Get the free RENTAL VEHICLE TAX EXEMPTION - dmv vermont

Show details

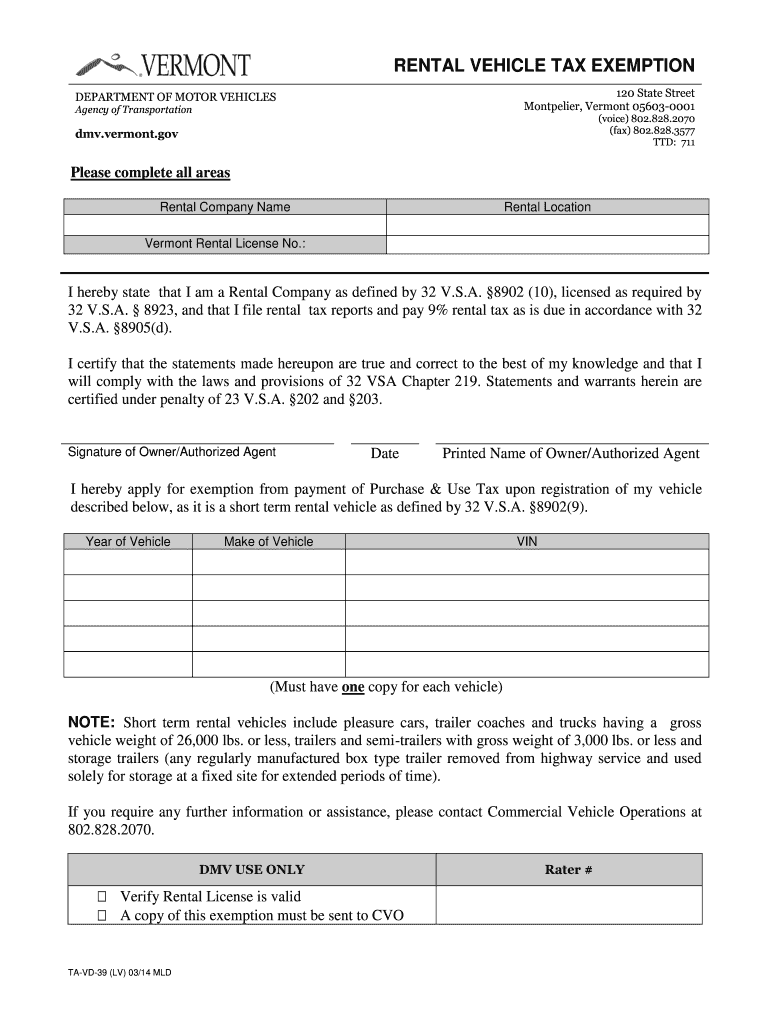

This document is an application for exemption from payment of Purchase & Use Tax for rental vehicles in Vermont, certifying compliance with local tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental vehicle tax exemption

Edit your rental vehicle tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental vehicle tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental vehicle tax exemption online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rental vehicle tax exemption. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental vehicle tax exemption

How to fill out RENTAL VEHICLE TAX EXEMPTION

01

Obtain the Rental Vehicle Tax Exemption form from your local government or tax office website.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide details of the rental vehicle, including make, model, and rental agreement number.

04

Indicate the reason for tax exemption, such as business or educational purposes.

05

Attach any necessary documentation that supports the request for exemption, such as proof of tax-exempt status.

06

Review the completed form for accuracy before submission.

07

Submit the form to the appropriate rental agency or local tax authority as instructed.

Who needs RENTAL VEHICLE TAX EXEMPTION?

01

Non-profit organizations that rent vehicles for exempt purposes.

02

Government agencies needing rental vehicles for official duties.

03

Businesses that qualify for tax exemptions for specific activities or operations.

04

Educational institutions renting vehicles for school-related functions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax exempt certificate in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What is the vehicle exemption in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Who qualifies for tax exempt purchases?

Depending on the state, these may include government entities, non-profits, and schools, to name a few. It is the buyers' responsibility to provide their exemption certificates in order to not be charged sales tax, and sellers need to keep documentation of these exemptions on file.

What is the tax exemption form for rental cars in Texas?

When renting tax-free to someone who can claim an exemption, you must attach Form 14-305 (Back), Motor Vehicle Rental Tax Exemption Certificate (PDF) to your rental contract. Exemption certificates show information about the vehicle and the renter, including the reason the renter is claiming the exemption.

Can I write off a rental car on my taxes?

The short answer is that you can deduct your rental car fees but not your mileage when you use a rental car to drive for rideshare or delivery. The standard mileage deduction is intended for use on cars that you own or lease, not on cars that you rent.

What is the vehicle rental excise tax in Kansas?

WHAT IS THE VEHICLE RENTAL EXCISE TAX? The vehicle rental excise tax is 3.5% on the rental or lease of motor vehicles for 28 consecutive days or less. This tax is imposed in addition to the Kansas Retailers' Sales tax (state and applicable local rate) due on each rental or lease transaction.

What is the tax on a rental car in NY?

Still, whether you are planning a trip to 'the Big Apple' from another state, or whether you live in New York and just need a car for a few days, you must be prepared to pay the tax. Currently, the car rental tax is calculated at 11% of your total bill.

What is the tax on a rental car in Texas?

For rental contracts of 30 days or less, the tax rate is 10 percent of the gross rental receipts. For contracts of 31 to 180 days, the tax rate is 6.25 percent of the gross rental receipts. For more information, visit our Web site .window.state.tx.us.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RENTAL VEHICLE TAX EXEMPTION?

RENTAL VEHICLE TAX EXEMPTION refers to the exemption from taxes imposed on rental vehicles, typically granted to specific entities or individuals for qualifying purposes, such as government agencies or non-profit organizations.

Who is required to file RENTAL VEHICLE TAX EXEMPTION?

Entities or individuals that qualify for tax exemption on rental vehicles, such as government agencies, educational institutions, or non-profit organizations, are required to file for RENTAL VEHICLE TAX EXEMPTION.

How to fill out RENTAL VEHICLE TAX EXEMPTION?

To fill out RENTAL VEHICLE TAX EXEMPTION, you need to complete the designated form, providing necessary information such as the entity's details, purpose of the rental, and any applicable exemption documentation.

What is the purpose of RENTAL VEHICLE TAX EXEMPTION?

The purpose of RENTAL VEHICLE TAX EXEMPTION is to relieve eligible entities or individuals from the financial burden of taxes on rental vehicles, allowing them to allocate more resources toward their primary functions or missions.

What information must be reported on RENTAL VEHICLE TAX EXEMPTION?

The information that must be reported on RENTAL VEHICLE TAX EXEMPTION typically includes the name and address of the exempt entity, the purpose of the rental, the duration of the rental, and any relevant identification numbers or documentation supporting the exemption.

Fill out your rental vehicle tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Vehicle Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.