Get the free Offering Circular Supplement

Show details

This document serves as a supplement to the Offering Circular dated September 13, 1995, detailing the terms and characteristics of the 7.50% Fixed Rate Debentures due 2006 issued by the Federal Home

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offering circular supplement

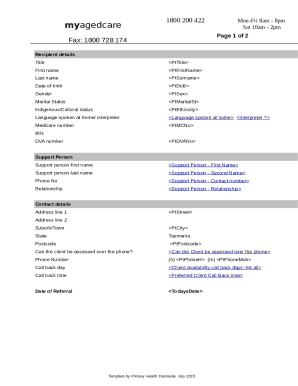

Edit your offering circular supplement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offering circular supplement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offering circular supplement online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit offering circular supplement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offering circular supplement

How to fill out Offering Circular Supplement

01

Identify the purpose of the Offering Circular Supplement.

02

Gather necessary documents and information related to the offering.

03

Fill out the cover page with the title and relevant dates.

04

Provide a summary of the offering details including securities being offered.

05

Include risk factors associated with the investment.

06

Describe the use of proceeds from the offering.

07

Detail the management team and their qualifications.

08

Provide financial statements and other relevant disclosures.

09

Review the completed form for accuracy.

10

Submit the Offering Circular Supplement to the appropriate regulatory body.

Who needs Offering Circular Supplement?

01

Investors looking to understand the details of a specific offering.

02

Companies issuing securities to provide additional information.

03

Financial advisors assisting clients with investment decisions.

04

Regulatory agencies requiring documentation for compliance.

05

Underwriters managing the offering process.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between offering memorandum and offering circular?

An offering circular includes several key components: a cover page detailing the name of the issuing company and the specifics of the securities being offered, summary information, risk factors, use of proceeds, description of the securities, business description, management and corporate governance information, and

What is the purpose of an offering circular?

An offering circular allows investors to access information regarding a new issue. It provides them with very important information about the security such as financial information about the issuer, the objective of the fund or purpose of the funds being raised, and other terms of the security issuance.

What is a listing circular?

Related Content. In the Listing Rules (LR), any document issued by a listed company to the holders of its listed securities including notices of meetings but excluding prospectuses, listing particulars, annual reports and accounts, interim reports, proxy cards and dividend or interest vouchers.

What is an offering circular used for?

A generic term applied to any document which is used to offer securities. Offering circulars are used on issues of all types of security, for example, shares and bonds.

What is the offering circular of a bond?

An offering memorandum (OM) or offering circular (OC) is a type of prospectus (finance) for a bond or other security. Sometimes, this is also referred to as a prospectus, offering memorandum, or short OC.

What are the contents of an offering circular?

An offering memorandum (OM) or offering circular (OC) is a type of prospectus (finance) for a bond or other security. Sometimes, this is also referred to as a prospectus, offering memorandum, or short OC.

What is the difference between offering circular and memorandum?

The offering memorandum document can also be referred to as an “offering circular” if it requires registration with the stock exchange commission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

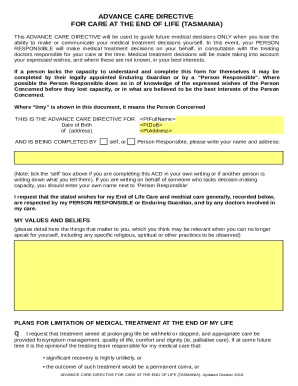

What is Offering Circular Supplement?

An Offering Circular Supplement is a document that provides additional information about a financial offering, often used in connection with securities offerings, to disclose material changes or updates to the information originally provided in the Offering Circular.

Who is required to file Offering Circular Supplement?

Entities involved in a securities offering, such as issuers and underwriters, are required to file an Offering Circular Supplement to ensure that investors receive timely and relevant updates or changes to the offering.

How to fill out Offering Circular Supplement?

To fill out an Offering Circular Supplement, follow the guidelines set by regulatory authorities, ensuring to include accurate updates, complete necessary sections, and reference the original Offering Circular while detailing any changes in material information.

What is the purpose of Offering Circular Supplement?

The purpose of an Offering Circular Supplement is to provide investors with timely updates on any material developments related to the offering, aiding in informed decision-making and compliance with disclosure requirements.

What information must be reported on Offering Circular Supplement?

Information that must be reported on an Offering Circular Supplement includes material changes in the business, financial condition, management, or any other significant developments that may impact investors' decisions.

Fill out your offering circular supplement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offering Circular Supplement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.