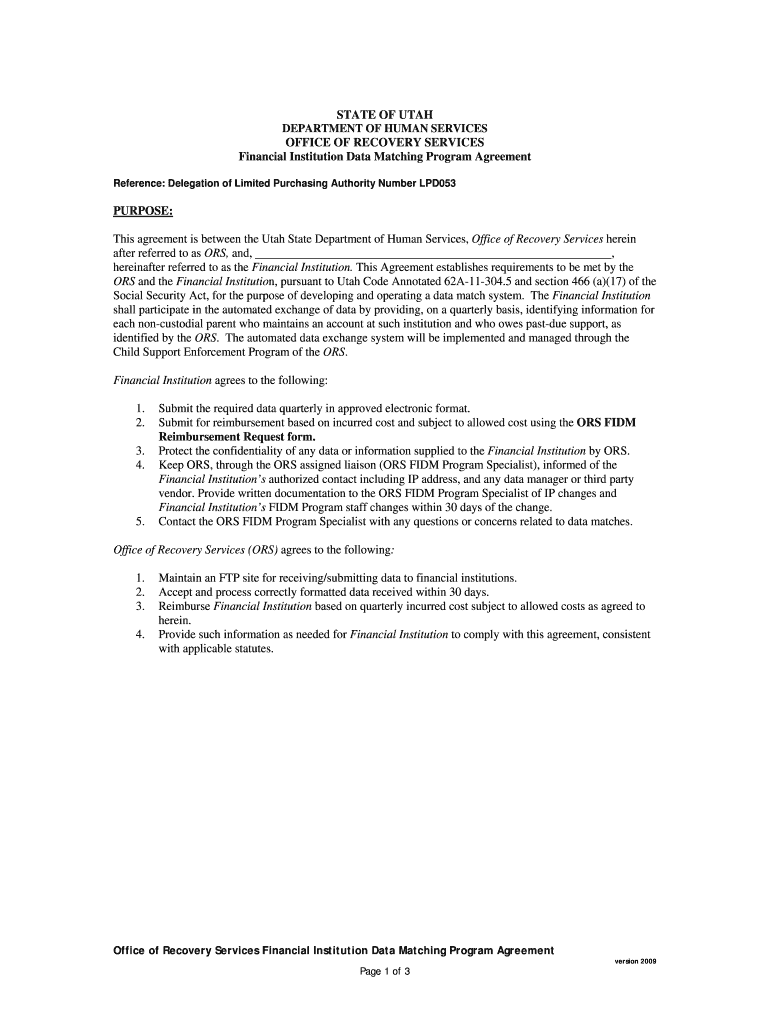

Get the free Financial Institution Data Matching Program Agreement - ors utah

Show details

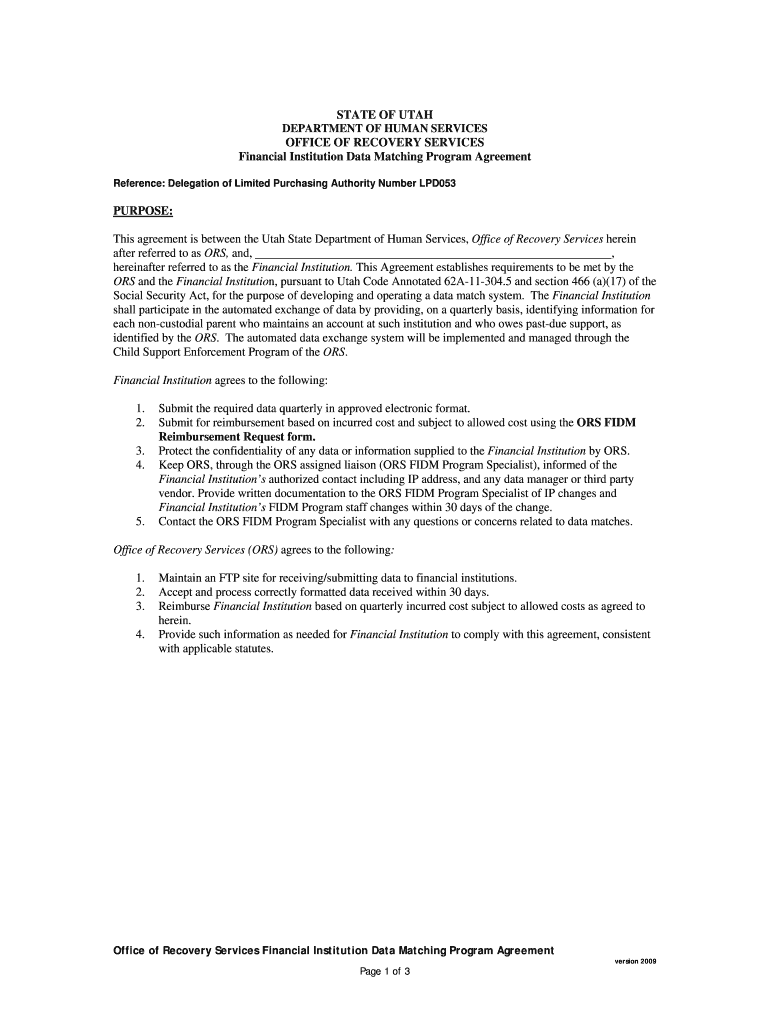

This agreement establishes requirements for the Utah State Department of Human Services and financial institutions for the automated exchange of data related to non-custodial parents owing past-due

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial institution data matching

Edit your financial institution data matching form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial institution data matching form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial institution data matching online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial institution data matching. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

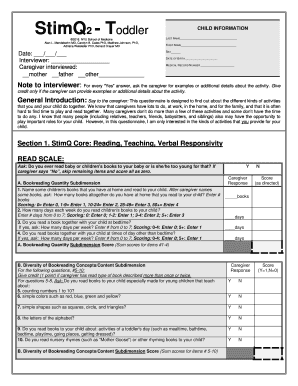

How to fill out financial institution data matching

How to fill out Financial Institution Data Matching Program Agreement

01

Begin by obtaining the Financial Institution Data Matching Program Agreement form from the relevant regulatory body.

02

Carefully read the instructions provided with the form to ensure all sections are understood.

03

Fill out the institutional information section, including the name, address, and contact details of the financial institution.

04

Provide the necessary identification numbers such as the Tax Identification Number or Employer Identification Number.

05

Input the relevant data regarding the services offered and the nature of data sharing intended.

06

Complete the confidentiality and compliance sections, indicating your commitment to data protection and privacy laws.

07

Review all information for accuracy and completeness before signing.

08

Sign and date the agreement in the designated area, and include the title of the signatory.

09

Submit the completed agreement to the appropriate regulatory body as specified in the instructions.

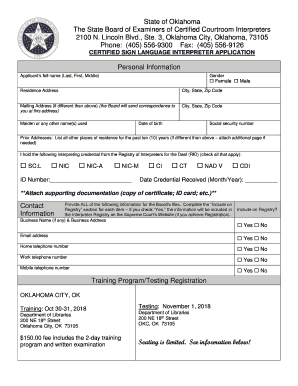

Who needs Financial Institution Data Matching Program Agreement?

01

Financial institutions participating in data matching programs to verify consumer information.

02

Organizations that require accurate data for compliance with federal or state regulations.

03

Lenders, banks, and credit unions needing to check financial histories and reduce fraud risks.

Fill

form

: Try Risk Free

People Also Ask about

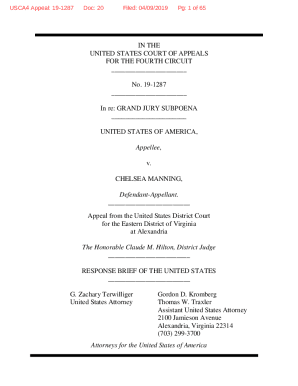

How does fidm work?

The Act provides for two different “match” methods: The “All Accounts” method, where your credit union would send a list of all memberships to the State, who would then use the file to match against their records; or the “Matched Accounts” method, where the State provides a complete list of all delinquent non-custodial

What is the US Right to Financial Privacy Act?

Existing law, the California Right to Financial Privacy Act, generally provides for the confidentiality of, and restricts access to, the financial records of people who transact business with, or use the services of, financial institutions or for whom a financial institution has acted as a fiduciary.

What is the US data privacy law for financial institutions?

Protecting Consumers' Financial Privacy Financial institutions are required to take steps to protect the privacy of consumers' finances under a federal law called the Financial Modernization Act of 1999, also known as the Gramm-Leach-Bliley Act.

What is the US data privacy law applicable to financial services?

The 1978 Right to Financial Privacy Act (RFPA) establishes specific procedures that federal government authorities must follow in order to obtain information from a financial institution about a customer's financial records.

What does "financial institution" mean on an application?

“Financial institution” means any institution the business of which is engaging in financial activities as described in Section 1843(k) of Title 12 of the United States Code and doing business in this state. An institution that is not significantly engaged in financial activities is not a financial institution.

What is a financial institution data match?

Background: Financial Institution Data Match (FIDM) The data match is intended to identify financial accounts held in banks, credit unions, money market mutual funds, etc., belonging to parents who are delinquent in the payment of their child support obligation.

What is the financial information Privacy Act?

Two federal laws cover your personal financial privacy: The Fair Credit Reporting Act (PDF) and the Gramm-Leach-Bliley Act.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Institution Data Matching Program Agreement?

The Financial Institution Data Matching Program Agreement is a program that facilitates the sharing of information among financial institutions and government agencies to assist in the identification of individuals for the purpose of enforcing support obligations, such as child support.

Who is required to file Financial Institution Data Matching Program Agreement?

Financial institutions, including banks and credit unions, are required to file the Financial Institution Data Matching Program Agreement when they participate in the program to comply with federal and state requirements.

How to fill out Financial Institution Data Matching Program Agreement?

To fill out the Financial Institution Data Matching Program Agreement, financial institutions must provide basic information about their organization, including contact details, and agree to the terms and conditions set forth in the agreement.

What is the purpose of Financial Institution Data Matching Program Agreement?

The purpose of the Financial Institution Data Matching Program Agreement is to enable the systematic matching of financial data to assist in the enforcement of child support and other obligations, thereby improving the collection of owed support payments.

What information must be reported on Financial Institution Data Matching Program Agreement?

The information that must be reported includes personal identification details of individuals owing support, account numbers, and the financial institution's information, as outlined in the agreement protocols.

Fill out your financial institution data matching online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Institution Data Matching is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.