Get the free Schedule M1ED

Show details

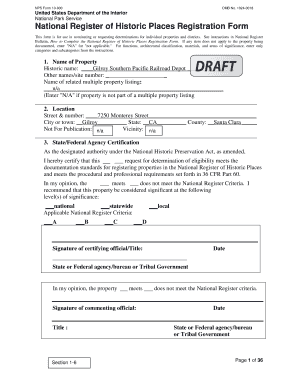

This document allows eligible taxpayers to claim a credit for education expenses incurred for qualifying children in grades K-12. It provides guidelines on reporting household income, qualifying education

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule m1ed

Edit your schedule m1ed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule m1ed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule m1ed online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule m1ed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule m1ed

How to fill out Schedule M1ED

01

Gather your financial documents, including income statements and deductions.

02

Obtain a blank Schedule M1ED form from the tax authority's website or office.

03

Start by filling in your personal information at the top of the form.

04

Report your total income in the designated section.

05

List any allowable tax credits and deductions in the appropriate areas.

06

Calculate your adjusted income by following the instructions carefully.

07

Double-check your entries for accuracy.

08

Sign and date the form, if required.

09

Submit the completed Schedule M1ED along with your tax return.

Who needs Schedule M1ED?

01

Individuals who earn income and are required to file state tax returns.

02

Taxpayers claiming specific deductions or credits applicable in their state.

03

Residents who have taxable income and need to report their earnings accurately.

Fill

form

: Try Risk Free

People Also Ask about

Can piano lessons be tax deductible?

Generally, Music Lessons Are Not Tax-Deductible As a general rule, the Internal Revenue Service (IRS) views music lessons as part of maintaining a hobby. If you pay for lessons to improve your musical performance, you can't write off those costs if you don't turn a profit.

What is the Minnesota education credit subtraction?

Minnesota allows a state income tax subtraction (deduction) for K-12 education-related expenses. The subtraction allows up to $2,500 to be subtracted for each dependent in grades 7-12 and up to $1,625 for each dependent in grades K-6.

Are piano lessons tax deductible in Minnesota?

Fees paid for individual instruction such as tutoring, music lessons and other academic pursuits also qualifies. This includes fees for a drivers education course IF the school offers a class as part of the curriculum, regardless of where the class is taken.

What hobby expenses are tax deductible?

So, under current law, you can't deduct any hobby-related expenses. As was the case before the TCJA, you must still report 100% of hobby-related income on your Form 1040. So, you'll be taxed on all the income even if the activity loses money.

What education expenses can I claim on my taxes?

Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. You must pay the expenses for an academic period* that starts during the tax year or the first three months of the next tax year.

What is the back to school tax credit in Minnesota?

If you qualify, you may claim a credit on your Minnesota income tax return equal to 75% of the qualifying expenses you paid during the year for your child's K–12 education, up to the maximum amounts. For tax years 2022 and earlier you must use household income to see if you qualify for the K-12 Education Credit.

What are qualified school expenses in Minnesota?

Qualifying expenses include tuition and fees, tutoring, textbooks, computer hardware, transportation, and after-school programs. The tax deduction is worth 100% of the amount spent on education, up to $1,625 per child in grades K–6 and $2,500 per child in grades 7–12. The tax deduction lowers a family's taxable income.

Are music lessons tax deductible in MN?

Fees paid for individual instruction such as tutoring, music lessons and other academic pursuits also qualifies. This includes fees for a drivers education course IF the school offers a class as part of the curriculum, regardless of where the class is taken.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

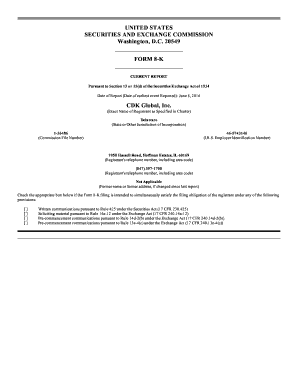

What is Schedule M1ED?

Schedule M1ED is a form used in conjunction with the Minnesota income tax return to report educational credits and expenses.

Who is required to file Schedule M1ED?

Taxpayers who are claiming the Minnesota K-12 Education Credit or the higher education tax credit may be required to file Schedule M1ED.

How to fill out Schedule M1ED?

To fill out Schedule M1ED, taxpayers must provide detailed information regarding educational expenses, credits being claimed, and other required financial data as prompted by the form.

What is the purpose of Schedule M1ED?

The purpose of Schedule M1ED is to facilitate the calculation and reporting of educational credits that taxpayers may qualify for, thereby reducing their overall tax liability.

What information must be reported on Schedule M1ED?

Taxpayers must report their qualifying educational expenses, the type of education provided, and any applicable credit amounts they wish to claim on Schedule M1ED.

Fill out your schedule m1ed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule m1ed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.