Get the free Notification Required from a Bank Headquartered Outside West Virginia to Become a Su...

Show details

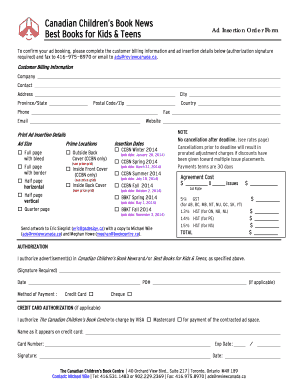

This document is a formal notification requirement for banks headquartered outside of West Virginia wishing to establish a Loan Production Office in the state. It outlines necessary documentation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notification required from a

Edit your notification required from a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notification required from a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notification required from a online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notification required from a. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notification required from a

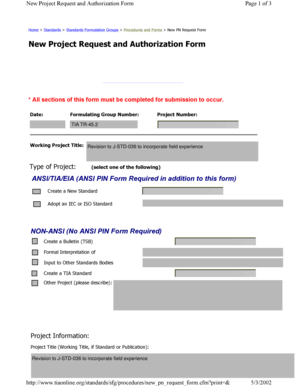

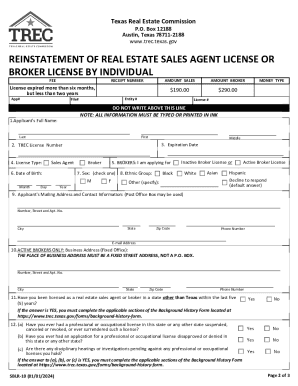

How to fill out Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution

01

Obtain the Notification Required form from the appropriate regulatory authority's website.

02

Fill out the bank's legal name, address, and contact information.

03

Provide details about the bank's home state and regulatory authority.

04

Include the information about the type of services the bank intends to offer in West Virginia.

05

Specify the anticipated date for the commencement of operations in West Virginia.

06

Attach any required documentation, including financial statements and reports from the home state regulator.

07

Review the completed form for accuracy and completeness.

08

Submit the form along with any applicable fees to the West Virginia Division of Financial Institutions.

Who needs Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

01

Banks that are headquartered outside of West Virginia but wish to conduct banking activities or establish a presence within West Virginia are required to submit this notification.

Fill

form

: Try Risk Free

People Also Ask about

Does regulation P require the bank provide opt out notices to customers and consumers?

Under Regulation P, financial institutions are required to give their customers notice of privacy practices and policies affecting them. These notices are intended to help consumers understand how their financial institutions are using their private information.

What is a supervised financial institution?

A supervised financial institution is an organization that engages in financial activities as its primary business and is subject to oversight by state or federal banking authorities.

Who does Regulation P require the bank provide opt out notices to?

Regardless of whether a consumer is your customer, you must give the consumer an “opt- out” notice that both describes the consumer's right to opt out and provides instructions about how he or she can exercise that right before you disclose nonpublic personal information about the consumer, unless an exception applies.

Who does reg.p. apply to?

Financial institutions subject to Regulation P may include, but are not limited to: Banks, savings associations, and credit unions. Non-bank mortgage lenders. Businesses that extend credit or service loans.

What are the exceptions to the requirement to provide an opt out notice?

There are some exceptions to the opt-out right. Common reasons why businesses may refuse to stop selling your personal information include: Sale or sharing is necessary for the business to comply with legal obligations, exercise legal claims or rights, or defend legal claims.

What is the difference between a bank and a non bank financial institution?

Banks are mainly focused on providing retail banking products and services, while non-banking financial institutions offer a wider range of products and services, including corporate banking, investment banking, and private banking.

Which act requires the lender to give a consumer an option to opt out?

The opt-out notice is included in a Gramm-Leach-Bliley Act privacy notice. The consumer is allowed to exercise the opt-out within a reasonable period of time and in the same manner as the opt-out under that privacy notice.

What prompted banks to have supervision and regulation?

The nation's periodic episodes of banking panics were one of Congress' most serious concerns in creating the Federal Reserve and led to one of the Fed's three main responsibilities: to foster safe, sound, and competitive practices in the nation's banking system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

It is a formal notice that a bank headquartered outside of West Virginia must file to inform the West Virginia regulatory authorities of its intention to operate as a supervised financial institution within the state.

Who is required to file Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

Any bank that is headquartered outside of West Virginia and seeks to operate or conduct business as a supervised financial institution in West Virginia is required to file this notification.

How to fill out Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

To fill out the notification, banks must provide essential information such as the bank's name, address, corporate structure, the nature of business, and any other required documentation as stipulated by the West Virginia regulator.

What is the purpose of Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

The purpose of the notification is to allow regulatory oversight of financial institutions operating in West Virginia to ensure compliance with state laws and regulations and to protect consumers.

What information must be reported on Notification Required from a Bank Headquartered Outside West Virginia to Become a Supervised Financial Institution?

The notification must report the institution's identification details, such as its corporate name, headquarters address, contact information, business activities, and other relevant regulatory information as requested by the state authorities.

Fill out your notification required from a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notification Required From A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.