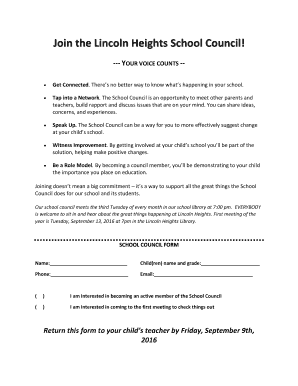

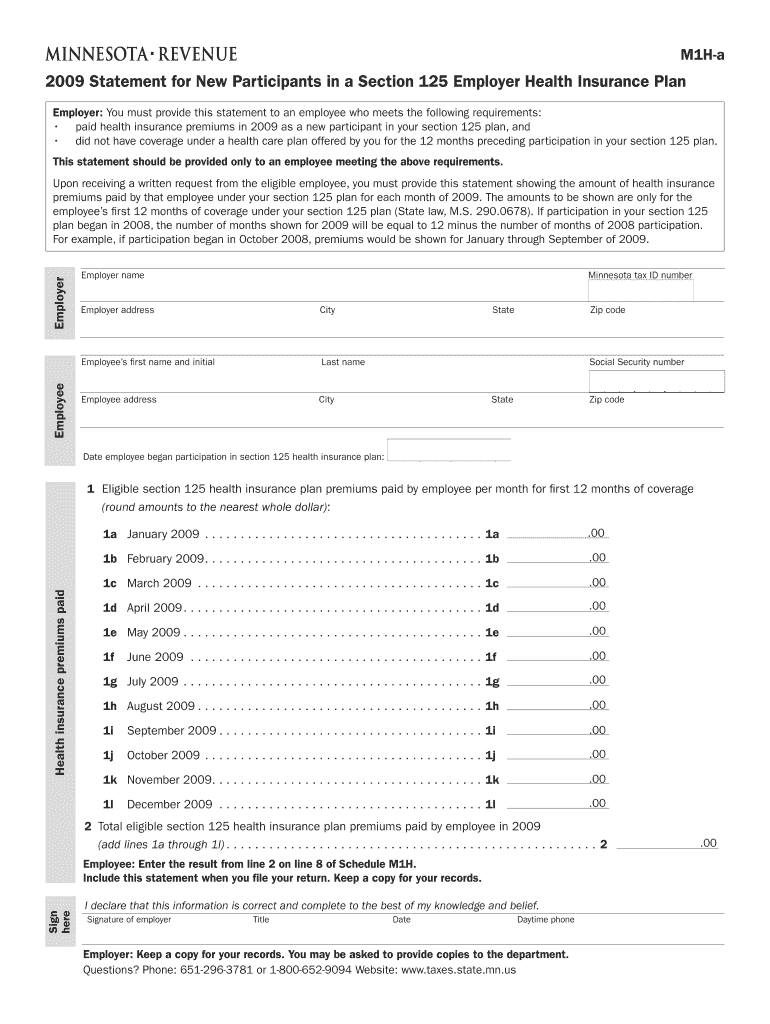

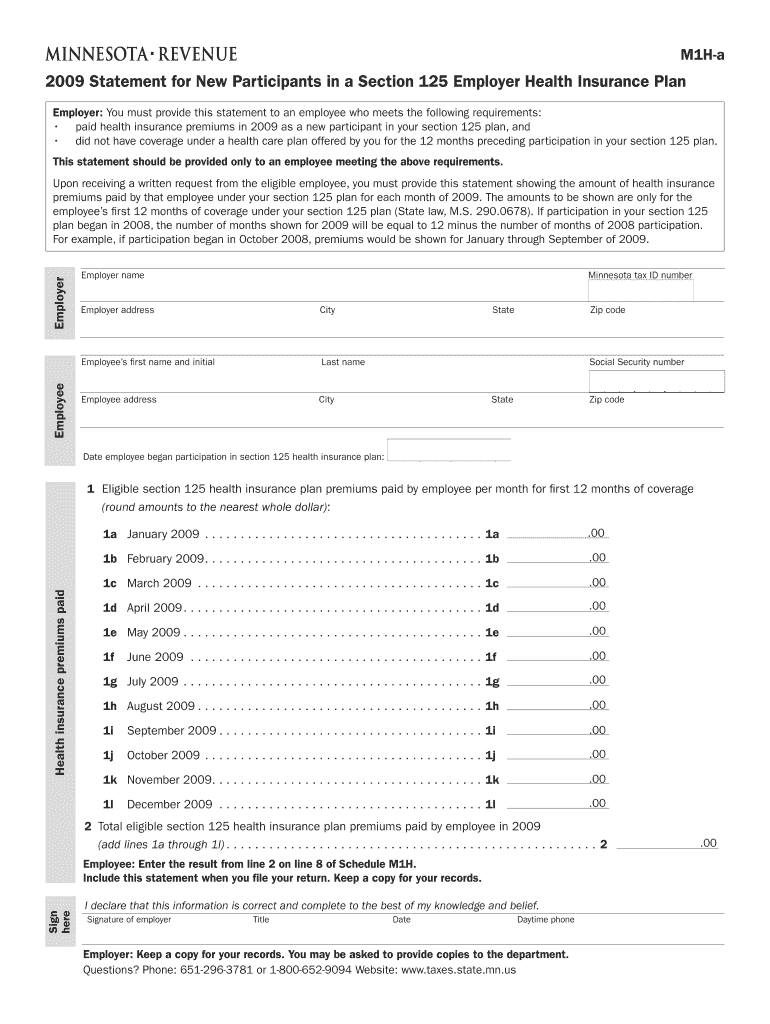

Get the free 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan

Show details

This document serves as a statement for employees who participated in a Section 125 health insurance plan, detailing the premiums paid during their first year of coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 statement for new

Edit your 2009 statement for new form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 statement for new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 statement for new online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2009 statement for new. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 statement for new

How to fill out 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan

01

Obtain the 2009 Statement for New Participants form from your employer or HR department.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal information, including your full name, address, and Social Security number.

04

Provide details about your employment, including your job title and the date you started working.

05

Indicate your current health insurance options and select your preferred plan under the Section 125 Employer Health Insurance Plan.

06

Review the section that outlines your contributions and any employer contributions to the health insurance plan.

07

Sign and date the form to confirm the accuracy of the information provided.

08

Submit the completed form to your HR department or the designated individual responsible for processing health plan enrollments.

Who needs 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

01

Employees who are newly enrolling in a Section 125 Employer Health Insurance Plan.

02

Individuals switching employers and joining a new employer's health insurance plan.

03

Employees who want to understand their choices and contributions in a health insurance plan.

Fill

form

: Try Risk Free

People Also Ask about

Who cannot participate in an FSA plan?

No. ing to IRS guidelines, anyone with two percent or more ownership in a schedule S corporation, LLC, LLP, PC, sole proprietorship, or partnership may not participate. C-corporation owners and their families are eligible to participate in FSA plans because they are considered to be W-2 common law employees.

Who is eligible for Section 125 plan?

Eligibility. Current or former employees are eligible to participate in a Section 125 plan. Only enrolled employees can make contributions to the plan. However, an employee's spouse, dependent child under age 27, or other qualified dependent can receive qualified benefits through the plan.

Who cannot participate in an HRA?

Generally, employers of any size can offer an individual coverage HRA, as long as they have one employee who isn't a self-employed owner or the spouse of a self-employed owner. HRAs are only for employees, not self-employed individuals.

What must be included in a Section 125 plan document?

These benefits include premium-only plans, flexible spending accounts, simple cafeteria plans, and full-flex cafeteria plans. Section 125 plan documents should include information about the plan year, available benefits, eligibility, and the process for making pre-tax elections.

Who is ineligible to participate in a Section 125 plan?

However, the following individuals are NOT eligible to participate in Section 125 Cafeteria Plan, Flexible Spending Account (FSA), or Premium Only Plan (POP), or any of its qualified benefits: More than 2% shareholder of an S-corporation, or any of its family members, Sole proprietor, Partner in a partnership, or.

Who cannot participate in a Section 125 plan?

Employers can be C corporations, S corporations, LLCs, partnerships, governmental entities or sole proprietorships. However, nonemployees cannot participate in a cafeteria plan; this exclusion applies to partners in a partnership, members of an LLC and individuals who own more than 2 percent of an S corporation.

How often does a section 125 document need to be updated?

Section 125 of the Internal Revenue Code (the Code) requires that Premium Only or Cafeteria plan documents be updated every five years. This means drafting a new document and giving a copy to every employee eligible for the plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

The 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan is a document provided to new employees or participants that outlines the benefits available under the Section 125 plan, including details about flexible spending accounts, premium conversion, and other employer-sponsored health insurance options.

Who is required to file 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

Employers who offer a Section 125 Cafeteria Plan to their employees are required to provide and file the 2009 Statement for New Participants. This includes businesses and organizations that provide flexible benefit plans and health insurance options under Section 125.

How to fill out 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

To fill out the 2009 Statement for New Participants, the employer or plan administrator should provide details such as the employee’s name, the effective date of coverage, the type(s) of benefits selected, and any enrollment or contribution amounts. Follow the provided guidelines specific to the Section 125 plan when filling out the statement.

What is the purpose of 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

The purpose of the 2009 Statement for New Participants is to inform new employees about their eligibility and options within the Section 125 cafeteria plan, ensuring they understand the benefits, contributions, and how to properly enroll or utilize the provided health insurance options.

What information must be reported on 2009 Statement for New Participants in a Section 125 Employer Health Insurance Plan?

The 2009 Statement must report essential information such as the employee's full name, employee ID, coverage start date, types of benefits elected (medical, dental, vision), contribution amounts, and any relevant terms or conditions associated with the plan.

Fill out your 2009 statement for new online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Statement For New is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.