Get the free ACCOUNTING CORPORATION APPLICATION - boa wv

Show details

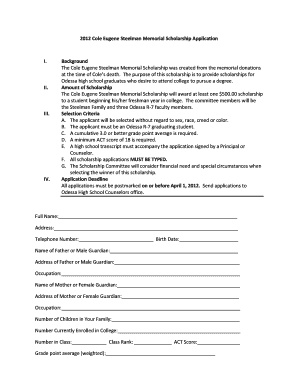

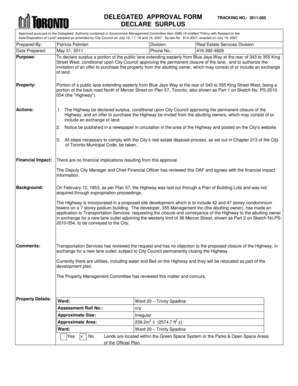

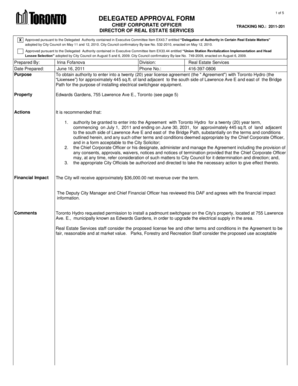

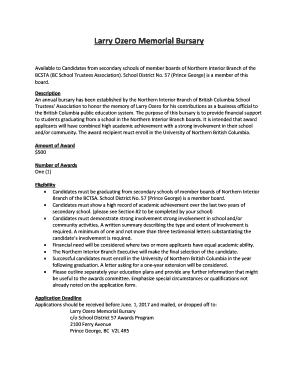

This document serves as an application for establishing an accounting corporation in West Virginia, outlining corporate details, ownership requirements, and compliance with state accountancy laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting corporation application

Edit your accounting corporation application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting corporation application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting corporation application online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accounting corporation application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting corporation application

How to fill out ACCOUNTING CORPORATION APPLICATION

01

Begin by obtaining the ACCOUNTING CORPORATION APPLICATION form from the relevant regulatory authority or organization.

02

Read the instructions carefully to understand the requirements and eligibility criteria.

03

Fill in the basic information such as the name of the corporation, address, and contact details.

04

Provide information about the directors and officers of the corporation, including their qualifications and experience.

05

Include details regarding the business structure and the services that the corporation will offer.

06

Attach the necessary supporting documents, such as proof of qualifications, business plan, and partnership agreements, if applicable.

07

Review the application for completeness and accuracy.

08

Submit the application along with any required fees to the appropriate regulatory body.

Who needs ACCOUNTING CORPORATION APPLICATION?

01

Any individual or group looking to establish an accounting corporation that provides accounting services.

02

Professionals seeking to formalize their accounting practice within a corporate structure.

03

Existing accounting firms wanting to restructure as a corporation for legal or financial benefits.

Fill

form

: Try Risk Free

People Also Ask about

Can a CPA firm be an LLC in Texas?

Individual License Fee Increase Effective September 1, 2024, the annual individual license fee will increase from $97 to $112 (includes $10 scholarship fee). All other fees will remain the same.

What is the value of a CPA license?

More Job Opportunities and Security Having a CPA license can help you find stable jobs in public accounting firms, government agencies, corporate finance, and nonprofits. Companies need CPAs to help with financial planning, taxes, and audits, so there is always a demand for them.

How much is the Tsbpa license fee?

To change your name in our records, you must submit a copy of official documentation, such as a court order, divorce decree, marriage license, or naturalization papers, that verifies your name change (Board Rule 514.1). I hereby certify that my answers to all questions on this form are true and correct.

Do I need a license to do bookkeeping in Texas?

Does providing bookkeeping services require a CPA license? A. You need neither an individual license nor a firm license from the Board to provide bookkeeping services or prepare financial statements.

How much does it cost to renew your CPA license in Texas?

Individual License Fee Increase Effective September 1, 2023, the annual individual license fee will increase from $85 to $97 (includes $10 scholarship fee).

How to apply for a CPA license in Texas?

A firm that will be practicing public accountancy in the State of Texas as a limited liability company (LLC) must register with the Board unless the firm is an out-of-state firm that meets the requirements of Section 901.461 of the Public Accountancy Act (effective September 1, 2007).

How much does it cost to take the CPA exam in Texas?

CPA Requirements in Texas Quick Facts Taking the Texas CPA exam costs $1,054.20. Texas CPA license requirements include passing the CPA exam, passing an ethics exam, meeting a minimum level of work experience, passing a background check, and completing continuing professional education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ACCOUNTING CORPORATION APPLICATION?

The Accounting Corporation Application is a formal document required for the registration and operation of a corporation that provides accounting services.

Who is required to file ACCOUNTING CORPORATION APPLICATION?

Individuals or groups wishing to establish a corporation that offers accounting services must file the Accounting Corporation Application.

How to fill out ACCOUNTING CORPORATION APPLICATION?

To fill out the Accounting Corporation Application, you must provide required details about the corporation, including its name, purpose, location, and the names of the officers and shareholders.

What is the purpose of ACCOUNTING CORPORATION APPLICATION?

The purpose of the Accounting Corporation Application is to legally establish a corporation that provides accounting services and to ensure compliance with state regulations.

What information must be reported on ACCOUNTING CORPORATION APPLICATION?

The information reported on the Accounting Corporation Application typically includes the corporation's name, address, purpose, the names of the directors and officers, and any required financial disclosures.

Fill out your accounting corporation application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Corporation Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.