Get the free SBA Form 2183 - archive sba

Show details

This form is used as part of the application process for the Small Business Investment Company (SBIC) program, which assesses the management, experience, and business background of principals of SBIC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba form 2183

Edit your sba form 2183 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 2183 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba form 2183 online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sba form 2183. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

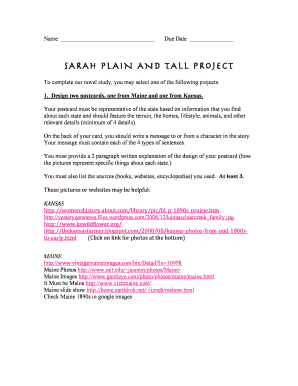

How to fill out sba form 2183

How to fill out SBA Form 2183

01

Download SBA Form 2183 from the official SBA website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information in the designated fields, including your name, address, and contact details.

04

Provide details about your business, including the business name, type of business, and any relevant identification numbers.

05

Indicate the loan amount you are requesting and provide a brief description of how the funds will be used.

06

Include any necessary financial information or documentation that supports your application.

07

Review the completed form for accuracy and completeness before submitting.

08

Sign and date the form where required.

09

Submit the form to the appropriate SBA office or designated lender.

Who needs SBA Form 2183?

01

Small business owners seeking government-backed loans.

02

Entrepreneurs applying for financial assistance related to their business operations.

03

Individuals seeking to refinance existing debt under SBA guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What documents do the SBA need?

Minimum SBA Loan Requirements Basic Criteria. Your business is currently in operation. Financial Criteria. Personal Background Statement. Borrow Information: SBA Form 1919. Personal Financial Statement: SBA Form 413. Personal Tax Returns. Personal Credit Report & Score. Professional Resume.

What is the SBA form 1031?

SBA Form 1031 collects Portfolio Concern Financing information SBA also pools information provided by individual SBICs to analyze the SBIC program as a whole and the impact of SBIC Financings on the growth of small business.

Is the SBA form 1846 required?

While this form remains available on the SBA website, the Agency clarified that its use is no longer required for any disbursement of any size 7(a) loan. SOPs 50 10 7 and 7.1 removed the requirement that this form be used to document the first disbursement on Standard 7(a) loans (those over $500,000).

Who needs to fill out the SBA form 1919?

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business' general operations.

Is the SBA form 1920 still required?

SBA Form 1920 has been retired as of August 1, 2023.

What is the SBA form for contractors?

When must a borrower or contractor sign SBA Form 601? As a starting point, borrowers and contractors must sign SBA Form 601 only when they will receive financial assistance through federal funds or programs. If your company is working on projects not financed with federal assistance, Form 601 should not be required.

What is the SBA form for contractors?

When must a borrower or contractor sign SBA Form 601? As a starting point, borrowers and contractors must sign SBA Form 601 only when they will receive financial assistance through federal funds or programs. If your company is working on projects not financed with federal assistance, Form 601 should not be required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Form 2183?

SBA Form 2183 is a document used by the Small Business Administration (SBA) for certain loan programs, primarily to report necessary information about business ownership and control.

Who is required to file SBA Form 2183?

Businesses seeking financial assistance from the SBA, particularly those applying for loans or grants, are required to file SBA Form 2183.

How to fill out SBA Form 2183?

To fill out SBA Form 2183, applicants must provide accurate information regarding ownership, affiliations, and control of the business. This includes detailed data about the business structure and its owners.

What is the purpose of SBA Form 2183?

The purpose of SBA Form 2183 is to collect essential data that helps the SBA assess eligibility for its loan and grant programs, ensuring compliance with federal regulations.

What information must be reported on SBA Form 2183?

SBA Form 2183 requires reporting information such as the names of business owners, their ownership percentages, the business structure, affiliations, and any relevant personal information that may affect the loan approval process.

Fill out your sba form 2183 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 2183 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.