Get the free 2009 Credit for Military Service in a Combat Zone

Show details

This form allows eligible military personnel to claim a tax credit for their service in a combat zone during 2009, detailing the requirements and process for submission along with necessary supporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 credit for military

Edit your 2009 credit for military form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 credit for military form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 credit for military online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2009 credit for military. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 credit for military

How to fill out 2009 Credit for Military Service in a Combat Zone

01

Obtain the Form 2009 Credit for Military Service in a Combat Zone from the IRS website or your local tax office.

02

Review the eligibility criteria for military service in a combat zone to ensure you qualify.

03

Fill out the personal information section accurately, including your name, Social Security number, and contact information.

04

Detail your military service by specifying the combat zone dates and locations where you served.

05

Attach any required documentation, such as deployment orders or military records that verify your service in a combat zone.

06

Calculate the credit based on your service duration and any applicable tax regulations as per IRS guidelines.

07

Sign and date the form, certifying that the information provided is accurate.

08

Submit the completed form to the relevant tax authority or include it with your tax return if filing electronically.

Who needs 2009 Credit for Military Service in a Combat Zone?

01

Active duty military personnel who served in a designated combat zone during the tax year.

02

Veterans who have experienced service in a combat zone and are seeking tax credits related to their service.

03

Individuals looking to claim tax benefits due to military service in combat zones as per IRS guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What is combat zone pay for military?

Combat pay is a tax-exempt monthly stipend paid to all active members of the U.S. armed services who are serving in designated hazardous zones. It is paid in addition to the person's base pay.

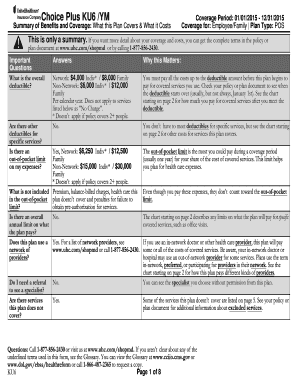

What is the Minnesota combat Zone tax credit?

The credit is equal to $120 for each month of service. Partial months are counted as full months. For example, if you served one day in No- vember, it would count as one full month. The 2023 Form M99 applies only to time served in a combat zone during 2023.

Is there a tax credit for being in the military?

Earned Income Tax Credit (EITC) Military families often qualify for the EITC, particularly if they have children. To qualify, earned and investment income must fall below a specified threshold. Service members should explore their eligibility for the EITC and ensure they claim the credit if they meet the criteria.

What is military service credit?

State & Schools Military service credit is a service credit purchase type for members who served in the military before becoming a CalPERS member . You may be eligible to purchase State & Schools Military service credit if you… • Are actively employed with, or have. retired from: − The State of California.

What are military service credits?

State & Schools Military service credit is a service credit purchase type for members who served in the military before becoming a CalPERS member . You may be eligible to purchase State & Schools Military service credit if you… Have previous active duty military service .

How does service credit work?

Examples of service credit include heat, electricity, water, phones, and similar services. Why is service credit important? Most families use service credit every day. Service credit is often one of the first forms of credit acquired by individuals starting out on their own.

What is an example of service credit?

Credit for Military Service As a general rule, military service in the Armed Forces of the United States is creditable for retirement purposes if it was active service terminated under honorable conditions, and performed prior to your separation from civilian service for retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Credit for Military Service in a Combat Zone?

The 2009 Credit for Military Service in a Combat Zone is a tax benefit that allows qualified military personnel to exclude certain income earned while serving in a combat zone from their taxable income.

Who is required to file 2009 Credit for Military Service in a Combat Zone?

Military personnel who served in a designated combat zone and earned income during that time may be required to file for the 2009 Credit for Military Service in a Combat Zone to obtain the tax benefits associated with their service.

How to fill out 2009 Credit for Military Service in a Combat Zone?

To fill out the 2009 Credit for Military Service in a Combat Zone, taxpayers must complete the designated forms for claiming the credit, which include providing proof of service, the period of service in the combat zone, and details of income that qualifies for exclusion.

What is the purpose of 2009 Credit for Military Service in a Combat Zone?

The purpose of the 2009 Credit for Military Service in a Combat Zone is to provide financial relief to military personnel by allowing them to exclude combat zone income from taxation, thereby acknowledging their service and sacrifices.

What information must be reported on 2009 Credit for Military Service in a Combat Zone?

Information that must be reported includes the taxpayer's military identification, dates of service in the combat zone, the total income earned during that period, and any relevant documentation proving eligibility for the credit.

Fill out your 2009 credit for military online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Credit For Military is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.