Get the free APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE - dfi wv

Show details

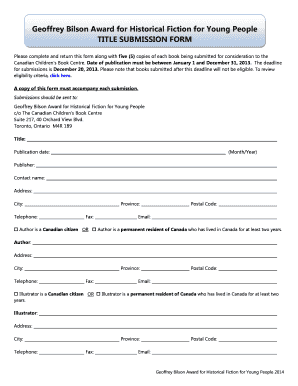

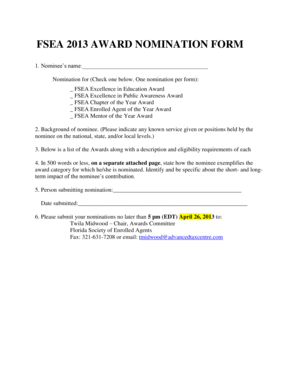

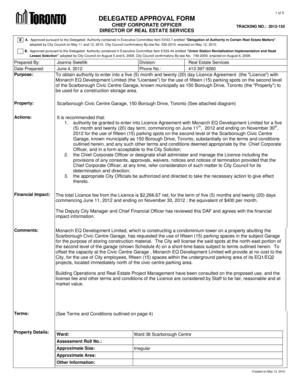

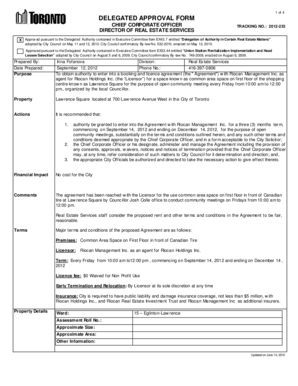

This document serves as an application form for obtaining a regulated consumer lender license in West Virginia. It requires detailed corporate information, compliance documentation, financial statements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to obtain a

Edit your application to obtain a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to obtain a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application to obtain a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application to obtain a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to obtain a

How to fill out APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE

01

Obtain the application form from the relevant regulatory authority's website.

02

Fill in your personal information including name, address, and contact details.

03

Provide business information such as the name of your company and its legal structure.

04

Disclose financial information, including assets, liabilities, and income sources.

05

List any previous licenses held and the status of those licenses.

06

Include fingerprints and a background check authorization for all principal members of the business.

07

Prepare a detailed business plan outlining your lending practices and target market.

08

Pay the required application fee as specified by the regulatory authority.

09

Submit the completed application form and all supporting documents to the regulatory authority.

Who needs APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

01

Individuals or businesses planning to engage in consumer lending activities.

02

Companies offering personal loans, payday loans, or other consumer credit products.

03

Entrepreneurs starting a new lending business who require legal authorization.

Fill

form

: Try Risk Free

People Also Ask about

What license do I need to lend money?

License Application To become a mortgage lender, you must obtain a Nationwide Mortgage Licensing System & Registry (NMLS) license. If you are looking to become a private lender or SBA lender, you may not process loans, but lenders that handle mortgage loans must be licensed.

Do you need a license to broker commercial loans in NY?

However, under New York law any person or entity that engages in the business of making loans in the principal amount of $50,000 or less for business and commercial loans, and charges, contracts for, or receives a greater rate of interest than the lender would be permitted by law, must be a Licensed Lender. See N.Y.

Do I need a license to lend money in the US?

If you are looking to become a private lender or SBA lender, you may not process loans, but lenders that handle mortgage loans must be licensed. Licensure requires a pre-licensure program consisting of a 20-hour course that reviews loan ethics, mortgage laws, and regulations.

What states require a lending license?

States Requiring Licensing for All Property Types (Residential & Commercial): California, Arizona, Nevada, North Dakota, South Dakota, Vermont: These six states mandate licensing regardless of the collateral type.

Is money lending legal in USA?

While private money lending is legal, there are essential things to remember. First, you should know what private lending entails to determine whether it covers your transaction. Second, transactions covered by private lending laws must comply strictly to avoid legal consequences.

What is required to be a lender?

Becoming a loan officer or mortgage lender often involves obtaining a Nationwide Mortgage Licensing System & Registry (NMLS) license. Private lenders and SBA lenders may not process mortgage loans, but lenders that handle mortgage loans must have a mortgage license.

How to get a CFL license?

An application for a license under the California Financing Law must be filed through the Nationwide Multistate Licensing System (NMLS). A company must complete an NMLS Company Form (MU1) for a main license before applying for a branch license on the NMLS Branch Form (MU3).

Do private money lenders need to be licensed?

As a private lender, it is important to be aware of the licensing requirements in the states in which you operate. For non-owner-occupied BPL, these states require a license to lend: California, Arizona, Nevada, Utah, Idaho, Oregon, Minnesota, South Dakota, North Dakota, and Vermont.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

The APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE is a formal request submitted by businesses or individuals seeking permission to operate as consumer lenders under state regulations, allowing them to offer loans to consumers.

Who is required to file APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

Any individual or business entity intending to engage in consumer lending activities, such as providing personal loans or installment loans, is required to file this application to ensure compliance with state lending laws.

How to fill out APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

To fill out the application, applicants must provide detailed information about their business, including legal structure, ownership, financial records, and operational plans, along with any required documentation and fees.

What is the purpose of APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

The purpose of the application is to ensure that consumer lenders comply with legal standards and consumer protection laws, promoting responsible lending practices and safeguarding consumers against predatory lending tactics.

What information must be reported on APPLICATION TO OBTAIN A REGULATED CONSUMER LENDER LICENSE?

Applicants must report information such as business identity, ownership details, financial stability, management experience, operational scope, and any prior lending history or regulatory actions.

Fill out your application to obtain a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Obtain A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.