Get the free Additional Charge for Underpayment of Estimated Tax 2010

Show details

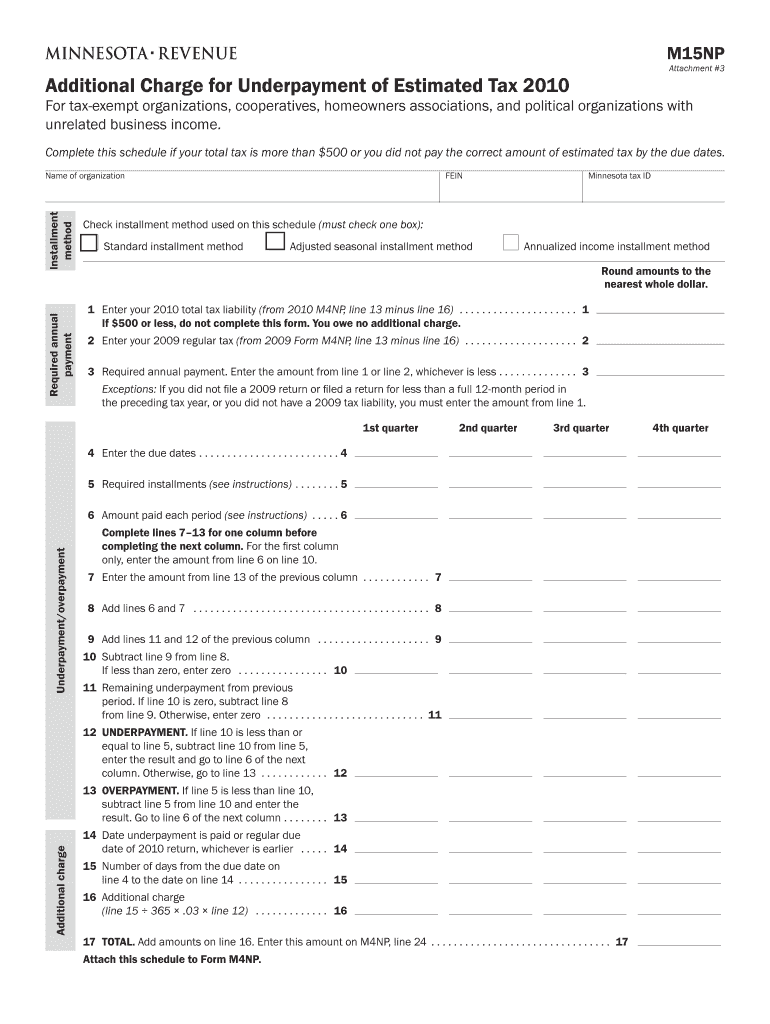

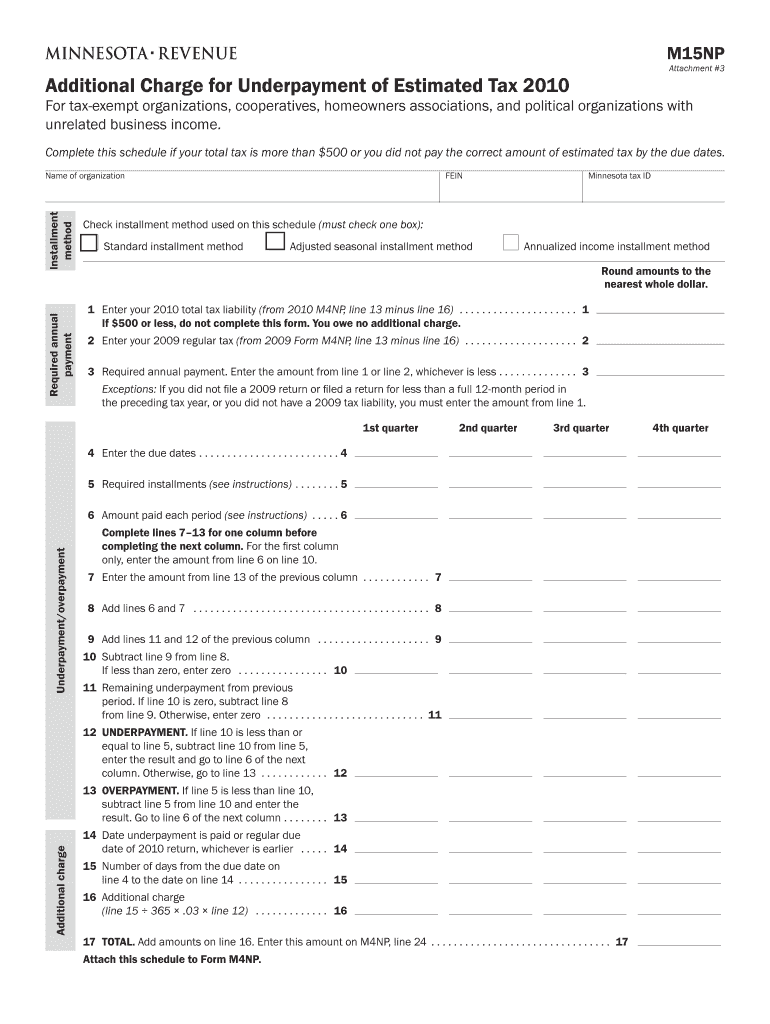

This document provides instructions for tax-exempt organizations, cooperatives, and homeowners associations regarding the calculation of additional charges for underpayment of estimated taxes for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional charge for underpayment

Edit your additional charge for underpayment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional charge for underpayment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit additional charge for underpayment online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit additional charge for underpayment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional charge for underpayment

How to fill out Additional Charge for Underpayment of Estimated Tax 2010

01

Obtain Form 2210 from the IRS website or a tax preparation office.

02

Determine if you meet the criteria for underpayment by reviewing your total tax liability and estimated tax payments made throughout the year.

03

Calculate the required estimated tax payments based on IRS guidelines for the 2010 tax year.

04

Fill out Part I of Form 2210 to determine if you owe additional charges for underpayment.

05

If applicable, complete Part II to calculate the amount of underpayment and any penalties owed.

06

Submit the completed Form 2210 along with your tax return by the filing deadline.

Who needs Additional Charge for Underpayment of Estimated Tax 2010?

01

Individuals who did not pay enough estimated tax throughout the year.

02

Taxpayers who had income not subject to withholding, such as self-employment income or rental income.

03

Those who received a notice from the IRS indicating an additional charge for underpayment.

Fill

form

: Try Risk Free

People Also Ask about

Why is TurboTax saying I have an underpayment penalty?

Turbo Tax Estimated Penalty Turbo Tax Estimated Penalty It is possible. The IRS levies underpayment penalties if you don't withhold or pay enough tax on income received during each quarter. Even if you paid your tax bill in full by the April deadline or are getting a refund, you may still get an underpayment penalty.

Why would the penalty be waived for underpayment of estimated tax?

The law allows the IRS to waive the penalty if: You didn't make a required payment because of a casualty event, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or.

Why do I have an underpayment penalty?

The IRS imposes a tax underpayment penalty when taxpayers fail to pay enough of their tax liability during the year. This penalty applies if you don't meet your obligations through withholding, estimated payments or a combination of both.

How to remove underpayment penalty from TurboTax?

You can go to Federal Taxes tab or Personal tab, under Other Tax Situations and select Start by the Underpayment Penalties. You will answer a series of questions that may reduce or eliminate the penalty. Or you can elect to have the IRS figure the penalty for you.

Why is TurboTax showing an underpayment penalty?

It doesn't have to do with last year's tax return or not paying estimates for this year. The penalty is an "estimated" amount. It's a penalty if you owe too much or for not paying in enough withholding during the year or not paying in evenly.

What is the underpayment charge?

An underpayment penalty is a charge the IRS imposes on taxpayers who did not pay all of their estimated income taxes for the year or paid their taxes late. You'll face an underpayment penalty if you: Didn't pay at least 90% of the tax on your current-year return or 100% of the tax shown on the prior year's return.

What is the penalty for underpaid estimated taxes?

Taxpayers who pay late also are fined. The usual penalty is the amount owed plus 5% of the underpayment amount. It's capped at 25%. Underpaid taxes accrue interest at a rate that the IRS sets quarterly.

How do I get rid of underpayment penalty?

Nobody wants to get hit with an underpayment penalty when they file their tax return. There are three key ways you can avoid this: 1. Pay 100% of your prior year tax. 2. Annualize your income. 3. Pay money with your tax extension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Additional Charge for Underpayment of Estimated Tax 2010?

The Additional Charge for Underpayment of Estimated Tax in 2010 refers to a penalty imposed by the IRS on taxpayers who do not pay enough in estimated taxes throughout the year, leading to underpayment at tax time.

Who is required to file Additional Charge for Underpayment of Estimated Tax 2010?

Taxpayers who owe tax and did not make sufficient estimated tax payments during the year are required to file for this charge. This includes individuals, corporations, estates, and trusts that fall below the minimum payment thresholds.

How to fill out Additional Charge for Underpayment of Estimated Tax 2010?

To fill out the form, taxpayers must calculate their total tax liability for the year, determine their estimated payments, and then use IRS Form 2210 to report any underpayment and calculate the additional charge.

What is the purpose of Additional Charge for Underpayment of Estimated Tax 2010?

The purpose of the Additional Charge is to encourage taxpayers to pay their taxes in a timely manner throughout the year, thereby reducing the risk of a large tax liability at year-end and ensuring that the government receives its tax revenue more steadily.

What information must be reported on Additional Charge for Underpayment of Estimated Tax 2010?

Taxpayers must report their total tax liability, any estimated tax payments made, any withholdings, and the amount of any underpayment. This information is used to compute the penalty for underpayment.

Fill out your additional charge for underpayment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Charge For Underpayment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.