Get the free Regulation Z - Truth in Lending R-1286 - federalreserve

Show details

This proposal addresses concerns regarding Regulation Z related to credit card companies and consumer protection, highlighting industry practices that negatively impact consumers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation z - truth

Edit your regulation z - truth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation z - truth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing regulation z - truth online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regulation z - truth. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation z - truth

How to fill out Regulation Z - Truth in Lending R-1286

01

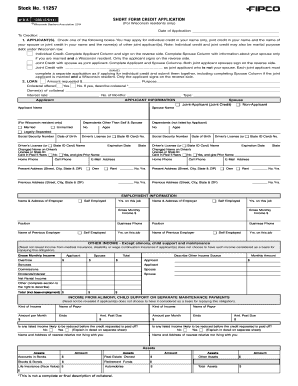

Gather all necessary loan documentation including the loan amount, interest rate, and terms.

02

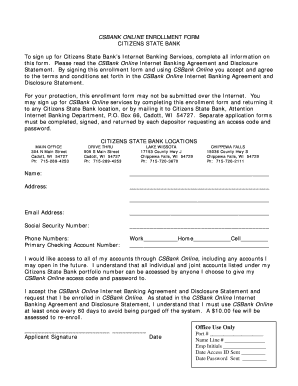

Access the Regulation Z - Truth in Lending R-1286 form.

03

Complete the Borrower's information section, including name and address.

04

Provide details about the credit transaction, including the amount financed and the finance charge.

05

Calculate the annual percentage rate (APR) based on the loan amount and the terms.

06

Fill out the payment schedule, including the payment amounts and due dates.

07

Review all entries for accuracy and completeness.

08

Sign and date the form as required.

Who needs Regulation Z - Truth in Lending R-1286?

01

Lenders offering credit to consumers, including banks and credit unions.

02

Consumers applying for any type of loan to understand their borrowing costs.

03

Mortgage brokers and real estate professionals involved in financing transactions.

04

Regulatory bodies that monitor compliance with lending laws.

Fill

form

: Try Risk Free

People Also Ask about

What are common regulation Z violations?

Finance Charge Regulation Z restricts how rates can be included in advertisements for closed-end credit. The APR must always be listed (and must state that the APR is subject to increase after consummation, if applicable). The interest rate may also be listed but not more conspicuously than the APR.

What must be disclosed under regulation Z?

Finance Charge Regulation Z restricts how rates can be included in advertisements for closed-end credit. The APR must always be listed (and must state that the APR is subject to increase after consummation, if applicable). The interest rate may also be listed but not more conspicuously than the APR.

What is regulation Z in the Truth in Lending Act?

Regulation Z provides finance charge tolerances for legal accuracy that should not be confused with those provided in the TILA for reimbursement under regulatory agency orders. As with disclosed APRs, if a disclosed finance charge were legally accurate, it would not be subject to reimbursement.

What are common regulation Z violations?

Those violations of Regulation Z involved understating the finance charge for discounted, adjustable rate mortgages (ARMs) and incorrectly listing the names of the settlement service providers.

What is the regulation Z of the Truth in Lending Act?

Those violations of Regulation Z involved understating the finance charge for discounted, adjustable rate mortgages (ARMs) and incorrectly listing the names of the settlement service providers.

What must be disclosed under regulation Z?

Regulation Z prohibits certain practices relating to payments made to compensate mortgage brokers and other loan originators. The goal of the amendments is to protect consumers in the mortgage market from unfair practices involving compensation paid to loan originators.

What are the requirements for regulation Z?

Regulation Z requires lenders to disclose a variety of information related to consumer borrowing, such as providing written information about interest rates and all fees and finance charges that are to be paid in association with a loan or credit card.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation Z - Truth in Lending R-1286?

Regulation Z, also known as the Truth in Lending Act (TILA), is a regulation that requires lenders to provide clear and accurate information about the terms and costs of credit to consumers. R-1286 is a specific form used to report compliance with Regulation Z requirements.

Who is required to file Regulation Z - Truth in Lending R-1286?

Entities that offer or extend credit to consumers, which typically includes banks, credit unions, and other financial institutions, are required to file Regulation Z - Truth in Lending R-1286.

How to fill out Regulation Z - Truth in Lending R-1286?

To fill out Regulation Z - Truth in Lending R-1286, lenders must provide information regarding the credit terms offered, including the Annual Percentage Rate (APR), finance charges, and total cost of credit, as well as ensure all required disclosures are present and accurate.

What is the purpose of Regulation Z - Truth in Lending R-1286?

The purpose of Regulation Z is to promote informed use of consumer credit by requiring disclosures about its terms and costs, helping borrowers understand their financial commitments and avoid deceptive lending practices.

What information must be reported on Regulation Z - Truth in Lending R-1286?

Information that must be reported on Regulation Z - Truth in Lending R-1286 includes the total finance charges, the annual percentage rate (APR), the total amount financed, and information about the payment schedule and any applicable fees or conditions.

Fill out your regulation z - truth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation Z - Truth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.