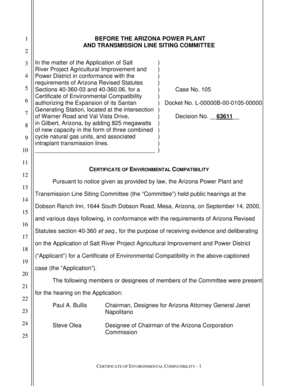

Get the free Flood Insurance Q&A - federalreserve

Show details

This document is a comment letter addressing proposed revisions to the Interagency Questions and Answers regarding flood insurance issued by multiple regulatory agencies. It outlines concerns and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flood insurance qa

Edit your flood insurance qa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flood insurance qa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flood insurance qa online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flood insurance qa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flood insurance qa

How to fill out Flood Insurance Q&A

01

Gather all necessary documentation related to the property.

02

Visit the National Flood Insurance Program (NFIP) website or your insurance provider's website.

03

Locate the Flood Insurance Q&A section.

04

Review each question carefully, ensuring you understand what is being asked.

05

Fill in your information accurately, providing details about your property and flood risk.

06

Double-check answers for accuracy before submission.

07

Submit the completed Q&A form as instructed on the website.

Who needs Flood Insurance Q&A?

01

Homeowners in flood-prone areas.

02

Businesses located in flood zones.

03

Property owners seeking to protect their investment.

04

Individuals who live near bodies of water, such as rivers or lakes.

05

Communities that experience heavy rainfall or storms.

Fill

form

: Try Risk Free

People Also Ask about

How to get out of paying flood insurance?

One way to avoid paying insurance is to own your house outright, or pay down the mortgage so no one can tell you what to do. Other than that, the insurance is a good value that should protect you if you home is in a flood zone. Regular homeowner's insurance will not work for a flood.

What is the average flood insurance claim?

By comparison, the average flood insurance claim payment over the past 5 years was about $69,000. Your client will never have to repay money received from a verified claim on their National Flood Insurance Program (NFIP) flood insurance policy.

What is the FEMA 80% rule?

Here are essential tips to follow: Take Pictures of Damage: Document everything before making repairs. Make Temporary Repairs: You could be liable for any additional damage after the disaster. “Do not make permanent repairs until you have authorization from your insurance,” Hayley reminds homeowners.

What is the FEMA 80% rule?

What Is the FEMA 80% Rule? FEMA's 80% rule states that property owners must insure their property for at least 80% of its value, or up to the maximum building coverage limit—that's $250,000 for homes and $500,000 for commercial property—whichever is less.

How to get the most out of your flood insurance claim?

Flood insurance is not required for loans that are otherwise covered by the regulation if: (1) the property securing the loan is state-owned and covered under a satisfactory self-insurance policy; or (2) the loan has a repayment term of one year or less with an original principal balance of $5,000 or less. 12 C.F.R.

How to maximize your flood insurance claim?

Document Everything: Capture photos, make lists of all damaged items, and check for any consultation reports to support your claim. Hire Experts: A public insurance adjuster for flood damage can guide you through the complexities, ensuring a fair settlement.

What does flood insurance actually cover?

What Is the FEMA 80% Rule? FEMA's 80% rule states that property owners must insure their property for at least 80% of its value, or up to the maximum building coverage limit—that's $250,000 for homes and $500,000 for commercial property—whichever is less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Flood Insurance Q&A?

Flood Insurance Q&A refers to a set of questions and answers designed to provide information and guidance regarding flood insurance policies, coverage options, and claims processes.

Who is required to file Flood Insurance Q&A?

Individuals or businesses located in flood-prone areas, or those who are required by their mortgage lenders to carry flood insurance, must file Flood Insurance Q&A.

How to fill out Flood Insurance Q&A?

To fill out Flood Insurance Q&A, you should read each question carefully, provide accurate and complete responses based on your insurance policy and situation, and consult your insurance agent if needed.

What is the purpose of Flood Insurance Q&A?

The purpose of Flood Insurance Q&A is to clarify the terms and conditions of flood insurance, assist policyholders in understanding their coverage, and enable them to file claims effectively.

What information must be reported on Flood Insurance Q&A?

The information that must be reported includes details about the property, insurance coverage amounts, any previous claims made, and any changes in property ownership or condition that may affect coverage.

Fill out your flood insurance qa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flood Insurance Qa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.