Get the free ssa 3911

Show details

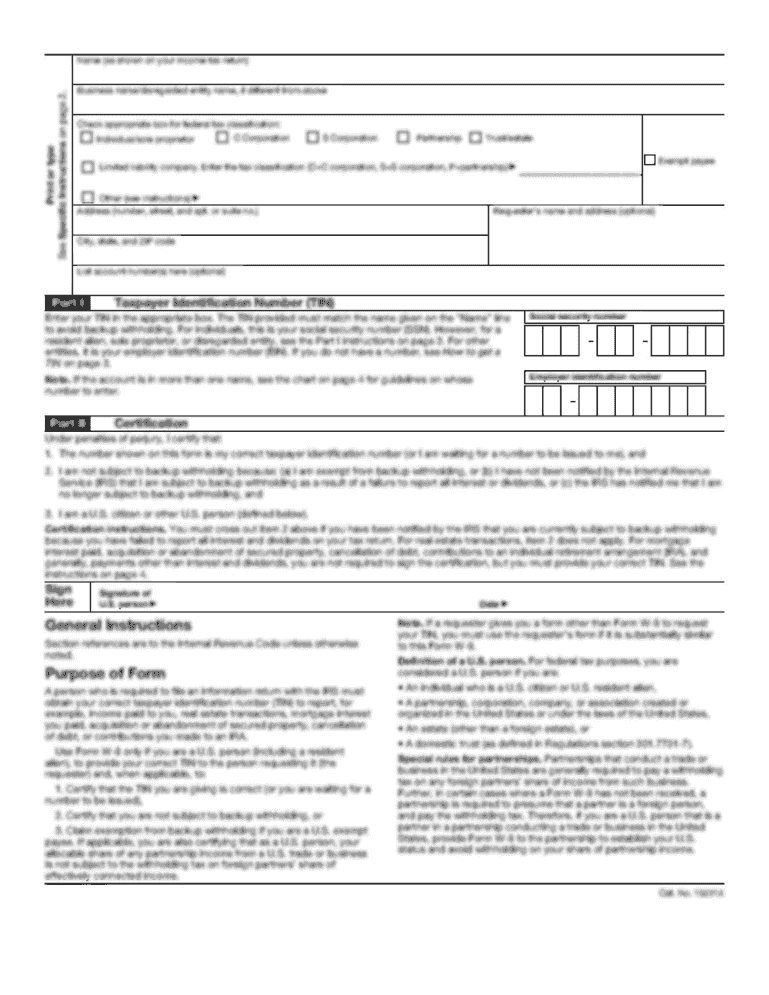

DESCRIPTION OF ITEM With Inclusive Dates or Retention Periods NO RECORDS RETENTION SUPPLEMENTAL Form SSA-3911. A multipart Data or its Report. AN. SECURITY DISPOSAL SAMPLE OR JOB NO. ACTION TAKEN SCHEIDULE INCOME RECORDS of Change - SSI Data form Form SSA-3911 equivalent used by sta es to -notify SSA of. Discrepancies between their reoords and the State Data Exchange record. Copies of the form are forwarded by States to the district offices DOls ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssa 3911 u4 form

Edit your printable irs form 3911 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your si 02306 703 ssa 3911 u4 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssa3911 u4 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ssa 3911 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssa 3911 form

How to fill out printable IRS Form 3911:

01

Start by reading the instructions provided with the form to understand the purpose and requirements of Form 3911.

02

Complete the heading section of the form, which includes providing your name, address, Social Security number or taxpayer identification number, and the tax year you are referencing.

03

In the "Reason for Submitting Form" section, select the appropriate option that describes why you are submitting Form 3911, such as a lost or stolen refund check or a refund check that was never received.

04

If you are requesting a refund trace, fill in the "Refund Information" section with details about the original refund, including the amount, refund check number (if applicable), and the date it was issued.

05

Provide your banking information in the "Direct Deposit Information" section if you want the refund to be deposited directly into your bank account. This includes providing the bank's routing number and your account number.

06

Include any additional information or explanations in the "Comments" section if necessary.

07

Sign and date the form at the bottom.

08

Make a copy of the completed form for your records before submitting it to the IRS.

Who needs printable IRS Form 3911:

01

Individuals who have lost or had a refund check stolen.

02

Taxpayers who have not received a refund check they were expecting.

03

Those who need to request a refund trace from the IRS to locate a lost or stolen refund check.

04

Claimants of a refund that was issued but has not been received or has been lost.

05

Taxpayers who want to update their banking information for a direct deposit refund.

It is important to consult the latest instructions and guidelines from the IRS before filling out Form 3911, as requirements may vary over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ssa 3911 form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ssa 3911 form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get ssa 3911 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ssa 3911 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the ssa 3911 form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ssa 3911 form in seconds.

What is si 02306 703 ssa?

SI 02306.703 is a Social Security Administration (SSA) document used for reporting information related to Social Security benefits, specifically related to the reporting of income and resources.

Who is required to file si 02306 703 ssa?

Individuals who receive Social Security benefits and need to report changes in their income or resources are required to file SI 02306.703 SSA.

How to fill out si 02306 703 ssa?

To fill out SI 02306.703, individuals must provide personal information, details about their income, resources, and any changes in circumstances that may affect their benefits.

What is the purpose of si 02306 703 ssa?

The purpose of SI 02306.703 is to collect necessary information to determine ongoing eligibility for Social Security benefits and to ensure that benefits are accurately calculated based on income and resources.

What information must be reported on si 02306 703 ssa?

Information that must be reported on SI 02306.703 includes details about earned and unearned income, bank accounts, property, and any changes in living arrangements or household composition.

Fill out your ssa 3911 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssa 3911 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.