Get the free Motor Vehicle Dealer Bond - dmv vermont

Show details

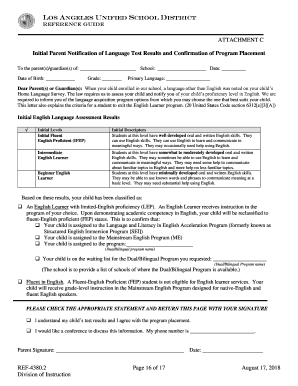

This document serves as a surety bond required for the registration of new and used car dealers in the State of Vermont, ensuring compliance with state statutes and providing indemnity against potential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle dealer bond

Edit your motor vehicle dealer bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle dealer bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor vehicle dealer bond online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit motor vehicle dealer bond. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle dealer bond

How to fill out Motor Vehicle Dealer Bond

01

Obtain the necessary forms from your state’s department of motor vehicles or the bond provider.

02

Fill out the application with required details such as your dealership's name, address, and type of dealership.

03

Provide any additional documentation requested, such as proof of business registration or financial statements.

04

Select the bond amount based on your state's requirements and submit any applicable fees.

05

Review the finalized bond agreement carefully before signing.

06

Submit the completed bond to the appropriate state agency to ensure compliance.

Who needs Motor Vehicle Dealer Bond?

01

Anyone looking to operate as a licensed motor vehicle dealer in their state.

02

Individuals or businesses that sell cars, motorcycles, or other motor vehicles.

03

Dealers who must comply with state regulations requiring a bond to protect consumers.

Fill

form

: Try Risk Free

People Also Ask about

How much is a $35000 surety bond?

In the case of a $35,000 surety bond, that means paying between $350 and $1,050. Get a quick estimate of your bond cost with our Surety Bond Cost Calculator below or apply online for free to receive an exact quote.

How much is a 20,000 auto dealer bond?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $15,000 $150 - $450 $450 - $750 $20,000 $200 - $600 $600 - $1,000 $25,000 $250 - $750 $750 - $1,2507 more rows

How does a bond work on a car?

If you do not have a title to provide proof of ownership for a vehicle, boat, trailer, or camper, you may need a certificate of title bond. A title bond guarantees the vehicle is yours to the DMV and will pay the value of the vehicle should there be an owner with the proper title. Title bond requirements vary by state.

How much does a $20,000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $20,000 $200 - $600 $600 - $1,000 $25,000 $250 - $750 $750 - $1,250 $30,000 $300 - $900 $900 - $1,5007 more rows

How do you go after a bond?

Filing a Bond Claim If the contractor does not comply with the conditions of the bond, a claim can be filed with the surety company. The consumer will contact the surety directly to engage this process.

How to file a complaint against a dealership surety bond?

The Surety Bond Branch only handles complaints made by federal agencies. If you are not a federal agency and need assistance, please contact your state's attorney general or contact an attorney.

What is a bond on a car?

Definition. At its core, a surety bond for a car is a form of insurance or a safety net. It's there to make sure that if something goes wrong in the process of proving a car's ownership, there's a way to fix it without anyone losing out. Think of it like a promise that is backed by a company. Three-party Agreement.

How to go after a dealer bond?

How to make a surety bond claim Step #1: Find out who bonded the offender. Step #2: Make contact with the bonding company, specifically their Claims Department. Step #3: File the surety bond claim as the surety company requires. Step #4: Once your claim is received, maintain contact with the surety company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Vehicle Dealer Bond?

A Motor Vehicle Dealer Bond is a type of surety bond required by state governments that serves as a guarantee that a motor vehicle dealer will operate within the bounds of state laws and regulations.

Who is required to file Motor Vehicle Dealer Bond?

Motor vehicle dealers, including those selling new and used cars, motorcycles, trailers, and other motor vehicles, are required to file a Motor Vehicle Dealer Bond as part of the licensing process.

How to fill out Motor Vehicle Dealer Bond?

To fill out a Motor Vehicle Dealer Bond, the dealer must provide their personal and business information, including the dealer's name, address, and license number, as well as the bond amount and the surety company details.

What is the purpose of Motor Vehicle Dealer Bond?

The purpose of a Motor Vehicle Dealer Bond is to protect customers and the state from losses due to fraud, misconduct, or failure to comply with laws by the dealer.

What information must be reported on Motor Vehicle Dealer Bond?

The Motor Vehicle Dealer Bond must report the dealer's name, address, the bond amount, the bond number, the surety company's name and address, and any state licensing information.

Fill out your motor vehicle dealer bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Dealer Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.