Get the free APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX - tennessee

Show details

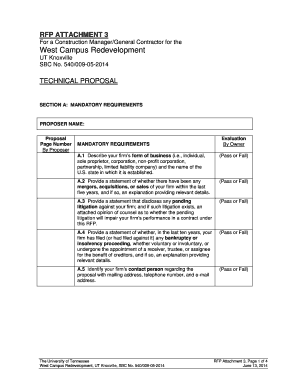

This application registers a business for the coin-operated amusement machine tax in Tennessee, requiring details about ownership, license levels, and business information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for registration coin-operated

Edit your application for registration coin-operated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for registration coin-operated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for registration coin-operated online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for registration coin-operated. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for registration coin-operated

How to fill out APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX

01

Obtain the APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX form from your local tax authority or online.

02

Fill out the applicant’s details, including name, business address, and contact information.

03

Provide the number of coin-operated amusement machines you are registering.

04

Include any relevant ownership information or business licenses.

05

Review the regulations to ensure compliance with local laws regarding coin-operated amusement machines.

06

Sign and date the application.

07

Submit the completed application along with any required fees to the appropriate tax authority.

Who needs APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

01

Business owners or operators who own coin-operated amusement machines.

02

Individuals or entities that are required to register these machines for taxation purposes.

03

Operators of arcades, entertainment centers, or businesses that feature such machines.

Fill

form

: Try Risk Free

People Also Ask about

What is a coin-operated machine?

: operated by coins inserted in a slot. a coin-operated laundry. … its arcade of coin-operated electronic amusement machines.

What is coin-operated amusement machines?

A bona fide coin-operated amusement machine is any type of machine or device that will automatically provide music or some other type of entertainment when a coin, , or some other object, such as a credit card, is deposited into the machine. Bona fide coin-operated amusement machines do not vend any merchandise.

What is the meaning of coin-operated?

Examples include: Batting cages. Cranes. Foosball and pool tables. Fortune telling machines. Photo or video booths. Rides. Video games.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

The APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX is a legal document that businesses must submit to register their coin-operated amusement machines for tax purposes. This application is a prerequisite for operating such machines legally and ensures compliance with local tax regulations.

Who is required to file APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

Any business or individual who owns or operates coin-operated amusement machines is required to file the APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX. This includes arcade owners, vending machine operators, and other entertainment facilities that feature such machines.

How to fill out APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

To fill out the APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX, applicants should provide the required information, which typically includes business details, the number of machines, and their locations. Additionally, applicants may need to sign and date the application and attach any necessary documentation before submitting it to the appropriate tax authority.

What is the purpose of APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

The purpose of the APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX is to ensure that all owners and operators of coin-operated amusement machines are registered for taxation. This helps local governments collect appropriate taxes on the income generated by these machines and ensure compliance with relevant laws.

What information must be reported on APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX?

The information that must be reported on the APPLICATION FOR REGISTRATION COIN-OPERATED AMUSEMENT MACHINE TAX often includes the applicant's name, business name, address, contact information, the number and types of machines being registered, their locations, and other details as requested by the taxing authority.

Fill out your application for registration coin-operated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Registration Coin-Operated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.