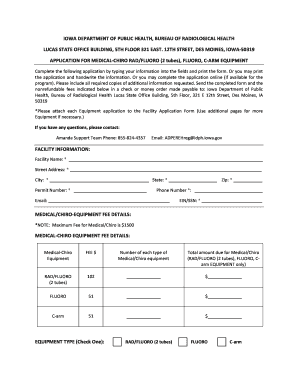

Get the free 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual

Show details

This document serves as the insurance premium tax return and firetown report for township mutual insurance companies in Minnesota, detailing tax liabilities and required filings.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 insurance premium tax

Edit your 2011 insurance premium tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 insurance premium tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 insurance premium tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 insurance premium tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 insurance premium tax

How to fill out 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual

01

Gather all necessary documents, including financial statements and relevant insurance policy information.

02

Complete the basic information section at the top of the form, including your organization's name, address, and tax identification number.

03

Report the total premiums collected during the reporting period accurately.

04

Calculate the applicable tax due by applying the appropriate tax rate to the total premiums reported.

05

Fill out any additional sections specific to your organization, including deductions or exemptions if applicable.

06

Review the completed form for accuracy and ensure all calculations are correct.

07

Sign and date the form where indicated.

08

Submit the form by the designated deadline, either electronically or via mail as instructed.

Who needs 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

01

Insurance companies operating in the Township Mutual who collect premiums and are subject to Insurance Premium Tax requirements.

02

Local government officials or auditors requiring detailed reporting for insurance transactions in their jurisdiction.

03

Insurance agents and tax professionals assisting clients with compliance and reporting obligations.

Fill

form

: Try Risk Free

People Also Ask about

How do you reconcile premium tax credits on your tax return for any past years?

Get your Form 1095-A. Print Form 8962 (PDF, 115 KB) and instructions (PDF, 348 KB). Use the information from your 1095-A form to complete Part II of Form 8962.

Where do I find my insurance premium for taxes?

The Form 1095-A will tell you the dates of coverage, total amount of the monthly premiums for your insurance plan, the second lowest cost silver plan premium that you may use to determine the amount of your premium tax credit, and amounts of advance payments of the premium tax credit.

Is it a good idea to use tax credit for health insurance?

If you qualify for a tax credit, using it can be an excellent way to lower your monthly healthcare costs.

What is premium tax return?

24, 2022) A1. The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your Premium Tax Credit is based on a sliding scale.

What is the meaning of premium tax?

The term “premium tax” means, with respect to surplus lines or independently procured insurance coverage, any tax, fee, assessment, or other charge imposed by a government entity directly or indirectly based on any payment made as consideration for an insurance contract for such insurance, including premium deposits,

How do I find my premium tax credit?

Use IRS Form 8962 to find out if you used the right amount of premium tax credit during the year. Use the form to compare the advance amount you use to the amount you qualify for based on your final income. If you used too much, you'll repay it via taxes. If you used too little, claim the difference as a credit.

Why do I have to pay back my premium tax credit?

Most people only have to pay back a portion of the extra because of limits on payback If you over-estimated your income in advance and got less premium tax credits than you deserved, then you get the extra amount that you are owed.

Who qualifies for the premium tax credit?

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

The 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual is a financial document that mutual insurance companies must submit to report their insurance premium taxes and to provide information on their financial activities for the year.

Who is required to file 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

Mutual insurance companies operating within the applicable jurisdiction are required to file the 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual.

How to fill out 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

To fill out the 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual, companies must gather their financial data related to premiums received, calculate the applicable tax amounts, and complete the form according to the instructions provided by the tax authority.

What is the purpose of 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

The purpose of the 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual is to ensure compliance with state tax laws, collect revenue from insurance premiums, and provide transparency regarding the financial operations of mutual insurance companies.

What information must be reported on 2011 Insurance Premium Tax Return and Firetown Report for Township Mutual?

The information that must be reported includes the total premiums written, any refunds or cancellations, deductions allowed by law, taxable premium amounts, and the total taxes owed.

Fill out your 2011 insurance premium tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Insurance Premium Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.