Get the free M23, Claim for a Refund Due a Deceased Taxpayer - revenue state mn

Show details

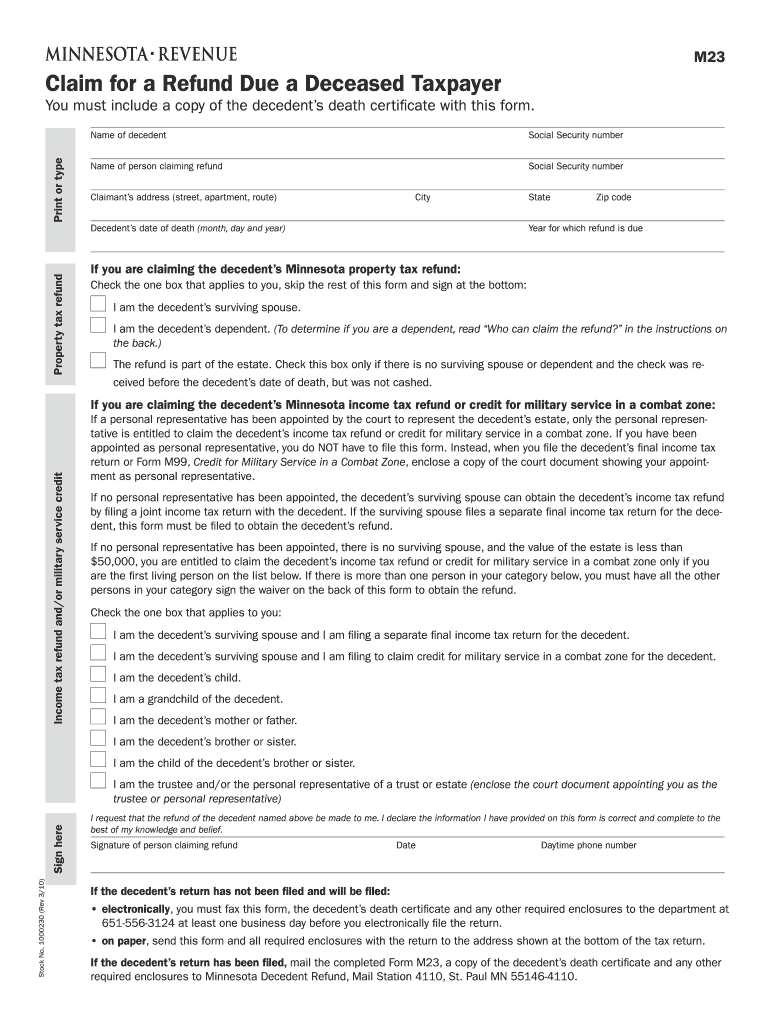

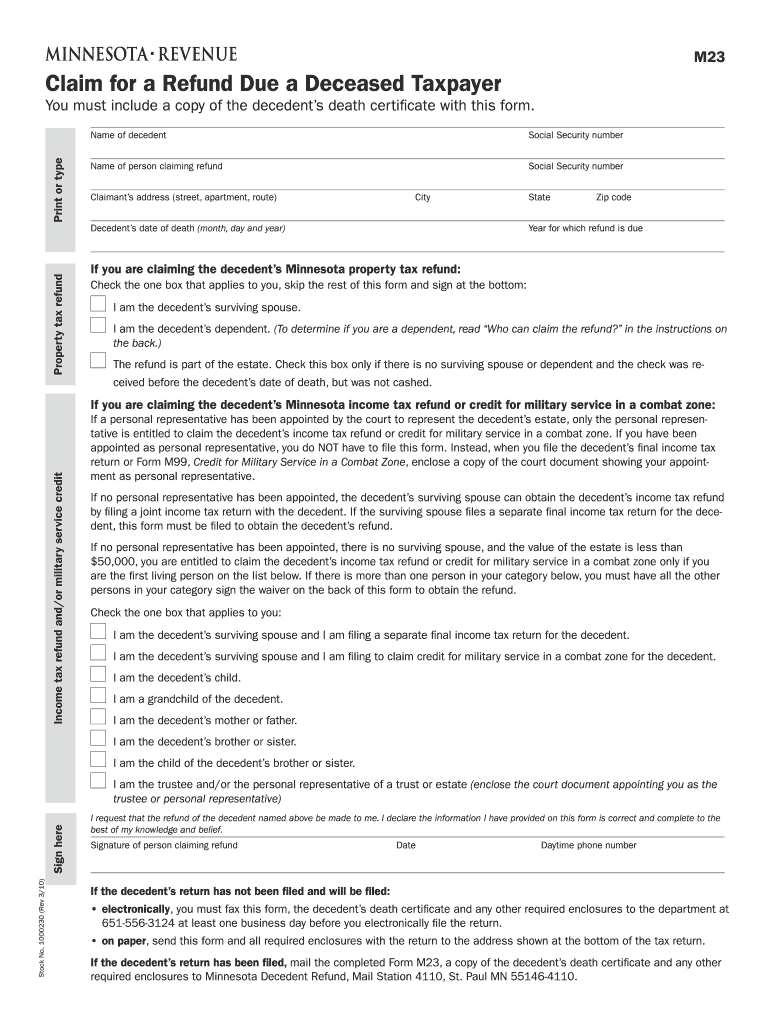

M23 Claim for a Refund Due a Deceased Taxpayer Name of decedent You must include a copy of the decedent's death certificate with this form. Social Security number Social Security number City State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign m23 claim for a

Edit your m23 claim for a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m23 claim for a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing m23 claim for a online

Follow the steps down below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit m23 claim for a. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out m23 claim for a

How to fill out m23 claim for a:

01

Gather all necessary documents and information: Make sure you have all relevant documents, such as medical records, invoices, and any other supporting evidence. Also, prepare personal information like your full name, address, and contact details.

02

Read instructions carefully: Review the instructions provided along with the m23 claim form. Familiarize yourself with the requirements, eligibility criteria, and any specific guidelines for filling out the form.

03

Complete personal details: Provide accurate and complete personal information in the designated fields. Ensure that all details such as your name, address, and contact details are correct and up to date.

04

State the nature of the claim: Clearly explain the reason for the claim in a concise manner. Describe the incident or circumstances that led to your claim and provide any relevant details that support your case.

05

Include supporting evidence: Attach all necessary supporting documents to validate your claim. This may include medical reports, receipts, photographs, witness statements, or any other relevant evidence that strengthens your case.

06

Double-check and review: Before submitting the form, carefully review all the information and documents provided. Ensure that everything is accurate, organized, and complete. Making any necessary corrections or additions at this stage can prevent delays or complications.

Who needs m23 claim for a:

01

Individuals seeking compensation: Anyone who has experienced an incident or suffered damage that entitles them to claim compensation can use the m23 claim form. This could include individuals involved in accidents, victims of negligence, or those facing financial loss due to someone else's actions.

02

Those with valid supporting evidence: The m23 claim form is suitable for individuals who have proper supporting evidence to substantiate their claims. This may include medical reports, documents, or any other relevant proof that demonstrates the validity of the claim.

03

Individuals meeting eligibility criteria: It is essential to ensure that you meet the eligibility criteria specified for making a claim using the m23 form. These criteria may vary depending on the nature of the claim and the jurisdiction in which it is being filed.

Note: It is always advisable to seek legal advice or assistance when filling out any claim form, particularly if the claim involves complex legal matters or significant amounts of compensation.

Fill

form

: Try Risk Free

People Also Ask about

What happens if a deceased person is owed a tax refund?

If there is a tax refund for a deceased person, the deceased person's Executor or personal representative will receive the refund. They are authorized to sign the check into the estate bank account. At that point, that money will be dealt with just like the rest of the funds that are contained within the estate.

What form do I use to claim a refund for a deceased?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer.

Can you electronically file a tax return for a deceased taxpayer?

A decedent taxpayer's tax return can be filed electronically. Follow the specific directions provided by your preparation software for proper signature and notation requirements.

Can you electronically file a return for a deceased taxpayer with a refund?

A decedent taxpayer's tax return can be filed electronically. Follow the specific directions provided by your preparation software for proper signature and notation requirements.

How do I file taxes on behalf of a deceased person?

The final return is filed on the same form that would have been used if the taxpayer were still alive, but "Deceased:" is written at the top of the return followed the person's name and the date of death. The deadline to file a final return is the tax filing deadline of the year following the taxpayer's death.

How do I file a tax return on behalf of a deceased taxpayer?

The final return is filed on the same form that would have been used if the taxpayer were still alive, but "Deceased:" is written at the top of the return followed the person's name and the date of death. The deadline to file a final return is the tax filing deadline of the year following the taxpayer's death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit m23 claim for a online?

With pdfFiller, the editing process is straightforward. Open your m23 claim for a in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit m23 claim for a in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing m23 claim for a and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my m23 claim for a in Gmail?

Create your eSignature using pdfFiller and then eSign your m23 claim for a immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is m23 claim for a?

M23 claim for a is a form used to file a claim for a specific type of reimbursement.

Who is required to file m23 claim for a?

Any individual or organization that is eligible for reimbursement can file an M23 claim for a.

How to fill out m23 claim for a?

To fill out an M23 claim for a, you need to provide specific information such as your personal details, supporting documentation, and a detailed explanation of the reimbursement request.

What is the purpose of m23 claim for a?

The purpose of the M23 claim for a is to request reimbursement for a specific expense or loss.

What information must be reported on m23 claim for a?

The M23 claim for a requires information such as the date of the expense or loss, the amount requested for reimbursement, and any supporting documentation.

Fill out your m23 claim for a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

m23 Claim For A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.