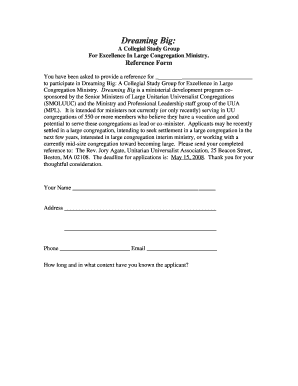

Get the free Mortgage Application Checklist

Show details

Ein Dokument, das die Unterlagen und Informationen enthält, die für die Beantragung eines Hypothekendarlehens erforderlich sind, einschließlich W2s, Steuererklärungen, Gehaltsabrechnungen, Bankauszüge

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage application checklist

Edit your mortgage application checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage application checklist online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage application checklist. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage application checklist

How to fill out Mortgage Application Checklist

01

Gather necessary personal information: include your full name, contact information, and social security number.

02

Compile financial documents: prepare your income statements, tax returns, bank statements, and any other financial assets.

03

List all debts: detail your existing debts such as credit cards, student loans, and car loans.

04

Provide property information: include details about the property you are looking to purchase, such as address and estimated value.

05

Complete the checklist: ensure all required documents and information are included and organized.

Who needs Mortgage Application Checklist?

01

Individuals applying for a mortgage to purchase a home.

02

First-time homebuyers seeking guidance through the mortgage process.

03

Real estate agents helping clients prepare for mortgage applications.

04

Mortgage brokers assisting clients in securing financing for property purchases.

Fill

form

: Try Risk Free

People Also Ask about

What are the documents required for a US mortgage?

You're likely to need: ID and Social Security number. Pay stubs from the last 30 days. W-2s or I-9s from the past 2 years. Proof of any other sources of income. Federal tax returns. Recent bank statements. Details on long term debts such as car or student loans. Real estate property information.

What is the 3 7 3 rule in mortgage?

Mortgage application requirements Employment and income details: Information about your employment and proof of income, such as pay stubs or tax returns. Assets and liabilities: Details about your savings, investments, properties and existing debts. Credit history: Your credit score and credit report.

What information do you need for a complete mortgage application?

Mortgage application requirements Key components of your mortgage application may include: Personal information: Your name, address, date of birth and Social Security number. Employment and income details: Information about your employment and proof of income, such as pay stubs or tax returns.

What information is needed to get preapproved for a mortgage?

Things that can prevent you from getting a mortgage include bad credit, high debt and low income. Tackle any of the relevant issues below to improve your odds of mortgage approval and favorable terms.

What information is needed for a mortgage application?

In order to confirm your income, a mortgage lender will request a few documents. A good way to remember the documentation you'll need is to remember the 2-2-2 rule: 2 years of W-2s. 2 years of tax returns (federal and state)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Application Checklist?

A Mortgage Application Checklist is a document that outlines the necessary items and information needed to apply for a mortgage loan.

Who is required to file Mortgage Application Checklist?

Typically, prospective homebuyers who are applying for a mortgage loan are required to complete and submit a Mortgage Application Checklist.

How to fill out Mortgage Application Checklist?

To fill out a Mortgage Application Checklist, start by gathering all necessary documents and information, such as personal identification, financial statements, and employment information, and then systematically complete each section of the checklist.

What is the purpose of Mortgage Application Checklist?

The purpose of the Mortgage Application Checklist is to ensure that all required documents and information are collected before submitting a mortgage application, helping to streamline the application process.

What information must be reported on Mortgage Application Checklist?

Information that must be reported on a Mortgage Application Checklist typically includes personal details, income and employment history, credit information, and details about the property being financed.

Fill out your mortgage application checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Application Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.