Get the free Consumer Complaint Letter regarding Credit Card Rates - federalreserve

Show details

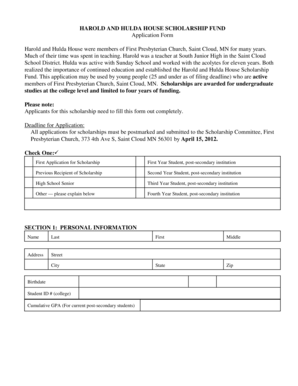

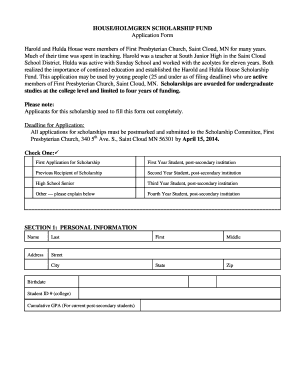

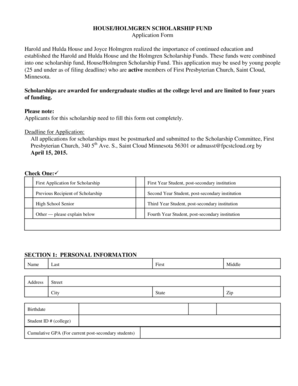

Date Oct 04 2007 Proposal Document ID Version Release Date Name Affiliation Category of Address Regulation Z - Truth in Lending R-1286 City State Country Zip PostalCode 05/23/2007 Lisa Shough-Jarvis Consumer / Citizen of the USA Other 26 Chamberlain St. Delaware OH UNITED STATES 43015 Comments To Whom this may concern It is about time something is done to stop the blantant rip-off of folks by these credit card companies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer complaint letter regarding

Edit your consumer complaint letter regarding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer complaint letter regarding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer complaint letter regarding online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consumer complaint letter regarding. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer complaint letter regarding

How to fill out Consumer Complaint Letter regarding Credit Card Rates

01

Identify the credit card issuer's name and address.

02

Clearly state your complaint regarding the credit card rates.

03

Include your account number and any relevant details.

04

Use a formal greeting, such as 'Dear [Issuer's Name]'.

05

Describe the issues you are facing with the rates and how they have impacted you.

06

Request specific action you want them to take, such as a rate review or adjustment.

07

Include any relevant documentation as evidence.

08

Close the letter with a polite sign-off, such as 'Sincerely' or 'Best regards'.

09

Provide your contact information for follow-up.

Who needs Consumer Complaint Letter regarding Credit Card Rates?

01

Consumers who are facing high credit card interest rates.

02

Individuals seeking to dispute or negotiate their credit card rates.

03

Anyone who feels they have been treated unfairly by their credit card issuer.

Fill

form

: Try Risk Free

People Also Ask about

Can you get interest charges removed from a credit card?

Most cards offer a grace period of at least 21 days between your statement date and payment due date, and if you pay your balance in full during this period, you can avoid interest charges entirely.

How to dispute interest charges on credit card?

Narrate what happened with dates. Second, include any supporting documents in dealing with merchant with your dispute. That makes the letter stronger. Also if you have a lawyer contact, add the name as a cc to the letter to give it added leverage. Finally, make mention of the length of time you have been a customer.

How do I get the interest removed from my credit card?

How to reduce or avoid credit card interest charges altogether. If you pay your balance off in full by the due date every month, you can avoid paying interest on new purchases. Even if you can't pay off the entire balance, making more than the minimum payment may still help you reduce how much interest you pay.

How to dispute an interest charge on a credit card?

Contact Your Credit or Debit Card Company If you see an error, submit a dispute right away. Start by calling the card company's customer service number to report the problem. Find the telephone number on your monthly statement or on the back of your card.

How to write a credit card charge dispute letter?

A. If the complaint is regarding the defect of goods /Items, or about the deficiency of service then provide details of deficiency/ type of services and date/year of purchase of goods/ service received. B. Details of the items/goods (provide information about defect/supplying of less quantity of goods/items.)

Can credit card interest charges be refunded?

You may also need to keep an eye on your credit card interest since any interest you may have accrued on the purchase is unlikely to be refunded. If you are still within your credit card's grace period, you may be able to avoid interest by paying off your statement balance in full.

How do you write a powerful complaint letter?

6 Tips on Writing a Winning Complaint Letter Be professional. Express your dissatisfaction clearly, with facts, dates, and details (including copies of receipts and so on) to help substantiate your claim. Be sincere. Be prompt. Don't expect compensation every time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Complaint Letter regarding Credit Card Rates?

A Consumer Complaint Letter regarding Credit Card Rates is a written document a consumer submits to a financial institution to express dissatisfaction with the terms or rates associated with their credit card. It outlines specific issues, such as high interest rates or unfair fees.

Who is required to file Consumer Complaint Letter regarding Credit Card Rates?

Any consumer who feels that they have been unfairly charged or misled about credit card rates or terms can file a Consumer Complaint Letter. This includes credit card holders or potential customers who feel their rights have been violated.

How to fill out Consumer Complaint Letter regarding Credit Card Rates?

To fill out a Consumer Complaint Letter regarding Credit Card Rates, clearly state the issue, include your account details (without sensitive information), describe your complaint with supporting evidence, and provide a resolution you seek. Ensure to include your contact information for follow-up.

What is the purpose of Consumer Complaint Letter regarding Credit Card Rates?

The purpose of a Consumer Complaint Letter regarding Credit Card Rates is to formally notify the credit card issuer of a consumer's concerns, prompting them to investigate and resolve the issue. It also serves as documentation of the consumer's grievance.

What information must be reported on Consumer Complaint Letter regarding Credit Card Rates?

A Consumer Complaint Letter regarding Credit Card Rates should include the consumer's contact information, account details (to identify the credit card), a detailed description of the complaint, proposed solutions, and any supporting documents or evidence related to the complaint.

Fill out your consumer complaint letter regarding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Complaint Letter Regarding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.