Get the free Charitable Organization and Solicitor Complaint Form - tennessee

Show details

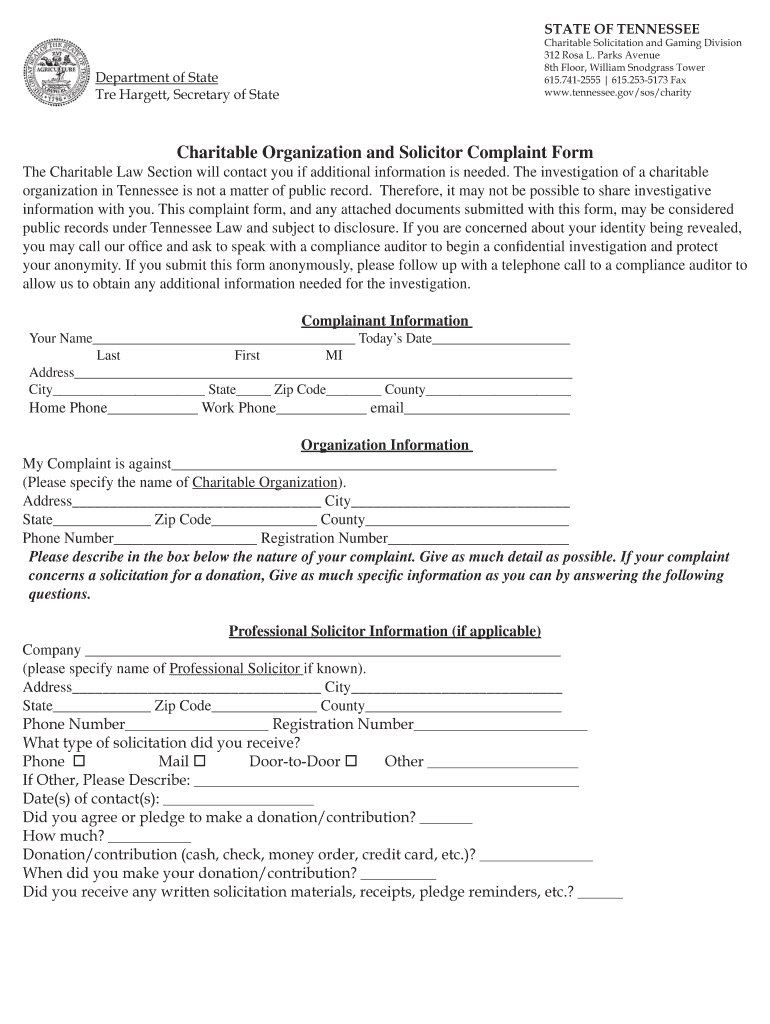

This form is used to file a complaint against charitable organizations or solicitors in Tennessee. The document collects information about the complainant, the organization in question, and the nature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable organization and solicitor

Edit your charitable organization and solicitor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable organization and solicitor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable organization and solicitor online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable organization and solicitor. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable organization and solicitor

How to fill out Charitable Organization and Solicitor Complaint Form

01

Download the Charitable Organization and Solicitor Complaint Form from the official website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide details about the charitable organization you are complaining about, including the name, address, and registration number if available.

04

Describe the nature of your complaint clearly and concisely, including specific incidents and dates.

05

Gather any supporting documentation that backs up your complaint, such as receipts or correspondence.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the form to confirm that the information provided is truthful.

08

Submit the form either by mail or through the designated online submission portal, following any additional instructions provided.

Who needs Charitable Organization and Solicitor Complaint Form?

01

Individuals who have experienced issues with registered charitable organizations or solicitors.

02

Donors wishing to report fraudulent activity or misuse of funds by a charity.

03

Members of the public needing to file complaints regarding unethical fundraising practices.

Fill

form

: Try Risk Free

People Also Ask about

How can a 501c3 lose its status?

Earning too much income generated from unrelated activities can jeopardize an organization's 501(c)(3) tax-exempt status. This income comes from a regularly carried- on trade or business that is not substantially related to the organization's exempt purpose.

Who holds nonprofit organizations accountable?

The public holds non-profit organizations accountable for several factors. Stakeholders need to know the vision, mission, values, and goals of the organization. These stakeholders will question the managers regularly based on their performance and progress in line with the set standards.

What can jeopardize 501c3 status?

Earning too much income generated from unrelated activities can jeopardize an organization's 501(c)(3) tax-exempt status. This income comes from a regularly carried- on trade or business that is not substantially related to the organization's exempt purpose.

What jeopardizes 501c3 status?

A section 501(c)(3) organization will jeopardize its exemption if it ceases to be operated exclusively for exempt purposes. An organization will be operated exclusively for exempt purposes only if it engages primarily in activities that accomplish the exempt purposes specified in section 501(c)(3).

What is a 501c3 prohibited from doing?

For example, the charitable organizations described in § 501(c)(3) may not engage in any campaign activity and may only conduct a limited amount of lobbying.

What is the complaint form for a nonprofit organization?

They may use Form 13909, Tax-Exempt Organization Complaint (Referral) Form, for this purpose. In addition to oversight by the IRS, tax-exempt organizations are subject to oversight by State charity regulators and State tax agencies. Additional resources include state charity regulators and/or state tax agencies.

How do you expose a corrupt non-profit?

In addition to filing a complaint with the Attorney General's Registry of Charities and Fundraisers, consider also filing complaints with: Better Business Bureau: (916) 443-6843. Department of Consumer Affairs: (916) 445-1254. Local Police Department.

What are 501c3 violations?

501c3 violations happen when the welfare of the private business is prioritized over the wellness of beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Organization and Solicitor Complaint Form?

The Charitable Organization and Solicitor Complaint Form is a document used to report concerns or complaints regarding charitable organizations or their solicitors, particularly in relation to their fundraising practices and compliance with relevant laws and regulations.

Who is required to file Charitable Organization and Solicitor Complaint Form?

Any individual or entity that has encountered issues or unethical practices with a charitable organization or its solicitors, including donors, beneficiaries, or the general public, is required to file the Charitable Organization and Solicitor Complaint Form.

How to fill out Charitable Organization and Solicitor Complaint Form?

To fill out the Charitable Organization and Solicitor Complaint Form, provide accurate details about the organization or solicitor involved, describe the nature of the complaint, include any evidence supporting the claim, and sign the form before submission to the appropriate regulatory body.

What is the purpose of Charitable Organization and Solicitor Complaint Form?

The purpose of the Charitable Organization and Solicitor Complaint Form is to facilitate the reporting and investigation of complaints related to charitable organizations and solicitors, ensuring transparency, accountability, and compliance with laws governing charitable fundraising.

What information must be reported on Charitable Organization and Solicitor Complaint Form?

The information that must be reported includes the name and contact information of the complainant, details of the charitable organization or solicitor involved, a description of the complaint, any relevant dates, and supporting evidence or documentation if available.

Fill out your charitable organization and solicitor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Organization And Solicitor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.