Get the free CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP - scc virginia

Show details

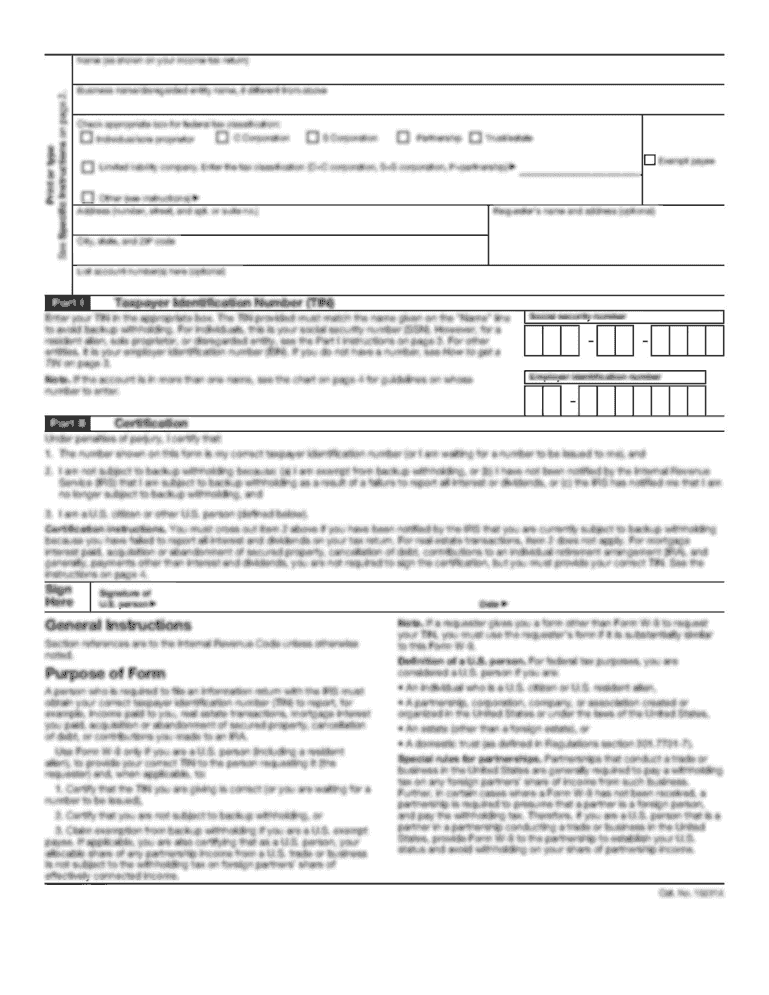

This document is used to formally cancel a limited partnership's registration in Virginia, detailing the name of the partnership, reason for cancellation, and signatures of the general partners.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of cancellation of

Edit your certificate of cancellation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of cancellation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of cancellation of online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of cancellation of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of cancellation of

How to fill out CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP

01

Obtain a copy of the 'Certificate of Cancellation of a Virginia Limited Partnership' form from the Virginia Secretary of State's website or office.

02

Fill in the name of the limited partnership as it appears on the records of the Virginia Secretary of State.

03

Provide the date of formation of the limited partnership.

04

Include the reason for cancellation, ensuring it complies with Virginia laws.

05

Specify the date the cancellation is effective.

06

Sign the certificate, ensuring it is signed by a general partner or an authorized person.

07

Submit the completed certificate along with the required filing fee to the Virginia Secretary of State's office.

Who needs CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

01

Any limited partnership in Virginia that has decided to terminate its business operations and needs to formally cancel its registration.

Fill

form

: Try Risk Free

People Also Ask about

What is a certificate of limited partnership?

Virginia Limited Liability Companies I want toFee Close Your Business Cancel your LLC (LLC1050) $25 For Protected Series LLCs Designate a Protected Series LLC under a Virginia LLC (LLC1095A) $100 Update your Principal Office Address (LLC1018.1PS) No Fee Amend the designation of a Protected Series LLC (LLC1095E) $2516 more rows

How much does it cost to dissolve an LLC in Virginia?

To dissolve your LLC in Virginia costs $25. Can you dissolve your Virginia LLC online? You can submit your Articles of Cancellation online using the SCC Clerk's Information System.

What is the annual fee for an LLC in Virginia?

All Virginia LLCs need to pay $50 per year for the Annual Report. These state fees are paid to the State Corporation Commission. And this is the only state-required Annual Fee. You have to pay this to keep your LLC in good standing.

What if I don't renew my LLC in Virginia?

Consequences of Non-Renewal: Missing renewal can lead to fines, dissolution of the LLC, and loss of liability protection.

How do I cancel my Virginia LLC?

To dissolve your Virginia LLC, you must file form LLC-1050, Articles of Cancellation, and confirm you have completed the winding-up process. A Virginia LLC manager or member must sign the articles of cancellation.

How do I officially close an LLC?

What typically has to be done. Notifying creditors that the LLC is dissolved. Closing out bank accounts. Canceling business licenses, permits, and assumed names. Paying creditors or establishing reserves to pay them. Paying taxes. Filing final tax returns and reports.

How much does it cost to close an LLC in Virginia?

INTRODUCTORY OVERVIEW. A limited partnership is a business entity comprised of two or more persons, with one or more general partners and one or more limited partners. A limited partnership differs from a general partnership in the amount of control and liability each partner has.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

The Certificate of Cancellation of a Virginia Limited Partnership is a document filed with the Virginia State Corporation Commission to officially dissolve and cancel the existence of a limited partnership in Virginia.

Who is required to file CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

The general partners of the limited partnership are required to file the Certificate of Cancellation when the partnership is no longer conducting business and wishes to formally dissolve.

How to fill out CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

To fill out the Certificate of Cancellation, one must provide basic information such as the name of the limited partnership, the date of its formation, the reason for cancellation, and the signatures of the general partners.

What is the purpose of CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

The purpose of the Certificate of Cancellation is to legally terminate the limited partnership's registration and business operations, ensuring that the partnership is removed from state records.

What information must be reported on CERTIFICATE OF CANCELLATION OF A VIRGINIA LIMITED PARTNERSHIP?

The information that must be reported includes the name of the limited partnership, the date of formation, reasons for cancellation, and the signatures of the general partners.

Fill out your certificate of cancellation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Cancellation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.