Get the free Regulation AA - Unfair or Deceptive Acts or Practices - federalreserve

Show details

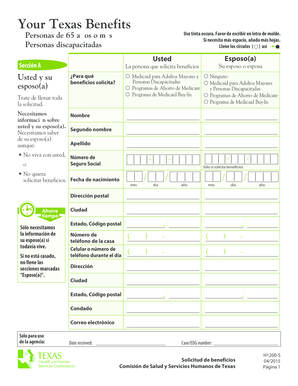

A document expressing concerns regarding the practices of large banks, particularly related to overdraft fees and withdrawal processing methods.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation aa - unfair

Edit your regulation aa - unfair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation aa - unfair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit regulation aa - unfair online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit regulation aa - unfair. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation aa - unfair

How to fill out Regulation AA - Unfair or Deceptive Acts or Practices

01

Read the Regulation AA documentation to understand its purpose and scope.

02

Gather all relevant information about your business practices and policies.

03

Identify any practices that may be considered unfair or deceptive.

04

Complete the required forms accurately, providing all necessary details.

05

Submit the completed forms to the appropriate regulatory agency, ensuring that you meet any deadlines.

06

Keep a copy of the submitted documents for your records.

Who needs Regulation AA - Unfair or Deceptive Acts or Practices?

01

Businesses that offer consumer credit or financial services.

02

Financial institutions that need to comply with federal regulations.

03

Companies that want to ensure fair practices in their marketing and customer service.

04

Consumers who may file complaints against unfair or deceptive business practices.

Fill

form

: Try Risk Free

People Also Ask about

What has been considered a deceptive practice by some regulators?

Examples of UDAAP include failing to provide customers with promised services, using bait-and-switch tactics, and misleading consumers about costs and prices for products and services.

What is unfair or deceptive acts or practices Regulation AA?

Regulation AA (Unfair or Deceptive Acts or Practices) was a regulation created by the Federal Reserve to address practices by banks that consumers believed to be unfair. Regulation AA was created in 1985 and repealed in 2016.

What are deceptive practices in consumer protection?

There must be a representation, omission, or practice that misleads or is likely to mislead the consumer. An act or practice may be found to be deceptive if there is a representation, omission, or practice that misleads or is likely to mislead a consumer.

What are examples of unfair acts or practices?

Acts or practices that have the potential to be deceptive include: making misleading cost or price claims; using bait-and-switch techniques; offering to provide a product or service that is not in fact available; omitting material limitations or conditions from an offer; selling a product unfit for the purposes for

What is the unfair or deceptive act or practices rule?

On April 1, 2022, UDAP Rule took effect. The rule was approved by the Minister of Finance on February 16, 2022. The rule strengthens the supervision of insurance industry conduct and enhances consumer protection by clearly defining outcomes that are unfair or otherwise harmful to consumers.

What is the unfair or deceptive acts or practices act?

An act or practice is unfair where it (1) causes or is likely to cause substantial injury to consumers, (2) cannot be reasonably avoided by consumers, and (3) is not outweighed by countervailing ben- efits to consumers or to competition.

What are the unfair acts?

The Intolerable Acts, sometimes referred to as the Insufferable Acts or Coercive Acts, were a series of five punitive laws passed by the British Parliament in 1774 after the Boston Tea Party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation AA - Unfair or Deceptive Acts or Practices?

Regulation AA is a set of rules established by the Federal Reserve to prevent unfair or deceptive acts or practices in the extension of credit, particularly in consumer financial products.

Who is required to file Regulation AA - Unfair or Deceptive Acts or Practices?

Entities that offer or extend credit to consumers, including banks, credit unions, and other financial institutions, are generally required to comply with Regulation AA.

How to fill out Regulation AA - Unfair or Deceptive Acts or Practices?

Filling out reports under Regulation AA typically involves documenting compliance efforts and any instances of unfair or deceptive practices in credit extensions. Institutions must ensure transparency and maintain records of their practices.

What is the purpose of Regulation AA - Unfair or Deceptive Acts or Practices?

The purpose of Regulation AA is to promote fair treatment of consumers by prohibiting unfair and deceptive practices in the lending process, thereby ensuring a fair and competitive lending environment.

What information must be reported on Regulation AA - Unfair or Deceptive Acts or Practices?

Institutions must report specific information regarding any unfair or deceptive acts, including descriptions of the practices, the date of occurrence, and any corrective actions taken to rectify the issues.

Fill out your regulation aa - unfair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation Aa - Unfair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.