Get the free Schedule RD for Claiming Credit for Increasing Research Activities

Show details

This schedule is used by corporations claiming the credit for qualified research expenses incurred in Minnesota for the tax year, detailing the calculation of the credit and associated expenses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule rd for claiming

Edit your schedule rd for claiming form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule rd for claiming form via URL. You can also download, print, or export forms to your preferred cloud storage service.

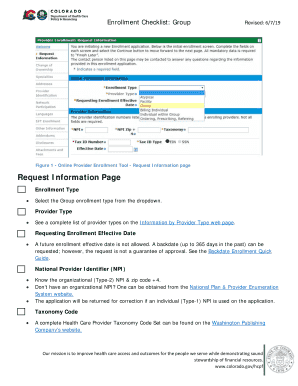

Editing schedule rd for claiming online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule rd for claiming. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule rd for claiming

How to fill out Schedule RD for Claiming Credit for Increasing Research Activities

01

Obtain the Schedule RD form from the IRS website or your tax software.

02

Start by filling out your name and identifying information at the top of the form.

03

Review the eligibility requirements for the Research Activities Credit to ensure you qualify.

04

Gather necessary documentation to substantiate your research activities, including receipts, payroll records, and project descriptions.

05

Complete Part I of the Schedule RD, detailing the qualified research expenses.

06

Fill out Part II to calculate the credit using the information from Part I.

07

Transfer the calculated credit amount to your main tax return form as instructed.

08

Review the completed Schedule RD for accuracy before submission.

Who needs Schedule RD for Claiming Credit for Increasing Research Activities?

01

Businesses engaged in qualified research activities as defined by the IRS.

02

Companies that have incurred eligible expenses for research and development.

03

Taxpayers looking to claim the Research Activities Credit to reduce their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What are the proposed changes to 6765?

New Qualitative Data Requirements for Form 6765 Historically, Form 6765 has been used primarily for reporting quantitative data, with qualitative documentation kept mainly for potential IRS audits. The revised Form 6765 now mandates the inclusion of significantly more qualitative data directly with the tax return.

How do I claim credit for increasing research activities?

Businesses can claim the R&D Credit by filing IRS Form 6765, Credit for Increasing Research Activities. As part of the process, they need to identify qualifying expenses and provide adequate documentation that shows how these costs meet the requirements under Internal Revenue Code Section 41.

What is 6765?

Use Form 6765 to: Figure and claim the credit for increasing research activities. Elect the reduced credit under section 280C. Elect and figure the payroll tax credit.

What does the IRS consider totally disabled?

The tax law definition of totally and permanently disabled is: The person can't perform significant duties over a reasonable period of time while working for pay or profit in a competitive work situation for at least the minimum wage because of a physical or mental condition.

What is the schedule 6765?

Purpose of Form Use Form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280C, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes.

What is the substantially all rule for research credits?

The “Substantially All” rule under Section 41 necessitates that the majority of a project's activities must qualify as research activities to be eligible for the R&D Tax Credit. This provision encourages extensive R&D endeavors, offering taxpayers the chance to claim credits for a wide array of qualifying activities.

What is the 80% rule for R&D credit?

What is the 80% rule for R&D credit? The IRS notes that if “substantially all” – that is, at least 80% – of the services performed by an employee fit the criteria of qualified research, then all of the employee's annual wages are eligible as QREs.

Who qualifies for R&D tax credit?

R&D tax credits are available to all organizations that engage in certain activities to develop new or improved products, processes, software, techniques, formulas or inventions.

Can you carry forward credit for increasing research?

What is the R&D Credit Carryforward? If you have Qualified Research Expenses (QRE), you can take any unused R&D tax credits and apply them to a future tax year. Companies may use these credits in bumper years to offset their tax liabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule RD for Claiming Credit for Increasing Research Activities?

Schedule RD is a form used by businesses to calculate and claim the Research and Development (R&D) tax credit under the Internal Revenue Code. It is designed to help organizations quantify their eligible research activities and related expenses.

Who is required to file Schedule RD for Claiming Credit for Increasing Research Activities?

Businesses that engage in qualified research activities and wish to claim the R&D tax credit must file Schedule RD. This includes corporations, partnerships, and other entities that incur eligible R&D expenses.

How to fill out Schedule RD for Claiming Credit for Increasing Research Activities?

To fill out Schedule RD, taxpayers must provide detailed information about their qualified research activities, including a description of the research projects, associated expenses, and other pertinent data as required by the form instructions.

What is the purpose of Schedule RD for Claiming Credit for Increasing Research Activities?

The purpose of Schedule RD is to allow taxpayers to document and claim the R&D tax credit, which incentivizes innovation and helps reduce the overall tax burden for companies investing in research and development.

What information must be reported on Schedule RD for Claiming Credit for Increasing Research Activities?

Information required on Schedule RD includes the amount of qualified research expenses, descriptions of eligible projects, the number of employees involved in the R&D process, and any other relevant details that support the claim for the tax credit.

Fill out your schedule rd for claiming online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Rd For Claiming is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.