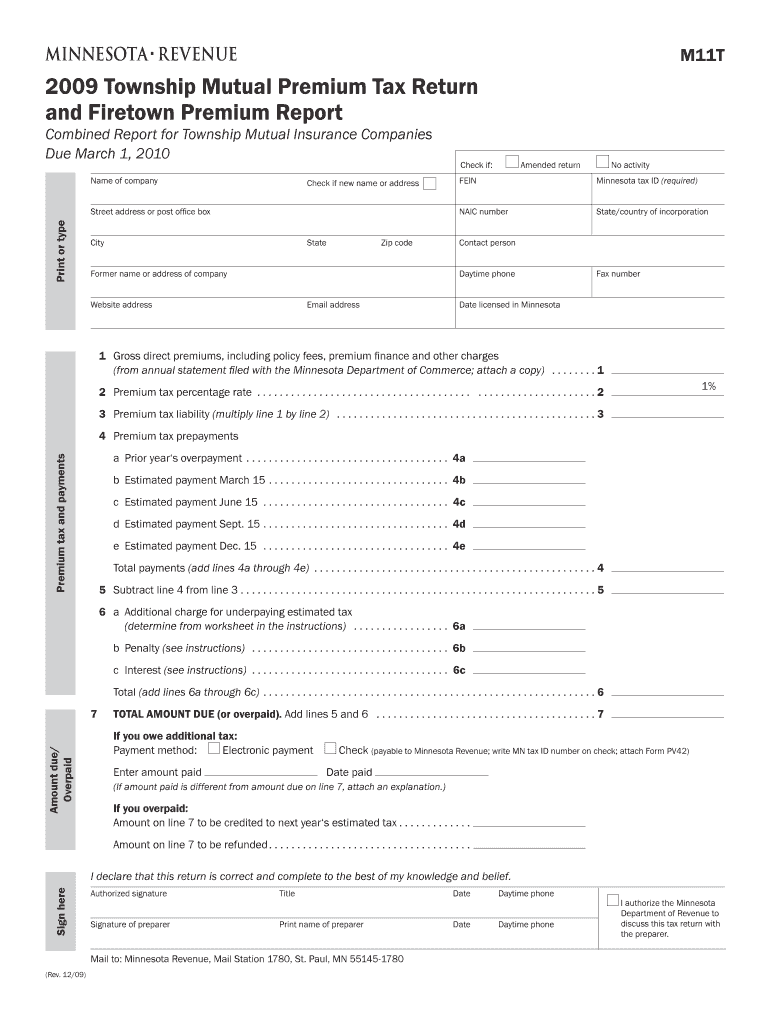

Get the free 2009 Township Mutual Premium Tax Return and Firetown Premium Report

Show details

This document serves as a combined premium tax return and firetown premium report for township mutual insurance companies in Minnesota, detailing required tax information and payment instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 township mutual premium

Edit your 2009 township mutual premium form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 township mutual premium form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 township mutual premium online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2009 township mutual premium. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 township mutual premium

How to fill out 2009 Township Mutual Premium Tax Return and Firetown Premium Report

01

Obtain the 2009 Township Mutual Premium Tax Return and Firetown Premium Report forms from the appropriate municipal website or office.

02

Gather all necessary financial records including premium amounts, policy numbers, and any applicable municipal regulations.

03

Fill out the identification section with your name, address, and contact details.

04

Enter the total premiums received for the year in the specified section of the form.

05

Calculate any applicable deductions as allowed by local regulations, ensuring you have the necessary documentation to support these deductions.

06

Fill out any additional required sections on the form, ensuring accuracy and completeness.

07

Review the completed form for any errors or missing information.

08

Submit the form by the designated deadline, either electronically or by mail, according to the guidelines provided.

Who needs 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

01

Insurance companies conducting business in Township Mutual areas.

02

Entities that collect premiums for insurance policies within the jurisdiction.

03

Local government offices requiring the report for assessing premium taxes.

Fill

form

: Try Risk Free

People Also Ask about

Why do I have to pay back premium tax credit?

Most people only have to pay back a portion of the extra because of limits on payback If you over-estimated your income in advance and got less premium tax credits than you deserved, then you get the extra amount that you are owed.

What does reconcile taxes mean?

Annual reconciliation in USA sales tax refers to the process of reviewing and verifying your business's sales tax records and filings for the entire year. This process involves comparing the total sales tax collected throughout the year with the amount remitted to the state or local tax authority.

Why am I getting a premium tax credit?

A1. The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your Premium Tax Credit is based on a sliding scale.

What is premium tax credits on their tax return?

24, 2022) A1. The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your Premium Tax Credit is based on a sliding scale.

What does it mean to reconcile premium tax credits on their tax return?

to lower your monthly payment, you'll have to “reconcile” when you file your federal taxes. This means you'll compare: The amount of the premium tax credit you used during the year. (This was paid directly to your health plan so your monthly payment was lower.)

What form do I use to report premium tax credit?

Form 8962, Premium Tax Credit Use IRS Form 8962 to find out if you used the right amount of premium tax credit during the year. Use the form to compare the advance amount you use to the amount you qualify for based on your final income. If you used too much, you'll repay it via taxes.

Where do I find my insurance premium for taxes?

The Form 1095-A will tell you the dates of coverage, total amount of the monthly premiums for your insurance plan, the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit, and amounts of advance payments of the premium tax credit.

What does it mean to reconcile premium tax credits?

People who receive a premium tax credit (PTC) in advance must report it on their tax return to determine whether the amount of PTC they received was correct (a process called “reconciliation”). The amount of PTC someone receives is based on their projected income for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

The 2009 Township Mutual Premium Tax Return and Firetown Premium Report is a financial document that insurance companies file to report their premium income and calculate premium taxes owed to local governments and fire protection services.

Who is required to file 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

Insurance companies and township mutual fire insurance companies operating within the jurisdiction that receive premium income are required to file the 2009 Township Mutual Premium Tax Return and Firetown Premium Report.

How to fill out 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

To fill out the report, companies must include detailed information regarding their premium income, applicable deductions, and calculate the tax owed based on the provided tax rates. Proper instructions are usually provided with the report forms.

What is the purpose of 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

The purpose of the report is to ensure that insurance companies accurately report their premium earnings and pay the necessary taxes to support local fire services and municipalities, thus helping to fund essential public safety services.

What information must be reported on 2009 Township Mutual Premium Tax Return and Firetown Premium Report?

The report must include total premium income, any deductions allowed, the calculation of taxes owed, and related administrative data concerning the insurance provider, such as their identification and contact details.

Fill out your 2009 township mutual premium online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Township Mutual Premium is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.