Get the free Form 1114-10 - blm

Show details

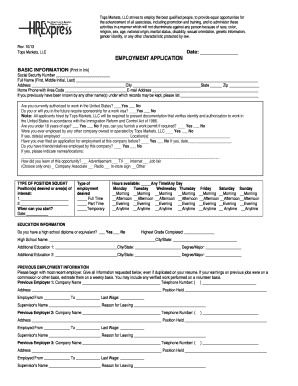

Application form for individuals interested in volunteering for various roles within the United States Department of the Interior, Bureau of Land Management.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1114-10 - blm

Edit your form 1114-10 - blm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1114-10 - blm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1114-10 - blm online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1114-10 - blm. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1114-10 - blm

How to fill out Form 1114-10

01

Obtain Form 1114-10 from the IRS website or your tax professional.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Report all foreign accounts as per the guidelines provided in the instructions.

05

Ensure that you provide accurate details about the financial institutions where your accounts are held.

06

Calculate the total value of your foreign accounts for the reporting period.

07

Sign and date the form, confirming that the information is accurate to the best of your knowledge.

08

Submit the completed form to the appropriate IRS address, as indicated in the instructions.

Who needs Form 1114-10?

01

Individuals who have foreign financial accounts totaling more than $10,000 at any time during the calendar year.

02

U.S. citizens living abroad with financial interests in foreign accounts.

03

U.S. residents who are required to report foreign income or assets.

Fill

form

: Try Risk Free

People Also Ask about

Can IRS track foreign bank accounts?

FATCA requires foreign financial institutions to report details about U.S. account holders, enabling the IRS to identify U.S. expats and their foreign holdings. If a taxpayer has an outstanding tax liability, the IRS may impose a federal tax lien and coordinate with foreign tax authorities to collect these debts.

Do I have to pay tax in USA if I receive money from abroad?

Americans who receive financial gifts from foreign loved ones won't have to pay taxes on the transfer. However, if you yourself sent funds to an American while abroad, you might. Recipients of foreign inheritances typically don't have a tax liability in the United States.

Who is exempt from FBAR?

Governmental Entity. A foreign financial account of any governmental entity is not required to be reported by any person. Example: A government employee retirement or welfare benefit plan is not required to file an FBAR because it is a governmental entity.

Can you file FBAR on your own?

Individuals may electronically file their FBAR through the BSA E-Filing System without registering for an BSA E-Filing account. If you are an attorney, CPA, or an enrolled agent filing the FBAR on behalf of a client, you must register to Become a BSA E-Filer and file as an institution rather than an individual.

Are foreign bank accounts taxable in the US?

U.S. citizens and residents must report foreign financial accounts on Schedule B of Form 1040, regardless of account balance, and must file FinCEN Form 114 (FBAR) if the total value exceeds $10,000 at any time during the year.

Do I have to pay US taxes on a foreign bank account?

U.S. citizens and residents must report foreign financial accounts on Schedule B of Form 1040, regardless of account balance, and must file FinCEN Form 114 (FBAR) if the total value exceeds $10,000 at any time during the year. Failing to comply with FBAR filing requirements can lead to severe penalties.

Do I have to report a foreign bank account to the IRS?

A U.S. person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report: a financial interest in or signature or other authority over at least one financial account located outside the United States if.

How much does it cost to file an FBAR?

FBAR Filing Service Cost The cost to file your FBAR (Foreign Bank Account Report) is $115, which includes up to five accounts. For each additional block of five accounts, there is an additional fee of $55.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 1114-10?

Form 1114-10 is a tax form used by U.S. taxpayers to report certain foreign financial assets and accounts as part of their requirement to comply with the Foreign Account Tax Compliance Act (FATCA).

Who is required to file Form 1114-10?

U.S. citizens, residents, and certain entities with foreign financial assets that exceed a specific threshold are required to file Form 1114-10.

How to fill out Form 1114-10?

To fill out Form 1114-10, taxpayers must provide their personal information, details about their foreign financial assets, and any income generated from those assets. It is advisable to refer to the instructions provided by the IRS for detailed guidance.

What is the purpose of Form 1114-10?

The purpose of Form 1114-10 is to ensure transparency regarding foreign financial assets owned by U.S. taxpayers, helping the IRS to combat tax evasion and comply with international tax regulations.

What information must be reported on Form 1114-10?

On Form 1114-10, taxpayers must report information including the type of foreign financial accounts, account numbers, names of financial institutions, maximum values of accounts during the year, and any income related to those accounts.

Fill out your form 1114-10 - blm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1114-10 - Blm is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.