Get the free ICCR Reciprocity Exemption for Individual Construction Contractors 2010

Show details

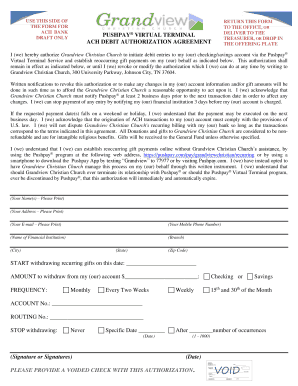

This document is to be completed by individual construction contractors who are residents of Michigan or North Dakota, allowing them to avoid Minnesota income tax withholding while working in Minnesota,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iccr reciprocity exemption for

Edit your iccr reciprocity exemption for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iccr reciprocity exemption for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iccr reciprocity exemption for online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit iccr reciprocity exemption for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iccr reciprocity exemption for

How to fill out ICCR Reciprocity Exemption for Individual Construction Contractors 2010

01

Download the ICCR Reciprocity Exemption form for Individual Construction Contractors 2010 from the official website.

02

Gather necessary documentation including proof of licensure, identification, and any relevant certifications.

03

Fill out personal information such as name, address, and contact details in the designated sections of the form.

04

Provide details about your construction work experience and specific projects you have completed.

05

Complete any required declarations regarding compliance with local regulations and safety standards.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form along with any supporting documents to the appropriate authority or organization.

Who needs ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

01

Individual construction contractors who are operating in multiple jurisdictions and wish to obtain exemptions.

02

Contractors looking to streamline the process of obtaining necessary licenses and permits in different areas.

03

Freelance construction workers seeking to legally work across state or regional boundaries.

Fill

form

: Try Risk Free

People Also Ask about

Can I use my California contractor's license in other states?

Contractors licensed in one state cannot take whatever projects they choose in another state, even if it offers reciprocity. In most cases, a contractor will still need to obtain a license for the type of work they'll be performing in the new state. Contractor license reciprocity simply streamlines that process.

Do you need a contractor's license in each state?

General contractors that perform construction services in multiple states need to meet the license requirements of every state they operate in. In some cases, states have reciprocal agreements that streamline the application process for out-of-state licensed contractors.

What states have contractor license reciprocity?

Unfortunately for many, there are only four states that California have reciprocity agreements with – Arizona, Louisiana, Nevada, and Utah. If you hold a contractor's license in any of these four states, you may be able to transfer your license to California via reciprocity.

What is the hardest state to get a contractor's license?

Their study found that the ten states with the most burdensome licensing regulations were: Missouri. Louisiana. Arizona. Wisconsin. Florida. Nevada. Alabama. Tennesse.

Does Virginia have reciprocity for contractors' license?

Also, if you're already licensed in another state, you may be able to take advantage of the Virginia general contractor license reciprocity program, which allows you to skip taking a licensing exam in Virginia.

What is the sales tax on construction materials in California?

Currently the state rate is 7.25%. You owe the tax rate in effect where you your materials, fixtures, and equipment. If you paid a lower rate at the location where you purchase your items than the rate where you your items, then you owe the difference.

What is a license reciprocity?

Quick Takeaways. License Reciprocity occurs when one state chooses to honor the official real estate license of another, lessening the time effort of completing a multi-state transaction.

Can a construction company be tax exempt?

In the majority of states, construction firms do not have to collect sales taxes on the services they provide. However, they're treated as a consumers of supplies and materials used in construction projects and generally have to pay sales or use taxes at the time of purchase.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

The ICCR Reciprocity Exemption for Individual Construction Contractors 2010 is a regulatory provision that allows individual construction contractors who have established reciprocity agreements with other jurisdictions to operate without the need for additional licensing in the jurisdictions that recognize their agreements.

Who is required to file ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

Individual construction contractors who wish to benefit from the reciprocity agreements and operate in jurisdictions that recognize the ICCR Reciprocity Exemption must file this exemption.

How to fill out ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

To fill out the ICCR Reciprocity Exemption form, individual contractors need to provide their personal details, including name and address, the jurisdictions with which they have reciprocity agreements, and any relevant licensing information from their home jurisdiction.

What is the purpose of ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

The purpose of the ICCR Reciprocity Exemption is to facilitate the mobility of individual construction contractors across jurisdictions while maintaining standards of compliance with local licensing requirements, thereby promoting fair competition and efficiency in the construction industry.

What information must be reported on ICCR Reciprocity Exemption for Individual Construction Contractors 2010?

The information that must be reported includes the contractor's name, address, license number from the home jurisdiction, the jurisdictions with which reciprocity is established, and any relevant work history or qualifications that may support the exemption claim.

Fill out your iccr reciprocity exemption for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iccr Reciprocity Exemption For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.