Get the free Confidentiality of Suspicious Activity Reports - gpo

Show details

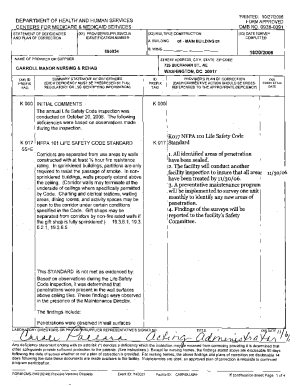

The rule amends the Bank Secrecy Act regulations regarding the confidentiality of suspicious activity reports (SARs) to clarify disclosure prohibitions and establish a safe harbor provision for financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confidentiality of suspicious activity

Edit your confidentiality of suspicious activity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confidentiality of suspicious activity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit confidentiality of suspicious activity online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit confidentiality of suspicious activity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

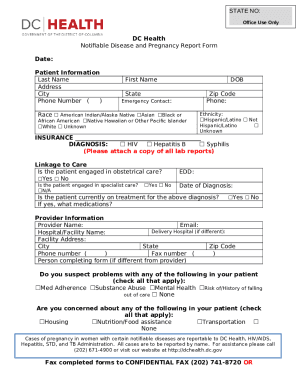

How to fill out confidentiality of suspicious activity

How to fill out Confidentiality of Suspicious Activity Reports

01

Obtain the Confidentiality of Suspicious Activity Reports form from your compliance department or appropriate regulatory authority.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the required fields with accurate information, such as the name of the reporting institution and the relevant dates.

04

Clearly state the reasons for confidentiality, citing applicable laws and requirements.

05

Indicate any necessary contacts for follow-up, ensuring confidentiality agreements are observed.

06

Review the completed form for accuracy and completeness.

07

Submit the form through the designated channels, ensuring it is sent securely to maintain confidentiality.

Who needs Confidentiality of Suspicious Activity Reports?

01

Financial institutions that report suspicious activities to regulatory authorities.

02

Compliance officers and legal teams within these institutions.

03

Law enforcement agencies that require confidentiality for ongoing investigations.

04

Customers or clients whose sensitive information might be involved in the reports.

Fill

form

: Try Risk Free

People Also Ask about

Are SAR filings confidential?

A SAR and any information that would reveal the existence of a SAR, are confidential, except as is necessary to fulfill BSA obligations and responsibilities.

Can you share a Suspicious Activity Report?

The recipient head office, controlling entities or parties may not disclose further any Suspicious Activity Report, or the fact that such report has been filed; however, the institution may disclose without permission underlying information (that is, information about the customer and transaction(s) reported) that does

Who can you share a SAR with?

regulatory agencies, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC)), the sharing of SAR information within an institution's corporate organizational structure, for purposes that are consistent with the Bank Secrecy Act, as determined by regulation or guidance.

Who do you send a suspicious activity report to?

A suspicious activity report (SAR) is a disclosure made to the National Crime Agency (NCA) about known or suspected: money laundering – under part 7 of the Proceeds of Crime Act 2002 (POCA)

What are the confidentiality requirements for suspicious activity reports?

Confidentiality of SARs Thus, the SAR Reporting Rule generally prohibits the disclosure of a SAR, or any information that would reveal the existence of a SAR—and specifically prohibits disclosure of this information by a broker-dealer, or any director, officer, employee, or agent of a broker-dealer.

Are suspicious activity reports confidential?

Confidentiality of SARs Thus, the SAR Reporting Rule generally prohibits the disclosure of a SAR, or any information that would reveal the existence of a SAR—and specifically prohibits disclosure of this information by a broker-dealer, or any director, officer, employee, or agent of a broker-dealer.

Can unusual activity referrals be shared outside the US?

A U.S. branch or agency of a foreign bank may share a SAR with its head office outside the United States. A U.S. bank may share a SAR with controlling companies whether domestic or foreign.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Confidentiality of Suspicious Activity Reports?

Confidentiality of Suspicious Activity Reports (SARs) refers to the legal protection and non-disclosure of the information contained in SARs, which are filed by financial institutions to report suspicious transactions that may indicate money laundering, fraud, or other illicit activities.

Who is required to file Confidentiality of Suspicious Activity Reports?

Financial institutions, including banks, credit unions, broker-dealers, and other entities regulated by the Bank Secrecy Act must file SARs when they detect suspicious activity that meets certain criteria.

How to fill out Confidentiality of Suspicious Activity Reports?

To fill out a Confidentiality of Suspicious Activity Report, a filer must identify the suspicious activity, provide detailed descriptions of the transaction and the involved parties, include relevant dates, amounts, and any other pertinent information, while adhering to the specific format and guidelines set by the Financial Crimes Enforcement Network (FinCEN).

What is the purpose of Confidentiality of Suspicious Activity Reports?

The purpose of Confidentiality of Suspicious Activity Reports is to assist law enforcement in identifying and investigating potential criminal activities while protecting the identities of the filers and subjects of the report, thus encouraging reporting without fear of backlash.

What information must be reported on Confidentiality of Suspicious Activity Reports?

Information that must be reported on Confidentiality of Suspicious Activity Reports includes the nature of the suspicious activity, the details of the transaction, identifying information about the parties involved, and any other relevant information that aids in the investigation of the suspected illegal activity.

Fill out your confidentiality of suspicious activity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confidentiality Of Suspicious Activity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.