Get the free Notice IRM-353

Show details

This notice provides guidance on the eFiling process for USDA Farm Service Agency employees, detailing the procedures for submitting electronic forms (eForms), eAuthentication registration, and managing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice irm-353

Edit your notice irm-353 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice irm-353 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice irm-353 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice irm-353. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

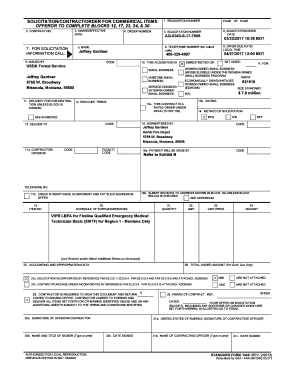

How to fill out notice irm-353

How to fill out Notice IRM-353

01

Obtain the Notice IRM-353 form from the official IRS website or your local IRS office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Provide the relevant details regarding the notices or issues you are responding to in the appropriate sections.

05

Attach any supporting documents or evidence that may be needed to substantiate your claims or responses.

06

Review the completed form for accuracy before submission.

07

Submit the form according to the instructions provided, ensuring you keep a copy for your records.

Who needs Notice IRM-353?

01

Individuals or businesses who have received an IRS notice regarding their tax responsibilities.

02

Taxpayers who need to clarify or dispute information related to their tax returns.

03

Those who are responding to a request for additional information from the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Why would the IRS send a registered letter?

IRS collection actions: When the IRS initiates collection activities for unpaid federal taxes, certified letters are sent to notify taxpayers of the actions being taken. This may include notices of liens, levies, or other enforcement actions.

What does it mean when IRS sends you a letter?

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

How do you know if the IRS is investigating you?

Signs That The IRS Might Be Investigating You IRS Agents And Auditors Have Stopped Contacting You. Your Bank Records are Being Subpoenaed. Your Previous Tax Returns are Being Audited. Disproportionate Interest in Specific Transactions. You're Contacted by The Criminal Investigation Division's Special Agent.

What does IRM stand for in taxes?

Abbreviation, Internal Revenue Manual Below is a pertinent abbreviation. Internal Revenue Manual=I.R.M. or IRM.

Why is the Internal Revenue Service sending me a letter?

The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment.

How do I request to be released from the withholding compliance program?

To make the request, you will be required to submit a new Form W-4 along with other documentations to prove that your financial situation has changed. In most cases, the IRS will require you to send the request directly to them and not your employer, often through the contact details provided in your lock-in letter.

What does IRM stand for?

Integrated Risk Management (IRM) Integrated Risk Management (IRM) is an organizationwide discipline informed by certain attributes, including strategy, assessment, response, communication and reporting, monitoring and technology.

Can you view IRS notices online?

You can find digital copies of most IRS notices in your online account, under the 'Notices and Letters' section.

What does IRM stand for in IRS?

IRM: What is the Internal Revenue Manual (IRM)

What is the difference between the IRC and the IRM?

In summary, the IRC provides the legal framework for taxation in the U.S., establishing and codifying the tax laws that both taxpayers and the IRS must follow. In contrast, the IRM offers detailed instructions and guidelines to IRS employees on how to administer and enforce the tax laws outlined in the IRC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice IRM-353?

Notice IRM-353 is a form issued by the IRS that provides guidance and notification related to specific tax matters, typically regarding certain compliance issues or reporting requirements.

Who is required to file Notice IRM-353?

Individuals or entities that are involved in specific transactions or activities outlined by the IRS in Notice IRM-353 are required to file this notice.

How to fill out Notice IRM-353?

To fill out Notice IRM-353, follow the instructions provided by the IRS, ensuring all required fields are completed accurately and any supporting documentation is attached.

What is the purpose of Notice IRM-353?

The purpose of Notice IRM-353 is to ensure compliance with IRS regulations by informing and guiding taxpayers on their obligations related to certain tax matters.

What information must be reported on Notice IRM-353?

The information that must be reported on Notice IRM-353 typically includes details about the taxpayer's identity, the nature of the transactions, and any relevant financial data required by the IRS.

Fill out your notice irm-353 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Irm-353 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.