Get the free Notice IRM-403 - fsa usda

Show details

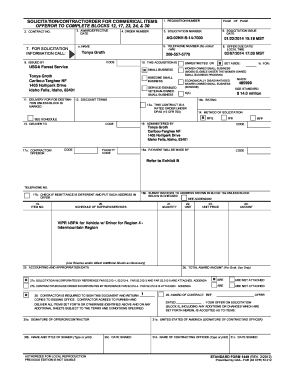

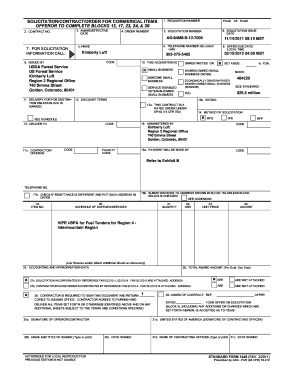

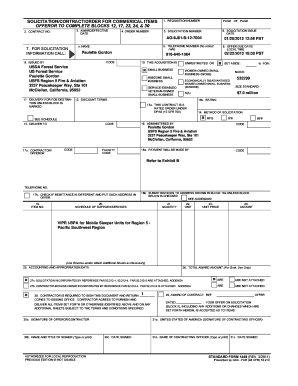

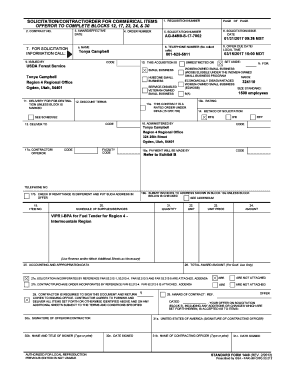

This document outlines the mandatory training requirements for USDA employees and contractors regarding computer security and privacy basics for FY 2008, including completion deadlines and guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice irm-403 - fsa

Edit your notice irm-403 - fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice irm-403 - fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice irm-403 - fsa online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notice irm-403 - fsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice irm-403 - fsa

How to fill out Notice IRM-403

01

Obtain a copy of Notice IRM-403 from the appropriate source.

02

Read the instructions provided on the notice carefully.

03

Fill in your personal information in the designated sections, including name and address.

04

Provide any requested details related to your case or situation.

05

Review all entries for accuracy and completeness.

06

Submit the completed Notice IRM-403 according to the submission guidelines provided.

Who needs Notice IRM-403?

01

Individuals who are involved in a specific tax-related process or audit.

02

Taxpayers who have received notification regarding their account.

03

Businesses that need to report certain information to tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

Where to fax a tax return?

However, if you do not have a legal residence, principal place of business, or primary office in any state, you can fax the IRS at 855-215-1627 if you are within the US, or at 304-707-9471 if you are outside the US.

What is the error resolution system for the IRS?

Error Resolution System Every tax return goes through a series of screenings that may flag an error or issue with the tax return that needs to be reviewed by an IRS employee. If a tax return is flagged, it is sent to the IRS Error Resolution System (ERS).

What does the IRS letter 6631 mean?

IRC 6631 provides that: The IRS must provide to individual taxpayers a computation of the underpayment interest with every IRS notice that includes an amount of interest required to be paid by the taxpayer and a citation to the Code section under which such interest is imposed.

How much do you have to owe the IRS to be denied a passport?

The Steps Leading Up to Passport Denial You owe a total $59,000 or more in past due taxes, penalties and interest (as of 2023). The IRS must file a notice of federal tax lien, and you must have had your Collection Due Process hearing or missed your deadline for the hearing. The IRS must issue a levy against you.

What does it mean if the IRS is holding your refund?

You filed your tax return and the IRS received it. The IRS is holding your refund while it is verifying the accuracy of your return, including one or more of the following you may have reported: credits, income (e.g., wages) and withholding that were reported on your return.

What is a CP508C?

IRS Notice CP508C – Notice of Certification of Your Seriously Delinquent Federal Tax Debt to the State Department.

Does notice of deficiency mean I owe money?

This is a notice that the IRS has made the legal determination that you owe additional income taxes beyond what you reported on your federal income tax return. The notice includes information that they will propose a change to your tax return based on the other records they've received for that tax year.

What is a CP508C notice?

A CP508C Notice is a warning letter from the IRS declaring that your tax debt is “seriously delinquent.” In other words, you have significant tax debt and the IRS wants to incentivize you to pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice IRM-403?

Notice IRM-403 is a form used by certain taxpayers to report information regarding their tax liabilities and compliance with IRS regulations.

Who is required to file Notice IRM-403?

Taxpayers who meet specific criteria related to their tax obligations and compliance requirements are required to file Notice IRM-403.

How to fill out Notice IRM-403?

To fill out Notice IRM-403, taxpayers must provide required information regarding their tax situation, including personal details, financial data, and any relevant compliance documentation as outlined in the instructions.

What is the purpose of Notice IRM-403?

The purpose of Notice IRM-403 is to ensure that the IRS has accurate information regarding a taxpayer's compliance with tax laws and to facilitate any necessary follow-up or actions.

What information must be reported on Notice IRM-403?

The information that must be reported on Notice IRM-403 includes taxpayer identification details, relevant income and expense information, and any disclosures related to compliance with tax laws.

Fill out your notice irm-403 - fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Irm-403 - Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.