Get the free Farm Loan Programs; Clarification and Improvement - fsa usda

Show details

This document proposes amendments to the Farm Loan Programs regulations, aiming to streamline loan making and servicing processes while offering borrowers greater flexibility. It covers appraisal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm loan programs clarification

Edit your farm loan programs clarification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm loan programs clarification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing farm loan programs clarification online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit farm loan programs clarification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

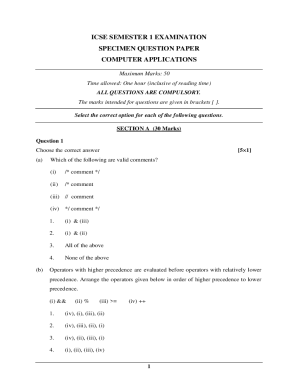

How to fill out farm loan programs clarification

How to fill out Farm Loan Programs; Clarification and Improvement

01

Gather necessary documents including identification and income statements.

02

Understand the specific type of farm loan program needed (e.g., direct loans, guaranteed loans).

03

Visit the official website of the Farm Service Agency (FSA) to access forms and guidelines.

04

Fill out the application form accurately, ensuring all information is complete.

05

Attach any required supporting documents, such as your farm business plan.

06

Review the completed application for errors or missing information.

07

Submit the application through the designated channels, either online or in person.

08

Follow up with the local FSA office to ensure the application is being processed.

Who needs Farm Loan Programs; Clarification and Improvement?

01

Farmers seeking financial assistance to start or expand their farm operations.

02

Ranchers looking for funding to improve livestock facilities or purchase equipment.

03

Agricultural producers needing support for purchasing land or making major renovations.

04

Young or beginning farmers needing capital to establish their agricultural business.

05

Minority farmers and those from historically underserved groups looking for equitable access to financial resources.

Fill

form

: Try Risk Free

People Also Ask about

What credit score is needed for a farm loan?

The credit score you need for a farm loan depends on your lenders, your personal finance history, and other factors relating to your loan request. As a baseline, you should maintain a credit score of at least 660, though most ag lenders will question a credit score below 700. However, there are exceptions.

How much down payment for a farm loan?

The Down Payment Farm Ownership loan is the only loan program that does not provide 100 percent financing. Down Payment loans require loan applicants to provide a minimum cash down payment of 5 percent of the purchase price of the farm.

How difficult is it to get a farm loan?

First time farmers can have a tough time qualifying for a loan. Like any business, it is hard to get financed when you don't have a track record of sales. Luckily, we are seeing a number of options that can help you get qualified. Loan financing can be a powerful tool when used properly.

What is the difference between a farm loan and a land loan?

Farm loans could also be made to pay living expenses until crop is harvested. Agricultural Land Loans on the other hand are made exclusively for the purchase of real estate used to produce farm products. They can also be used to refinance long term loans.

How difficult is it to get a farm loan?

First time farmers can have a tough time qualifying for a loan. Like any business, it is hard to get financed when you don't have a track record of sales. Luckily, we are seeing a number of options that can help you get qualified. Loan financing can be a powerful tool when used properly.

How much do you have to put down on a farm loan?

Direct Farm Ownership Down Payment Loan Down Payment loans require loan applicants to provide a minimum cash down payment of 5 percent of the purchase price of the farm.

Do you have to put 50% down on land?

Down Payment: The Federal Deposit Insurance Corp (FDIC) sets minimum down payment requirements for land loans. These range from 15-35% depending on the type of land, with undeveloped, raw land requiring the highest down payment. Keep in mind that these are minimums, and many lenders require up to 50% down.

What are the benefits of a farm credit loan?

Farm Ownership Loans can be used to purchase or expand a farm or ranch. This loan can help with paying closing costs, constructing or improving buildings on the farm, or to help conserve and protect soil and water resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Farm Loan Programs; Clarification and Improvement?

Farm Loan Programs are financial assistance initiatives provided by the government aimed at supporting farmers through loans that help with purchasing land, equipment, and other farm-related expenses. Clarification and improvement efforts seek to streamline the application process and enhance program effectiveness.

Who is required to file Farm Loan Programs; Clarification and Improvement?

Farmers and agricultural producers who are seeking financial assistance through government-backed loans are required to file for Farm Loan Programs. This includes individual farmers, farming partnerships, corporations, and cooperatives engaged in agricultural production.

How to fill out Farm Loan Programs; Clarification and Improvement?

To fill out Farm Loan Programs applications, applicants should gather required documents such as financial statements, business plans, and proof of income. They can then complete the application form, ensuring all information is accurate and complete, before submitting it online or in person to the designated lending authority.

What is the purpose of Farm Loan Programs; Clarification and Improvement?

The primary purpose of Farm Loan Programs is to provide financial support to farmers to ensure the sustainability of agricultural operations. These programs aim to improve access to capital, promote responsible farming practices, and enhance overall agricultural productivity.

What information must be reported on Farm Loan Programs; Clarification and Improvement?

When applying for Farm Loan Programs, applicants must report personal and business information, financial documents, details about the proposed use of funds, repayment plans, and any relevant agricultural experience. Additionally, applicants may need to disclose their credit history and other financial obligations.

Fill out your farm loan programs clarification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Loan Programs Clarification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.