Get the free PROPERTY AND CASUALTY COMPANIES - ASSOCIATION EDITION *34754200420100100* ANNUAL STA...

Show details

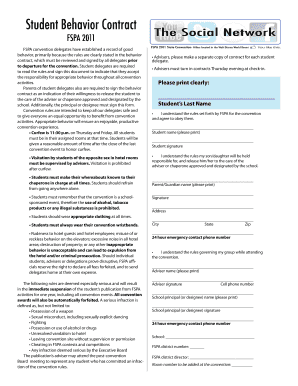

Annual Statement for the year 2004 of the COMMERCE INSURANCE COMPANY. 20. EXHIBIT OF PREMIUMS AND LOSSES (Statutory Page 14).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property and casualty companies

Edit your property and casualty companies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property and casualty companies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property and casualty companies online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property and casualty companies. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property and casualty companies

How to fill out property and casualty companies:

01

Research the market: Start by conducting thorough research on the property and casualty insurance industry. Understand the current trends, regulations, and market opportunities.

02

Obtain necessary licenses and permits: Familiarize yourself with the specific licensing requirements for property and casualty companies in your jurisdiction. Obtain the necessary licenses and permits to legally operate the business.

03

Develop a business plan: Create a comprehensive business plan outlining your company's goals, target market, competitive analysis, marketing strategies, and financial projections. A well-crafted business plan will help attract investors and guide your company's growth.

04

Secure sufficient capital: Property and casualty companies often require significant financial resources. Ensure you have adequate capital to cover start-up costs, operational expenses, and potential claims payouts.

05

Establish underwriting guidelines: Develop underwriting guidelines that outline the types of risks your company is willing to insure. These guidelines will help ensure consistent decision-making in assessing insurance applications and setting premiums.

06

Partner with reinsurance companies: Reinsurance is a crucial aspect of property and casualty companies as it helps to spread and manage risk. Establish partnerships with reinsurance companies to protect against large claims and secure sufficient capacity.

07

Build a strong network of insurance agents: Identify and recruit insurance agents who specialize in selling property and casualty insurance. These agents will serve as your company's sales force, promoting your products and driving business growth.

08

Implement robust risk management practices: To succeed in the property and casualty insurance industry, you must have effective risk management strategies in place. This includes conducting thorough risk assessments, implementing loss control measures, and continuously monitoring and evaluating risks.

Who needs property and casualty companies:

01

Homeowners and renters: Property and casualty companies provide insurance coverage for homes and personal property against perils such as fire, theft, and natural disasters.

02

Business owners: Business owners rely on property and casualty insurance to protect their premises, equipment, inventory, and liability against potential risks and lawsuits.

03

Auto owners: Property and casualty companies offer auto insurance policies that provide coverage for vehicle damage, liability, and medical expenses resulting from accidents.

04

Contractors and construction companies: Property and casualty insurance is essential for contractors and construction companies to protect against property damage, job site accidents, and third-party liability claims.

05

Healthcare facilities: Hospitals, clinics, and other healthcare facilities require property and casualty insurance to cover their premises, medical equipment, and professional liability risks.

06

Professionals: Professionals such as lawyers, architects, and accountants often acquire professional liability insurance from property and casualty companies to protect against claims of negligence or errors in their professional services.

07

Non-profit organizations: Non-profit organizations rely on property and casualty insurance to safeguard their assets, protect against liability claims, and cover the risks associated with their operations.

08

Government entities: Property and casualty insurance is necessary for various government entities, including municipalities, schools, and public utilities, to protect their assets and manage liability risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property and casualty companies?

Property and casualty companies are insurance providers that offer coverage for physical assets (property) and legal liabilities (casualty). This includes insurance for homes, vehicles, businesses, and other property, as well as protection against legal claims for personal injury or property damage.

Who is required to file property and casualty companies?

Property and casualty companies are required to be filed by insurance companies that offer policies for property and casualty coverage. These companies must submit the necessary reports and financial statements to regulatory bodies and comply with the applicable laws and regulations.

How to fill out property and casualty companies?

Filling out property and casualty companies involves compiling and submitting relevant financial and operational information about the insurance company. This includes details about premiums collected, claims paid, underwriting practices, and other financial data. The specific requirements may vary based on the jurisdiction and regulatory body overseeing the insurance industry.

What is the purpose of property and casualty companies?

The purpose of property and casualty companies is to provide insurance coverage for physical assets and legal liabilities. These companies help individuals, businesses, and organizations manage the financial risks associated with property damage, loss, or legal claims. The coverage offered by property and casualty insurers allows policyholders to transfer the risk of potential losses to the insurance company.

What information must be reported on property and casualty companies?

The information reported on property and casualty companies typically includes financial data such as premiums written, premiums earned, claims incurred, claims paid, investment income, and underwriting expenses. Additional details may include policyholder counts, exposure to risk, reinsurance arrangements, and regulatory compliance information.

How can I modify property and casualty companies without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including property and casualty companies. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in property and casualty companies?

With pdfFiller, the editing process is straightforward. Open your property and casualty companies in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the property and casualty companies in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your property and casualty companies in seconds.

Fill out your property and casualty companies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property And Casualty Companies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.