Get the free WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE - washco utah

Show details

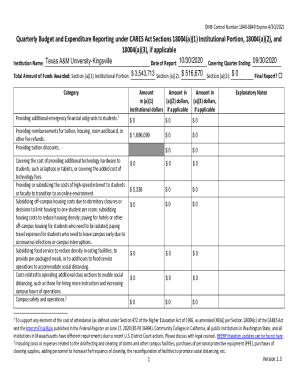

This document is a notice for personal property taxation, detailing the assessment process and tax obligations for property owners in Washington County, Utah, for the year 2012. It includes instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign washington county personal property

Edit your washington county personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washington county personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit washington county personal property online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit washington county personal property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out washington county personal property

How to fill out WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE

01

Start by obtaining the WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE form from the county office or website.

02

Enter your full name and address in the designated fields.

03

List all personal property you own, including vehicles, boats, and any other taxable items.

04

Provide the identification details for each item, such as make, model, year, and VIN (Vehicle Identification Number) for vehicles.

05

Include the estimated value of each item on the form.

06

Review any exemptions you may qualify for and indicate them on the form.

07

Sign and date the form at the bottom to certify that all information is accurate.

08

Submit the completed form to the appropriate tax office by the deadline specified.

Who needs WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

01

Residents of Washington County who own personal property that is subject to taxation.

02

Individuals or businesses with assets such as vehicles, boats, or equipment in Washington County.

Fill

form

: Try Risk Free

People Also Ask about

How long can property taxes go unpaid in Colorado?

The property owner has three years to redeem the tax lien before the investor is eligible to apply for a treasurer's deed on the property. In addition to the amount of the delinquent taxes, the property owner pays an interest charge, which is credited to the tax lien investor.

At what age do you stop paying property taxes in Washington?

At least 61 years of age or older. Retired from regular gainful employment due to a disability. Veteran of the armed forces of the United States receiving compensation from the United States Department of Veterans Affairs at one of the following: Combined service-connected evaluation rating of 80% or higher.

Why do I pay personal property tax?

One method that states can use to raise revenue is to charge you a tax on your personal property. This type of tax is separate, and may be in addition, to the state and local taxes you pay on your real estate.

Are delinquent property taxes deductible?

Real property taxes However, if you agree to pay the seller's delinquent taxes from an earlier year at the time you close the sale, you are not permitted to deduct them on your tax return. This payment must be treated as part of the cost of buying the home, rather than as a property tax deduction.

Are property taxes deductible for IRS?

State and local real property taxes are generally deductible. Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare.

Can you write off delinquent property taxes?

Delinquent taxes are unpaid taxes that were imposed on the seller for an earlier tax year. If you agree to pay delinquent taxes when you buy your home, you can't deduct them. You treat them as part of the cost of your home. See Real estate taxes, later, under Basis.

How do I pay my property taxes in Washington County, MN?

Property Tax Payments Payments may be made via U.S. mail, online, bill pay service, or in-person at any Washington County Service Center or at the Government Center in Stillwater. For more assistance or questions, call 651-430-6175, Monday–Friday between 8 a.m. – 4:30 p.m.

Can I claim property taxes from previous years?

by TurboTax• 191• Updated 2 months ago You can claim prior years' property tax in the tax year you paid them. For example, if you paid your 2022 property taxes in 2024, claim them on your 2024 taxes. However, you can't include any late fees, interest, or penalties—just the tax itself.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

The WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE is a legal document sent to individuals and businesses to inform them of their personal property tax obligations in Washington County.

Who is required to file WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

Individuals and businesses that own personal property in Washington County are required to file the WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE.

How to fill out WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

To fill out the WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE, you need to provide your name, address, a description of the personal property, and its assessed value, after which you must sign and date the form.

What is the purpose of WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

The purpose of the WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE is to notify taxpayers of their tax liabilities and ensure compliance with local tax regulations.

What information must be reported on WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE?

The information that must be reported on the WASHINGTON COUNTY PERSONAL PROPERTY TAX NOTICE includes the owner's name, location of the property, a detailed description of the personal property, its taxable value, and any relevant exemptions.

Fill out your washington county personal property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Washington County Personal Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.