MN Form ST101 2013 free printable template

Show details

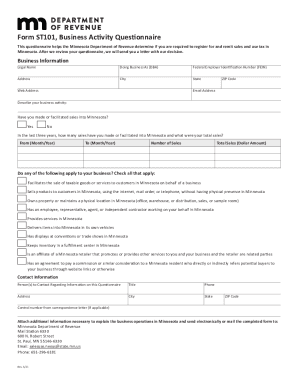

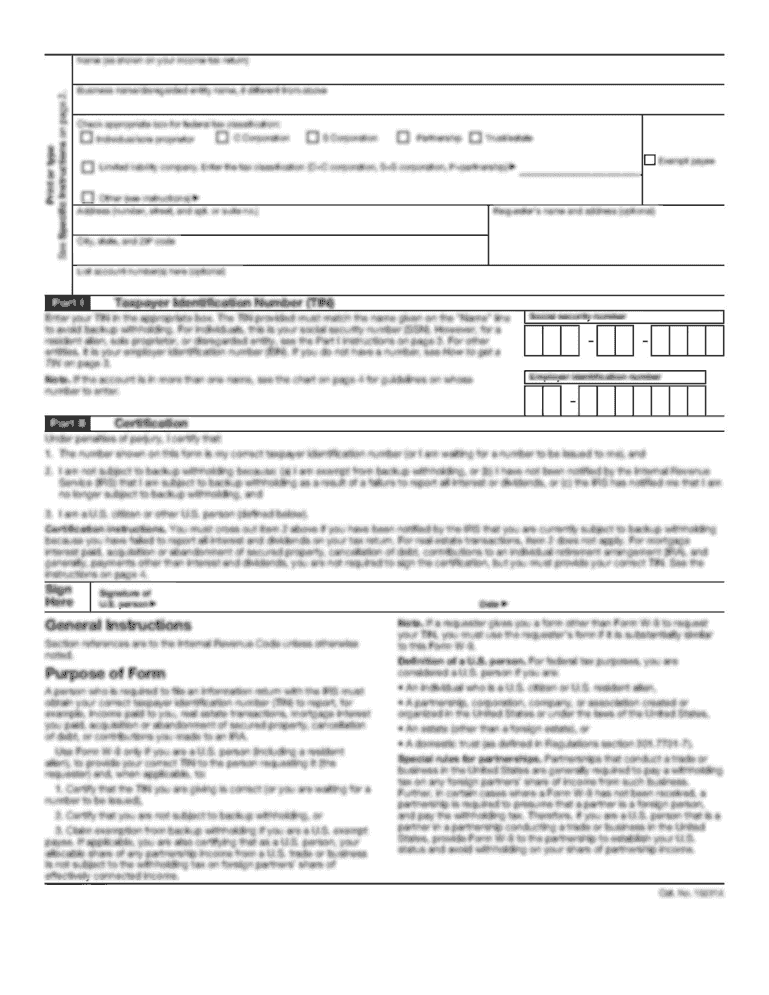

ST101 Minnesota Business Activity Questionnaire for Determining Sales Tax Nexus Legal name of business Federal employer ID number FEIN Date income year ends Home office mailing address Phone Fax Web address Email address State/year of incorporation or organization Year of subchapter S election City State Zip code Type of business Corporation Partnership Other If S corporation or partnership enter Number of shareholders or partners Percentage ownership of the partner/shareholder owning the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Form ST101

Edit your MN Form ST101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Form ST101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN Form ST101 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MN Form ST101. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Form ST101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Form ST101

How to fill out MN Form ST101

01

Download the MN Form ST101 from the Minnesota Department of Revenue website.

02

Provide your name and address in the designated fields.

03

Indicate the type of exemption you are claiming.

04

Fill in the exempt organization's name and address if applicable.

05

Enter the sales tax identification number if you are a registered purchaser.

06

Provide a description of the items you are purchasing.

07

Sign and date the form before submission.

Who needs MN Form ST101?

01

Any individual or organization seeking a sales tax exemption for purchases in Minnesota needs to fill out MN Form ST101.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from MN sales tax?

When an item is exempt from sales or use tax by law, the seller does not have to show why no tax was charged, but must indicate the item was food, clothing, drugs, or another exempt good. The seller does not have to collect sales tax if the purchaser gives them a completed Form ST3, Certificate of Exemption.

Why does Minnesota have no sales tax?

Many states first implemented sales taxes during the Great Depression, which was taking a toll on public budgets. But Minnesota held out largely because the Farmer-Labor governor at the time, Floyd B. Olson, objected to the tax as an unfair burden on the poor.

How long is a resale certificate good for in MN?

This certificate remains in force as long as the purchaser continues making purchases or until otherwise cancelled by the purchaser. Check if this certificate is for a single purchase and enter the related invoice/purchase order # .

Do Minnesota sales tax Exemption certificates expire?

Exemption certificates do not expire unless the information on the certificate changes. But we recommend updating exemption certificates every three to four years. Below is a list of most nontaxable items. An exemption certificate or other documentation may be required.

Does a exemption certificate expire?

Certificates are valid for up to three years.

Is toilet paper taxed in MN?

Several services are also taxable.Taxable Purchases and Use Tax. Taxable PurchasesGeneral itemsExamplesCash register tapes Cleaning supplies Computer hardware and software Free candy and matches Furniture and fixtures Menus Office equipment and supplies Paper towels Toilet tissue Apr 11, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MN Form ST101 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including MN Form ST101. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get MN Form ST101?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific MN Form ST101 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete MN Form ST101 online?

Completing and signing MN Form ST101 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is MN Form ST101?

MN Form ST101 is a sales tax form used in Minnesota for claiming exemption from sales tax on certain purchases.

Who is required to file MN Form ST101?

Any purchaser who intends to claim an exemption from sales tax for items purchased must file MN Form ST101.

How to fill out MN Form ST101?

To fill out MN Form ST101, you need to provide your name, address, the reason for exemption, and details of the purchased items, along with the seller's information.

What is the purpose of MN Form ST101?

The purpose of MN Form ST101 is to document sales tax-exempt purchases and to provide sellers with proof of the exemption status.

What information must be reported on MN Form ST101?

MN Form ST101 requires the reporting of the purchaser's information, the seller's information, the reason for claiming exemption, and a description of the items or services being purchased.

Fill out your MN Form ST101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Form st101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.