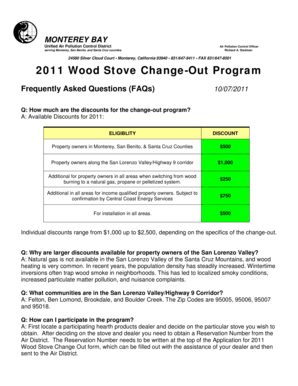

Get the free Frequently Asked Questions: Tax Year 2013 Tax Returns - wiesbaden army

Show details

This document provides comprehensive information for individuals regarding tax preparation for the year 2013, including necessary forms, service options, and tax law changes for U.S. taxpayers, particularly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign frequently asked questions tax

Edit your frequently asked questions tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your frequently asked questions tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit frequently asked questions tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit frequently asked questions tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out frequently asked questions tax

How to fill out Frequently Asked Questions: Tax Year 2013 Tax Returns

01

Gather all necessary documents such as W-2s, 1099s, and other income statements.

02

Review the tax forms for Tax Year 2013 that you need to complete.

03

Fill in your personal information including your name, address, and Social Security number.

04

Report all sources of income as required on the appropriate tax forms.

05

Claim any eligible deductions and credits to minimize your tax liability.

06

Review the completed forms for accuracy and completeness.

07

Submit your completed tax return electronically or via mail before the deadline.

Who needs Frequently Asked Questions: Tax Year 2013 Tax Returns?

01

Individuals who filed or are required to file a tax return for Tax Year 2013.

02

Taxpayers seeking clarification on specific tax issues related to Tax Year 2013.

03

Accountants and tax preparers assisting clients with Tax Year 2013 returns.

Fill

form

: Try Risk Free

People Also Ask about

Are federal taxes reduced at age 65?

For single filers and heads of households age 65 and over, the additional standard deduction increases slightly — from $1,950 in 2024 (returns you'll file soon in early 2025) to $2,000 in 2025 (returns you'll file in early 2026). For 2025, married couples over 65 filing jointly will also see a modest benefit.

At what age do you no longer have to file federal income tax?

When can I stop filing tax returns? Regardless of your age, you'll be required to keep filing a tax return and paying tax as long as you meet the gross income requirements. However, if you are over the age of 65, the gross income limits are a bit higher.

Can I still file my 2013 tax return?

* The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2013 electronic filing has passed on October 15, 2014. You may still prepare your 2013 taxes using our website.

What is the standard deduction for 2013?

Standard Deduction Rates. The applicable standard deduction rates for 2013 are $12,200 for married taxpayers filing jointly; $8,950 for head of household; $6,100 for individual taxpayers and $6,100 for married taxpayers filing separate.

Do you pay income tax after 70 years old?

While you may have heard at some point that Social Security is no longer taxable after 70 or some other age, this isn't the case. In reality, Social Security is taxed at any age if your income exceeds a certain level.

Where can I get tax question answers?

Visit the IRS contact page to get help using online tools and resources. Or: For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time.

At what age do seniors stop paying federal taxes?

Taxes aren't determined by age, so you will never age out of paying taxes. People who are 65 or older at the end of 2025 have to file a return for that tax year (which is due in 2026) if their gross income is $16,550 or higher. If you're married filing jointly and both 65 or older, that amount is $32,300.

At what age does the federal government stop taxing Social Security?

Bottom Line. Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age. There is some variation at the state level, though, so make sure to check the laws for the state where you live.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Frequently Asked Questions: Tax Year 2013 Tax Returns?

Frequently Asked Questions: Tax Year 2013 Tax Returns is a resource that provides guidance and answers to common questions regarding the filing and requirements of tax returns for the tax year 2013.

Who is required to file Frequently Asked Questions: Tax Year 2013 Tax Returns?

Individuals or entities that had a reportable income, were self-employed, or met specific income thresholds as set by the IRS for the tax year 2013 are required to file their tax returns.

How to fill out Frequently Asked Questions: Tax Year 2013 Tax Returns?

To fill out the Frequently Asked Questions: Tax Year 2013 Tax Returns, individuals should gather their financial documents, follow the instructions on the form, and report their income, deductions, and credits accurately.

What is the purpose of Frequently Asked Questions: Tax Year 2013 Tax Returns?

The purpose of Frequently Asked Questions: Tax Year 2013 Tax Returns is to assist taxpayers in understanding their obligations, the filing process, and to clarify any uncertainties regarding tax regulations for that year.

What information must be reported on Frequently Asked Questions: Tax Year 2013 Tax Returns?

Taxpayers must report their total income, deductions, tax credits, filing status, and any other relevant financial information on the Frequently Asked Questions: Tax Year 2013 Tax Returns.

Fill out your frequently asked questions tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Frequently Asked Questions Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.