Get the free Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance - tdi texas

Show details

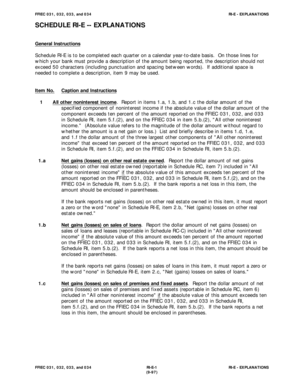

This document outlines the rights of consumers regarding their homeowners, dwelling, and renters insurance in Texas, as mandated by the Texas Department of Insurance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer bill of rights

Edit your consumer bill of rights form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer bill of rights form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer bill of rights online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consumer bill of rights. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer bill of rights

How to fill out Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance

01

Start by obtaining the Consumer Bill of Rights document from your insurance provider or the state insurance department.

02

Read the document carefully to understand your rights as a policyholder.

03

Fill in your personal information, including name, address, and policy number at the top of the form.

04

Review the sections that detail your rights regarding coverage, claims processing, and privacy practices.

05

Identify and mark any specific areas that require your acknowledgment or signature, if applicable.

06

Keep a copy for your records once the document is completed and signed.

Who needs Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

01

Homeowners seeking to understand their rights related to property insurance.

02

Renters who want to know their rights under renters insurance policies.

03

Individuals purchasing dwelling insurance to ensure they receive fair treatment and coverage.

04

Insurance agents and brokers who assist clients in understanding their policies.

Fill

form

: Try Risk Free

People Also Ask about

What is the Unfair Claims Act in Texas?

However, Texas is not a no-fault state. The no-fault rules do not apply, and instead, a driver will have to file a claim against another to secure compensation for their injuries.

What are the rules for insurance claims in Texas?

Texas' Prompt Payment of Claims Act (Chapter 542.055 – .057) Acknowledge claim, commence investigation, request information within 15 days after notice of loss. Notify insured in writing of acceptance or rejection of claim within 15 business days of receive all items to secure final proof of loss before deadline.

How long does an insurance company have to settle a claim in Texas?

Always File a Claim, Regardless of Who Was At-Fault One of the primary questions we receive from clients who have been in an accident is whether they should report the accident to their own auto insurance carrier, particularly when the accident was not their fault. And the answer to that question is: always.

How long does an insurance company have to settle a homeowners claim in Texas?

After you submit any requested documentation, the company has 15 days to accept or reject your claim. Once the company agrees to pay your claim, it must send a draft or check within 5 business days. A company that cannot meet the above deadline must send you a written notice explaining why.

Should I file a claim if I'm not at-fault?

Insurance companies violate the Texas Unfair Claims Practices Act when they: Knowingly misrepresent material facts or policy provisions related to coverage. Fail to attempt in good faith to effectuate a prompt, fair and equitable settlement of a claim with respect to which their liability has become reasonably clear.

What is going on with homeowners insurance in Texas?

Texas homeowners' insurance rates are rising fast, and there is little the Texas Legislature or anyone else can do to slow them down. Average premiums for Texans have jumped 43% since 2023 and will rise about $500 this year, ing to Insurify, an insurance comparison shopping website. That's only the beginning.

What is the homeowner claims bill of rights?

Understanding the Homeowner Claims Bill of Rights This legal documentation sets the obligations of the insurer towards the claimant, ensuring timely acknowledgment and action on claims. In the event of an insurance claim dispute, this piece of legislation can prove to be instrumental in affirming your legal rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

The Consumer Bill of Rights for Homeowners, Dwelling and Renters Insurance is a document that outlines the rights of consumers regarding their insurance policies, ensuring they are informed about their coverage, claims processes, and responsibilities.

Who is required to file Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

Insurance companies that provide homeowners, dwelling, and renters insurance are required to file the Consumer Bill of Rights with the appropriate regulatory body to ensure compliance and transparency for consumers.

How to fill out Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

To fill out the Consumer Bill of Rights, consumers typically need to review the provided information from their insurance provider, ensure all personal details are correct, and acknowledge their understanding of the policy terms by signing the document.

What is the purpose of Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

The purpose of the Consumer Bill of Rights is to protect consumers by ensuring they have clear information about their rights and responsibilities under their insurance policies, facilitating informed decision-making.

What information must be reported on Consumer Bill of Rights - Homeowners, Dwelling and Renters Insurance?

The Consumer Bill of Rights must report information such as the rights of consumers, details about coverage limits, the claims process, and the responsibilities of both the insurer and the insured regarding policy management.

Fill out your consumer bill of rights online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Bill Of Rights is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.