Get the free Credit Union Activities and Application Notice - cud texas

Show details

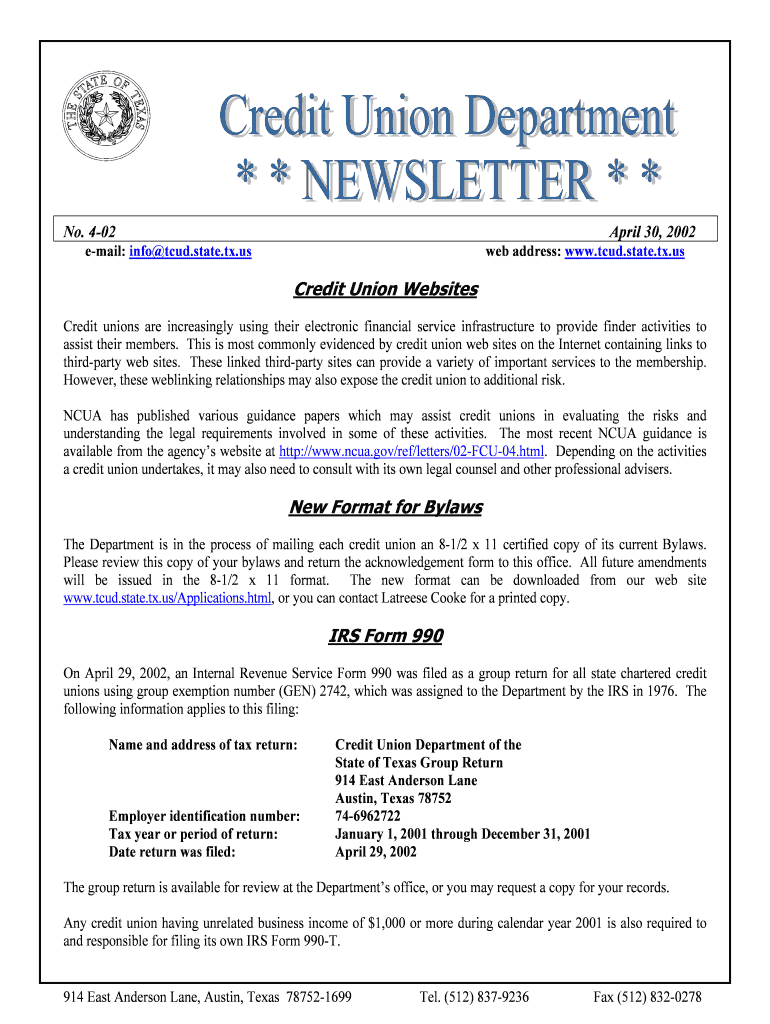

This document provides guidance on the electronic services and obligations for credit unions in Texas, including bylaws updates, IRS Form 990 filings, application deadlines, and field of membership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit union activities and

Edit your credit union activities and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union activities and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit union activities and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit union activities and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit union activities and

How to fill out Credit Union Activities and Application Notice

01

Gather required financial documents and identification.

02

Obtain the Credit Union Activities and Application Notice form from your credit union.

03

Read the instructions carefully to understand the sections you need to complete.

04

Fill out your personal information accurately including your name, address, and contact details.

05

Provide details of your expected activities and services requested from the credit union.

06

Include any additional information or documents required by your credit union.

07

Review the completed application for accuracy and completeness.

08

Submit the Credit Union Activities and Application Notice to the designated credit union representative.

Who needs Credit Union Activities and Application Notice?

01

Individuals seeking to engage with a credit union for financial services.

02

Members of a credit union applying for new activities or services.

03

Potential members wanting to understand their options within a credit union.

Fill

form

: Try Risk Free

People Also Ask about

Is it easy to get approved at a credit union?

Eligibility requirements for personal loans from credit unions are less strict than a bank's criteria. In particular, a low credit score may not disqualify you from a loan with a credit union because a credit union is more likely to take into account your overall financial circumstances.

Is it hard to get approved for credit union?

Credit unions require membership to open a bank account or utilize services. Usually, you'll have to work for a select employer or live in a specific city or county. However, some credit unions have pretty easy membership requirements that you let join from anywhere in the U.S.

What is a credit union in English?

credit union | Business English a financial organization that is owned and controlled by its members, who can borrow at low interest rates from the money they have saved as a group: To take out a loan, a customer must first be a member of the credit union by opening a savings account with a minimal balance.

How hard is it to get into a credit union?

Credit unions require membership to open a bank account or utilize services. Usually, you'll have to work for a select employer or live in a specific city or county. However, some credit unions have pretty easy membership requirements that you let join from anywhere in the U.S.

How do you know if a credit union is legit?

You can research credit unions on the NCUA website to verify their assets, number of members, and founding date.

What is the main disadvantage of a credit union?

Cons. While credit unions offer several advantages over traditional banks, they also have certain limitations: Limited accessibility: Credit unions are often regionally based, and their physical branches and ATM networks may be less extensive than those of larger banks.

What is the minimum credit score for a credit union?

Most credit unions look for a minimum score of around 580, though having a good credit score, typically defined as 670 or higher, can help you qualify for better rates and terms. However, credit unions consider more than just your credit score.

Why would you get denied from a credit union?

Each bank or credit union has its own policies about the way the information in your checking account report impacts your ability to open an account. Some banks and credit unions require you to pay any old, unpaid charges and fees before you are allowed to open a new account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Union Activities and Application Notice?

Credit Union Activities and Application Notice is a document used by credit unions to notify regulatory authorities about specific activities and applications, ensuring compliance with applicable laws and regulations.

Who is required to file Credit Union Activities and Application Notice?

All credit unions that engage in certain activities or seek to make changes that require regulatory approval are required to file the Credit Union Activities and Application Notice.

How to fill out Credit Union Activities and Application Notice?

To fill out the Credit Union Activities and Application Notice, credit unions must provide detailed information about the activity or application, including relevant identifiers, descriptions of the actions, and any supporting documentation as required.

What is the purpose of Credit Union Activities and Application Notice?

The purpose of the Credit Union Activities and Application Notice is to ensure transparency and regulatory oversight of credit union activities, allowing regulatory bodies to monitor compliance and protect member interests.

What information must be reported on Credit Union Activities and Application Notice?

The information that must be reported includes the credit union's name and identification details, the nature of the activity or application, supporting documentation, and the expected impact of the proposed activity on members and the community.

Fill out your credit union activities and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Activities And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.