Get the free Cost Report Auditing and Cost Settlement Services - dvha vermont

Show details

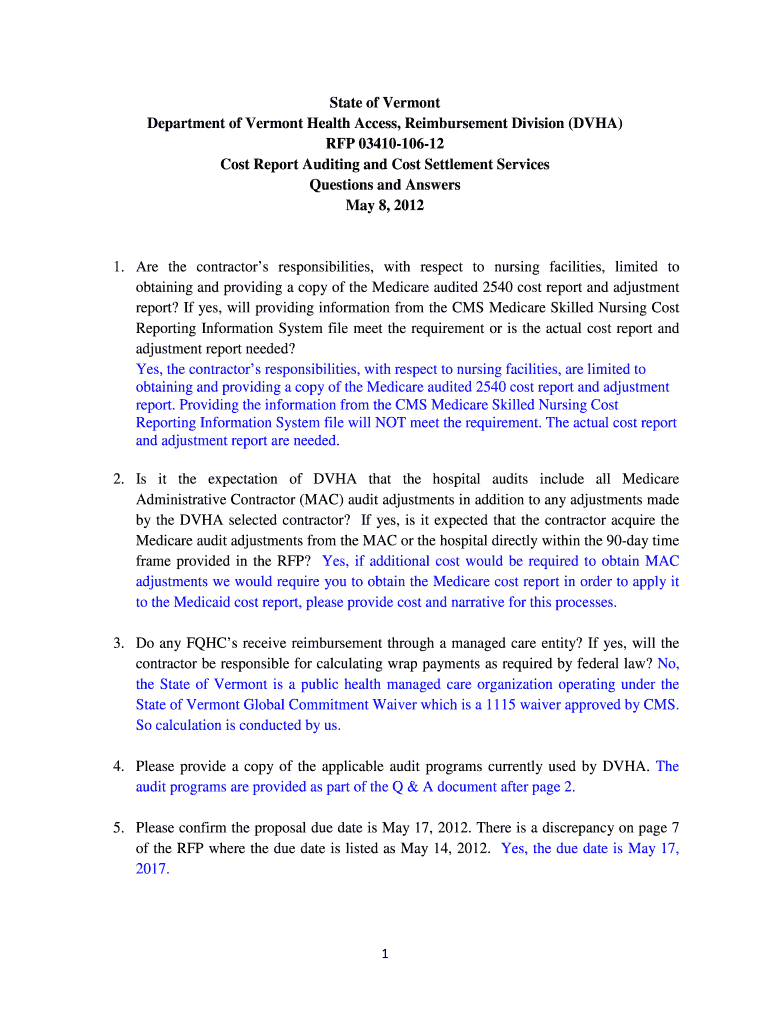

This document provides a set of questions and answers regarding the responsibilities and requirements for the auditing and settlement of cost reports for various health facilities in Vermont.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost report auditing and

Edit your cost report auditing and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost report auditing and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cost report auditing and online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cost report auditing and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost report auditing and

How to fill out Cost Report Auditing and Cost Settlement Services

01

Gather all relevant financial documents and reports related to costs incurred.

02

Organize the data systematically by category, such as labor, materials, and overhead.

03

Use a standardized template for the cost report to ensure consistency.

04

Complete each section of the cost report, providing clear and concise descriptions of each cost item.

05

Verify calculations and ensure all expenses are accurately reflected in the report.

06

Include any supporting documentation, such as invoices and receipts, to validate the costs listed.

07

Submit the completed cost report to the designated auditor or reviewing authority for assessment.

Who needs Cost Report Auditing and Cost Settlement Services?

01

Businesses seeking to manage and monitor their project costs effectively.

02

Organizations that require compliance with regulatory standards for financial reporting.

03

Contractors involved in government or large-scale projects requiring detailed financial auditing.

04

Companies looking to identify areas of cost savings and improve overall financial efficiency.

Fill

form

: Try Risk Free

People Also Ask about

What is a cost report settlement?

The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in the Healthcare Provider Cost Reporting Information System (HCRIS).

What is a cost report audit?

This cost report review, audit, and settlement process provides a method to detect improper payments and identify the reasons these improper payments have occurred.

What is the difference between cost audit report and financial audit report?

In a financial audit, an auditor has to check the exact value of the closing stock for the balance sheet. In a cost audit, an auditor has to check the adequacy of the stock keeping in view the needs of the concern.

Who needs to file a Medicare cost report?

Each year, Medicare Part A providers must submit an acceptable Medicare Cost Report (MCR) package to their Medicare Administrative Contractor (MAC) for the purposes of determining their Medicare reimbursable cost.

How to do a cost report?

How to Create a Cost Report? Creating a cost report requires gathering data from multiple sources such as invoices, contracts, and timesheets. This data should then be organized into categories such as labor costs, materials, and overhead expenses.

What is a cost audit report?

A cost audit represents the verification of cost accounts and checking on the adherence to cost accounting plan. Cost audit ascertains the accuracy of cost accounting records to ensure that they are in conformity with cost accounting principles, plans, procedures and objectives.

What is the purpose of the cost report?

A cost report is a document that provides an overview of the costs associated with a project. It typically includes information about the budget, actual costs, and any variances between the two. The report can also include details about labor costs, materials, and other expenses related to the project.

How much does an audit report cost?

Audit costs: $5-150k The bigger your company, the more you're likely to pay. Of course, the CPA firm you hire will influence the price as well.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cost Report Auditing and Cost Settlement Services?

Cost Report Auditing and Cost Settlement Services involve the review and reconciliation of cost reports submitted by healthcare providers to ensure accuracy and compliance with regulatory standards. This process validates the reported costs associated with providing services and facilitates the settlement of costs with payers.

Who is required to file Cost Report Auditing and Cost Settlement Services?

Typically, healthcare providers that receive reimbursement from government programs, such as Medicare and Medicaid, are required to file for Cost Report Auditing and Cost Settlement Services. This includes hospitals, skilled nursing facilities, and other entities that claim cost-based reimbursement.

How to fill out Cost Report Auditing and Cost Settlement Services?

To fill out Cost Report Auditing and Cost Settlement Services, providers need to gather financial and operational data, including costs of services, patient days, and revenue. They must complete the prescribed forms accurately, ensuring all relevant expenses are documented and aligned with regulatory guidelines before submission.

What is the purpose of Cost Report Auditing and Cost Settlement Services?

The purpose is to ensure that healthcare providers are reimbursed accurately for the services provided, based on actual costs. It helps maintain financial integrity within the healthcare system and ensures that taxpayer funds are appropriately utilized.

What information must be reported on Cost Report Auditing and Cost Settlement Services?

Providers must report detailed financial information including total operating costs, service-specific costs, revenue data, patient volume metrics, and any adjustments necessary for compliance with regulations. It's essential that all reported information is accurate and verifiable.

Fill out your cost report auditing and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Report Auditing And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.