Get the free Insurance Division Regulation 99-1 Record Retention - dfr vermont

Show details

This regulation establishes rules for the preservation and retention of insurer records, including media types, retention durations, and examination requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance division regulation 99-1

Edit your insurance division regulation 99-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance division regulation 99-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

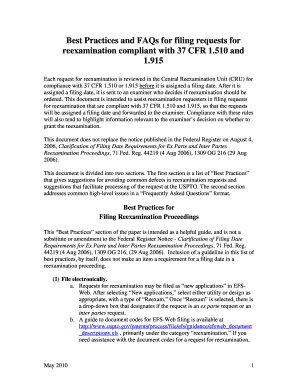

How to edit insurance division regulation 99-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance division regulation 99-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance division regulation 99-1

How to fill out Insurance Division Regulation 99-1 Record Retention

01

Gather all necessary documents that need to be retained according to the regulation.

02

Review the specific records that fall under the categories defined by Regulation 99-1.

03

Determine the retention period for each type of record based on the regulation guidelines.

04

Create a filing system to organize the records by type and retention period.

05

Ensure that all records are securely stored and protected against unauthorized access.

06

Establish a process for regularly reviewing and updating the records to comply with any changes in regulations.

07

Document the retention policies and procedures for future reference and employee training.

Who needs Insurance Division Regulation 99-1 Record Retention?

01

Insurance companies operating within the jurisdiction governed by the regulation.

02

Insurance agents and brokers who handle client records.

03

Regulatory bodies overseeing compliance with insurance record retention mandates.

04

Legal professionals involved in insurance matters.

Fill

form

: Try Risk Free

People Also Ask about

How long does a company have to keep insurance documents?

As a general matter, seven years is usually sufficient for insurance agencies to maintain client records–that is, seven years after the policy ends or claims can no longer be filed.

How long to keep certificates of insurance?

It's recommended to keep a certificate of insurance (COI) indefinitely for any vendors or third-party companies you work with, even after its expiration date. After a COI expires, it's beneficial to retain it as a record of when your vendors were insured by a specific policy.

How long must an insurer keep records of claims?

(a) Every administrator shall maintain at its principal administrative office for the duration of the written agreement referred to in Section 1759.1 and five years thereafter adequate books and records of all transactions between it, and insurers and insured persons.

How long must every insurance agent maintain all records, books, and documents?

Every insurance agent/broker MUST maintain all records, books, and documents for insurance transactions for a period of not less than 5 years.

How long should you keep insurance policy documents?

Generally, you should keep most insurance documents for at least as long as the policy is in effect or, if your policy has ended, until any still-open claims are settled.

What is the 7 year retention rule?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.

How many years do insurance companies keep records?

The answer varies depending on the state. In California, the retention period can be anywhere from two to ten years, depending on the type of procedure or healthcare provider. However, an insurance claim medical report should only look as far back as the injury in question.

How far back do insurance companies keep records?

How long are medical records kept? The answer varies depending on the state. In California, the retention period can be anywhere from two to ten years, depending on the type of procedure or healthcare provider. However, an insurance claim medical report should only look as far back as the injury in question.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurance Division Regulation 99-1 Record Retention?

Insurance Division Regulation 99-1 Record Retention establishes guidelines for the retention of insurance records, ensuring that companies maintain appropriate documentation for a specified duration.

Who is required to file Insurance Division Regulation 99-1 Record Retention?

Insurance companies and organizations operating within the jurisdiction of the regulation are required to file Insurance Division Regulation 99-1 Record Retention.

How to fill out Insurance Division Regulation 99-1 Record Retention?

To fill out Insurance Division Regulation 99-1 Record Retention, entities must complete the designated form by providing the required information about their records, including types of records retained and their respective retention periods.

What is the purpose of Insurance Division Regulation 99-1 Record Retention?

The purpose of Insurance Division Regulation 99-1 Record Retention is to ensure that insurance records are preserved adequately, providing a basis for audits, consumer protection, and compliance with legal standards.

What information must be reported on Insurance Division Regulation 99-1 Record Retention?

Entities must report information such as the types of records maintained, the retention periods for each type, and any relevant policies governing record retention and destruction.

Fill out your insurance division regulation 99-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Division Regulation 99-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.