Get the free 2011 Corporation Franchise Tax Return

Show details

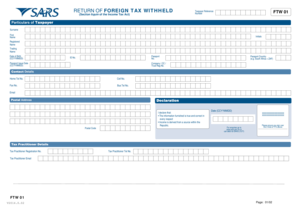

This document serves as the official tax return for corporations registered in Minnesota, detailing the corporation's income, deductions, and tax liability for the tax year ending in 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 corporation franchise tax

Edit your 2011 corporation franchise tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 corporation franchise tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 corporation franchise tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 corporation franchise tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 corporation franchise tax

How to fill out 2011 Corporation Franchise Tax Return

01

Gather all necessary financial documents, including balance sheets, income statements, and records of deductions.

02

Download the 2011 Corporation Franchise Tax Return form from the relevant tax authority's website.

03

Fill in the corporation's name, address, and taxpayer identification number at the top of the form.

04

Report the corporation's total gross income for the year in the designated section.

05

List allowable deductions in the appropriate section of the form.

06

Calculate the corporation's net taxable income by subtracting deductions from gross income.

07

Determine the tax liability based on the applicable tax rates for the year.

08

Sign and date the return, ensuring it is completed by an authorized individual.

09

File the completed return by the due date, either electronically or by mail.

Who needs 2011 Corporation Franchise Tax Return?

01

All corporations operating in the jurisdiction that are subject to franchise taxes based on their business activities and generated income.

02

Corporations that have opted to do business in the state and hold assets or have a physical presence within the state.

Fill

form

: Try Risk Free

People Also Ask about

When must a foreign corporation file a form 1120-F?

A foreign corporation that maintains an office or place of business in the United States must generally file Form 1120-F by the 15th day of the 4th month after the end of its tax year.

Does a foreign corporation have to file a US tax return?

A foreign corporation that is engaged in a US trade or business at any time during the year must file a return on Form 1120-F. The return is required even if the foreign corporation had no effectively connected income or the income was exempt from US tax under a tax treaty.

Can I do my own corporation tax return UK?

You can either get an accountant to prepare and file your tax return or do it yourself. If you have a limited company, you may be able to file your accounts with Companies House at the same time as your tax return.

Do foreign companies have to file US tax returns?

A foreign corporation that is engaged in a US trade or business at any time during the year must file a return on Form 1120-F. The return is required even if the foreign corporation had no effectively connected income or the income was exempt from US tax under a tax treaty.

What is a foreign corporation for US tax purposes?

A foreign corporation is one that does not fit the definition of a domestic corporation. A domestic corporation is one that was created or organized in the United States or under the laws of the United States, any of its states, or the District of Columbia.

Can I claim franchise tax on my taxes?

For starters, franchisees can deduct the initial franchise fee over a 15-year period, enhancing their ability to manage cash flow in the early years. Additionally, ongoing royalty fees, advertising costs, and other expenses related to the franchise can be written off as business expenses.

Is foreign corporate income taxable in the US?

The United States asserts jurisdiction to tax foreign corporations only if they are engaged in business in the United States or receive income from sources within the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Corporation Franchise Tax Return?

The 2011 Corporation Franchise Tax Return is a tax form that corporations use to report their income, expenses, and other tax information to the relevant state tax authority for the year 2011.

Who is required to file 2011 Corporation Franchise Tax Return?

All corporations doing business in the state, including domestic and foreign corporations earning income or conducting business activities in that state, are generally required to file the 2011 Corporation Franchise Tax Return.

How to fill out 2011 Corporation Franchise Tax Return?

To fill out the 2011 Corporation Franchise Tax Return, corporations need to gather their financial records, complete the designated sections of the form based on their income and expenses, and ensure all required schedules and documentation are attached before submitting it to the tax authority.

What is the purpose of 2011 Corporation Franchise Tax Return?

The purpose of the 2011 Corporation Franchise Tax Return is to assess and collect state taxes owed by corporations based on their income and business activities within the state.

What information must be reported on 2011 Corporation Franchise Tax Return?

The 2011 Corporation Franchise Tax Return typically requires the reporting of total revenue, cost of goods sold, total expenses, deductions, net income, and any applicable credits, along with identifying information about the corporation.

Fill out your 2011 corporation franchise tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Corporation Franchise Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.