Get the free 2015 Report on Value Lost Because of School District Participation in Tax Increment ...

Show details

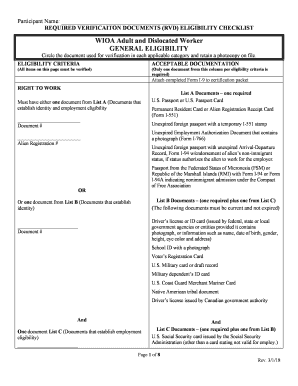

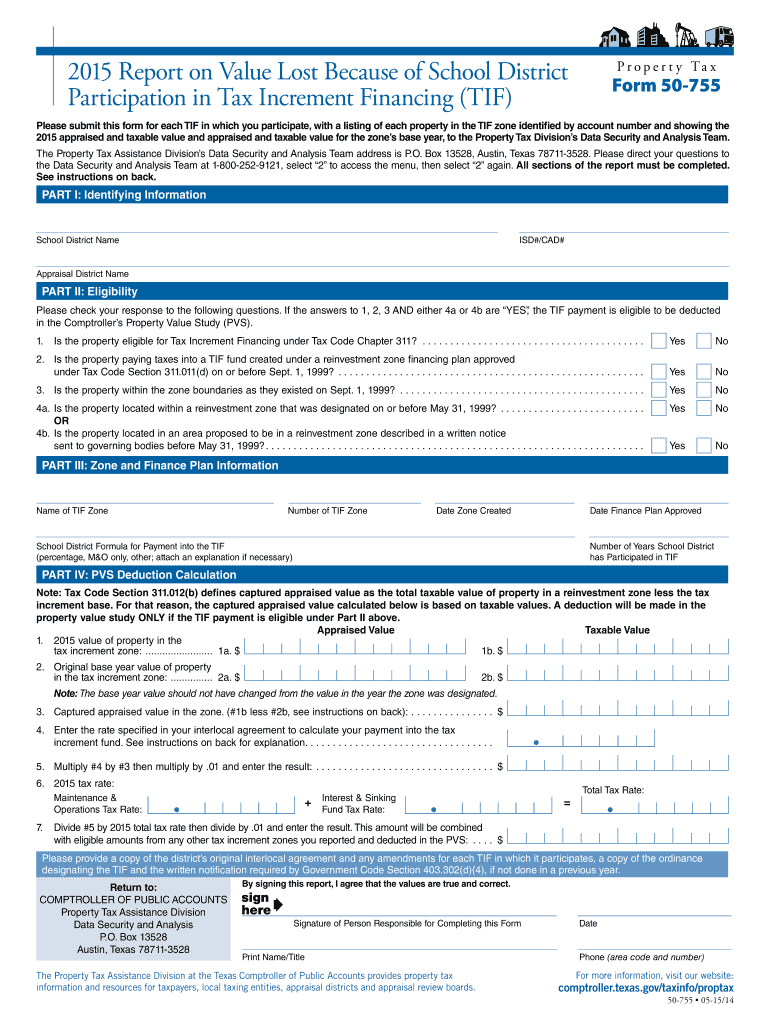

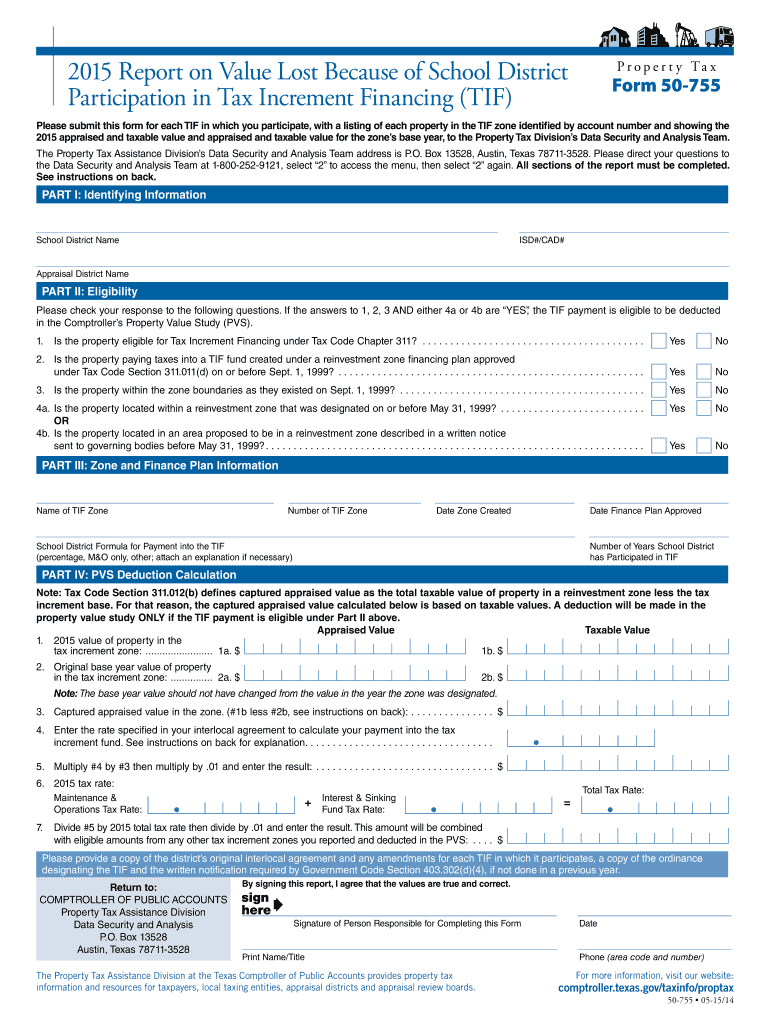

This form is used to report the value lost due to a school district's participation in a Tax Increment Financing program, requiring details of appraised values and eligibility for deductions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2015 report on value

Edit your 2015 report on value form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 report on value form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2015 report on value online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2015 report on value. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2015 report on value

How to fill out 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)

01

Gather financial statements from the school district prior to TIF involvement.

02

Determine the years of TIF participation affecting the district.

03

Calculate the assessed value of properties within the TIF district as of the latest assessment date.

04

Identify the baseline property tax revenues before TIF implementation.

05

Assess the incremental property tax revenues generated during the TIF period.

06

Document any lost revenue due to redirected property taxes to the TIF fund.

07

Compile all calculations and findings into the required report format.

08

Review the report for accuracy and completeness before submission.

Who needs 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

01

School districts that have participated in Tax Increment Financing.

02

Local government officials overseeing TIF programs.

03

Tax assessors and financial analysts evaluating the impact of TIF on school funding.

04

Policy makers who need insights into the economic effects of TIF on education funding.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside to a TIF?

A TIF allows the increase in assessed value (increment) of an improvement to real property to be exempt from real property taxation (the “exempted taxes”) and instead have those funds assist with costs necessary for a project to move forward.

What does .TIF stand for?

TIF CONS: • TIFs may set different urban areas and different levels of government in competition with one another over funding. Cities can obtain revenues that would otherwise have flowed to overlying government levels or school districts.

Why is tax increment financing bad?

However, the reality of TIF projects is far more complicated, as audits frequently show delays in cost recovery and overestimated economic benefits. Worse, these government subsidies often crowd out private investment and leave taxpayers footing the bill for developments that may not deliver their promised benefits.

What are the problems with TIF?

Disadvantages. Approval challenges — TIFs require approval from local government, which can be difficult depending on the community. Funding competition — There can be many parts of government and the private sector seeking funds, which can lead to challenges in fund allocation.

What does TIF stand for tax increment financing?

Tax Increment Financing, or TIF, is a geographically targeted economic development tool. It captures the increase in property taxes, and sometimes other taxes, resulting from new development, and diverts that revenue to subsidize that development.

What does TIF stand for in finance?

What is TIF? Tax Increment Financing, or TIF, is a geographically targeted economic development tool. It captures the increase in property taxes, and sometimes other taxes, resulting from new development, and diverts that revenue to subsidize that development.

Do TIFs increase property taxes?

A city designates a small geographic area to be redeveloped (a “TIF district”), usually at the request of a corporation or a developer. When that redevelopment happens, property values will go up, and therefore property taxes will be higher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

The 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF) assesses the financial impact on school districts due to property tax revenues excluded from their budgets as a result of TIF agreements.

Who is required to file 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

School districts that have participated in Tax Increment Financing programs and have experienced a loss in tax revenue as a result are required to file the 2015 Report.

How to fill out 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

To fill out the 2015 Report, school districts must gather data on property tax revenues lost due to TIF agreements, complete the reporting form with this data, and submit it by the designated deadline.

What is the purpose of 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

The purpose of the report is to document and analyze the financial effects of TIF participation on school districts, ensuring transparency and accountability in the use of tax revenue.

What information must be reported on 2015 Report on Value Lost Because of School District Participation in Tax Increment Financing (TIF)?

The report must include details on the total value of properties affected by TIF, the amount of tax revenue lost, and any relevant financial data that illustrates the impact on the school district's funding.

Fill out your 2015 report on value online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Report On Value is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.