Get the free 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insu...

Show details

This form is used to determine eligibility for a credit equal to 20% of health insurance premiums paid under a Section 125 plan for the first 12 months of participation, contingent upon specific income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 schedule m1h credit

Edit your 2011 schedule m1h credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 schedule m1h credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 schedule m1h credit online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 schedule m1h credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 schedule m1h credit

How to fill out 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan

01

Obtain the 2011 Schedule M1H form from the official IRS website or your tax advisor.

02

Complete your personal information at the top of the form including your name and Social Security number.

03

Enter the details of your Section 125 employer health insurance plan, including the employer's name and EIN.

04

Fill in the dates when you became a new participant in the plan.

05

Calculate the credit amount based on the contributions made to your health insurance premiums.

06

Transfer the calculated credit amount to your main tax return form as instructed.

07

Review the completed form for accuracy and completeness before submission.

08

Submit the form along with your tax return by the filing deadline.

Who needs 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

01

Individuals who are new participants in a Section 125 employer health insurance plan for the tax year 2011.

02

Taxpayers seeking to claim a tax credit for health insurance premiums paid under a Section 125 plan.

03

Employees whose employers offer Section 125 plans and who want to benefit from the available tax credits.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a section 125 plan?

A section 125 plan allows employers to offer employees, their spouses and dependents certain benefits on a pretax basis, thereby lowering the employee's taxable income. It essentially puts more money back in the employee's pocket, which can help businesses attract and retain talent.

What taxes are exempt from section 125?

Section 125 Tax Exemptions Social Security Tax and Medicare Tax Exemptions: Section 125 plans provide exemptions from Social Security tax (FICA) and Medicare tax for employees and employers on contributions made to the plan. This reduces the tax burden on employees and leads to payroll tax savings for employers.

Can you opt out of Section 125 plan?

While opt-out arrangements are lawful, there are some caveats to consider. Opt-out arrangements should be offered under a Section 125 cafeteria plan to avoid unfavorable employee taxation.

Does section 125 reduce taxable income?

Section 125 plans reduce an employee's taxable salary, so businesses will pay less in payroll taxes, FICA taxes, unemployment insurance and workers' compensation.

Is a section 125 plan a good idea?

This can save workers 20% to 40% in taxes per year but these plans offer employers some tax-saving benefits as well. It can be worth it to suggest that your employer set up such a plan or keep it in mind if you're job hunting so you can potentially hire on with a company that does offer a cafeteria plan.

What is the section 125 plan for health insurance premiums?

A Section 125 plan lets employees set aside insurance premiums and other funds on a pretax basis. This can save workers 20% to 40% in taxes per year but these plans offer employers some tax-saving benefits as well.

What is an employer's section 125 plan?

Employers can be C corporations, S corporations, LLCs, partnerships, governmental entities or sole proprietorships. However, nonemployees cannot participate in a cafeteria plan; this exclusion applies to partners in a partnership, members of an LLC and individuals who own more than 2 percent of an S corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

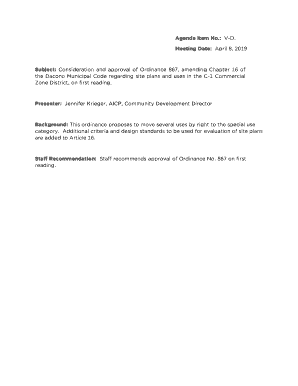

What is 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

The 2011 Schedule M1H is a tax form used by specific taxpayers to claim a credit for new participants who enroll in a Section 125 employer-sponsored health insurance plan. This form is part of the taxation process, helping to reduce the overall tax burden for eligible individuals.

Who is required to file 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

Taxpayers who have newly enrolled participants in their employer's Section 125 health insurance plan during the tax year are required to file Schedule M1H to claim the corresponding credit.

How to fill out 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

To fill out Schedule M1H, taxpayers must provide their personal information, details about the employer-sponsored health insurance plan, and the number of new participants enrolled. Specific instructions and calculations for determining the credit amount are also included in the form's guidelines.

What is the purpose of 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

The purpose of Schedule M1H is to incentivize employers to offer health insurance plans by providing a tax credit for new participants. This helps to broaden access to healthcare coverage for workers and reduce their financial burden.

What information must be reported on 2011 Schedule M1H, Credit for New Participants in a Section 125 Employer Health Insurance Plan?

Information required on Schedule M1H includes the taxpayer's name, Social Security number, identification of the employer's health insurance plan, the number of newly enrolled participants, and specific details needed to calculate the credit amount.

Fill out your 2011 schedule m1h credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Schedule m1h Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.