Get the free Notice 98-52 - gpo

Show details

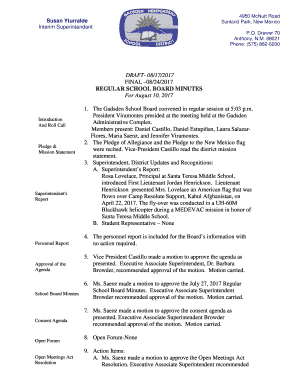

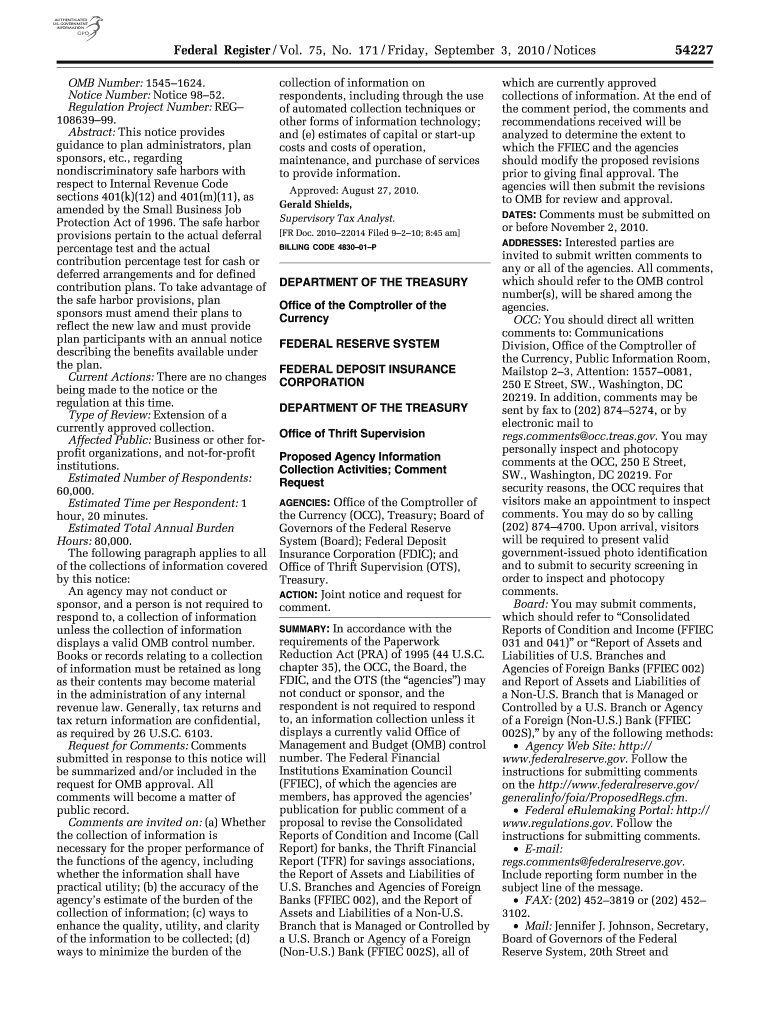

This notice provides guidance to plan administrators and sponsors regarding nondiscriminatory safe harbors related to certain Internal Revenue Code sections involving retirement plans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice 98-52 - gpo

Edit your notice 98-52 - gpo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice 98-52 - gpo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice 98-52 - gpo online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice 98-52 - gpo. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice 98-52 - gpo

How to fill out Notice 98-52

01

Obtain a copy of Notice 98-52 from the IRS website.

02

Read the instructions and guidelines provided in the notice.

03

Fill out your personal identification information, including your name, address, and tax identification number.

04

Provide information about the qualified expenses for the tax year you are reporting.

05

Ensure that you have supporting documentation for all claims made.

06

Double-check all entries for accuracy before submission.

07

Submit the completed Notice 98-52 to the appropriate IRS address as indicated in the notice.

Who needs Notice 98-52?

01

Individuals or entities that qualify for certain tax credits or deductions as outlined in Notice 98-52.

02

Taxpayers who have incurred specific expenses that can be reported to the IRS for tax benefits.

03

Accountants and tax professionals assisting clients with their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What does safe harbor non-elective contribution mean?

QACA Safe Harbor Non-Elective Contribution Formula: In a QACA non-elective safe harbor 401(k) plan, employers must contribute a minimum of 3% of pay for every eligible employee, regardless of whether the employee chooses to defer contributions. Automatic enrollment is required, and a 2-year vesting schedule is allowed.

What is the formula for safe harbor contribution?

A basic safe harbor matching formula requires a match rate of 100% of employee deferrals up to 3% of compensation plus 50% of employee deferrals between 3% – 5% of compensation, for a maximum match of 4% of eligible compensation.

Who qualifies for safe harbor?

Estimated tax payment safe harbor details The IRS will not charge you an underpayment penalty if: You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year, or. You owe less than $1,000 in tax after subtracting withholdings and credits.

What is a safe harbor notice for a 401k?

A safe harbor 401(k) plan requires the employer to provide: timely notice to eligible employees informing them of their rights and obligations under the plan, and. certain minimum benefits to eligible employees either in the form of matching or nonelective contributions.

What is a 401k safe harbor notice?

A safe harbor 401(k) plan requires the employer to provide: timely notice to eligible employees informing them of their rights and obligations under the plan, and. certain minimum benefits to eligible employees either in the form of matching or nonelective contributions.

What is the difference between safe harbor 401k and regular 401k?

A safe harbor 401(k) plan is similar to a traditional 401(k) plan, but, among other things, it must provide for employer contributions that are fully vested when made.

What is the disadvantage of safe harbor 401k?

The main drawbacks of safe harbor plans are the mandatory employer contribution and immediate vesting requirements. That means less flexibility for the business and potentially higher costs. Some employers also don't love that they can't use vesting as a retention tool.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice 98-52?

Notice 98-52 is a guidance issued by the IRS regarding the reporting requirements for certain distributions to beneficiaries from retirement plans.

Who is required to file Notice 98-52?

Plan administrators of retirement plans that make distributions to beneficiaries are required to file Notice 98-52.

How to fill out Notice 98-52?

To fill out Notice 98-52, plan administrators must provide the necessary information about the distribution, including the recipient's name, the amount distributed, and the tax year applicable.

What is the purpose of Notice 98-52?

The purpose of Notice 98-52 is to clarify the reporting requirements and ensure that beneficiaries receive accurate information about their distributions for tax purposes.

What information must be reported on Notice 98-52?

Notice 98-52 must report information such as the beneficiary's name, Social Security number, the amount of distribution, and any federal income tax withheld.

Fill out your notice 98-52 - gpo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice 98-52 - Gpo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.