Get the free General Reporting and Recordkeeping by Savings Associations and Savings and Loan Hol...

Show details

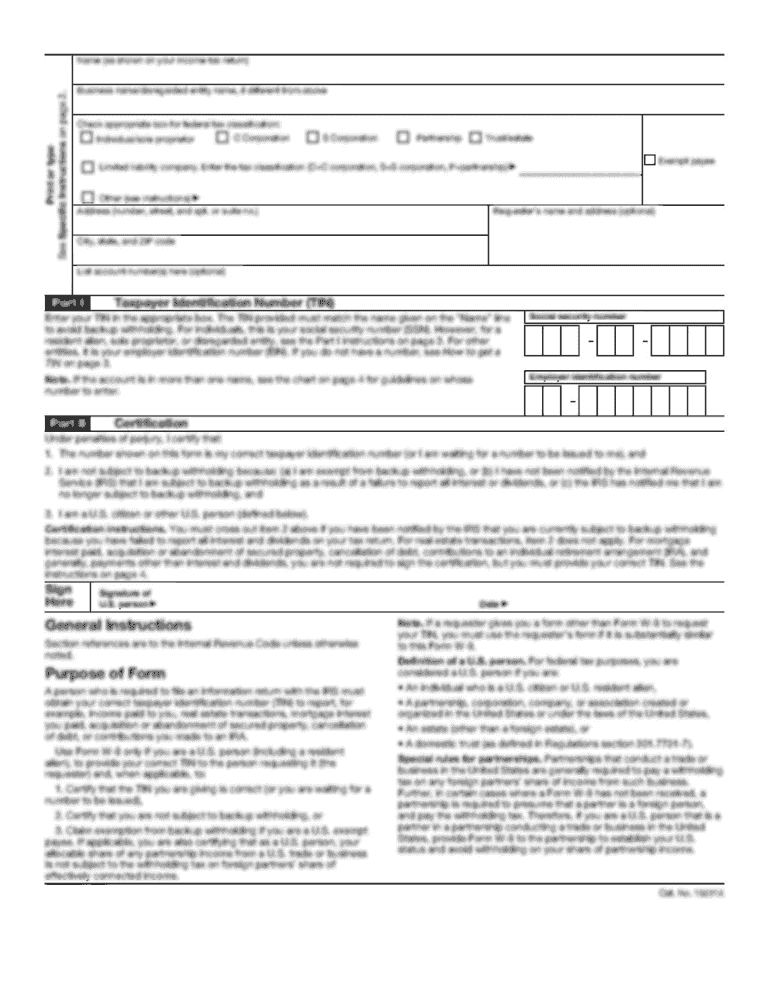

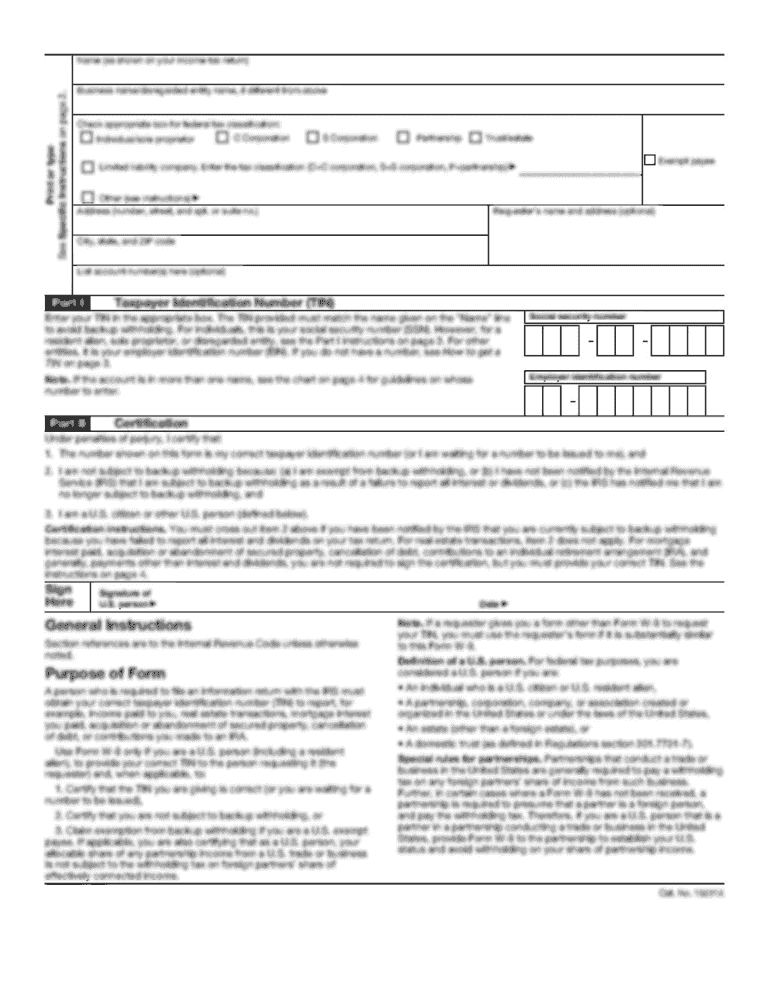

This document is a notice from the Office of Thrift Supervision announcing the proposed collection of information regarding reporting and recordkeeping by savings associations and savings and loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general reporting and recordkeeping

Edit your general reporting and recordkeeping form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general reporting and recordkeeping form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general reporting and recordkeeping online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit general reporting and recordkeeping. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general reporting and recordkeeping

How to fill out General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies

01

Gather required financial information and data relevant to your institution's operations.

02

Identify the specific reports needed based on regulatory requirements for savings associations and holding companies.

03

Access the necessary forms and guidelines provided by the regulatory authority.

04

Fill out each section of the report accurately, ensuring all figures reflect the institution's actual financial status.

05

Review the completed report for accuracy and completeness before submission.

06

Submit the report within the specified deadline through the designated platform or method outlined by the regulatory agency.

Who needs General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

01

Savings associations that hold customer deposits and offer financial services.

02

Savings and loan holding companies that supervise savings associations.

03

Regulatory bodies that require periodic reporting for monitoring compliance and financial health.

Fill

form

: Try Risk Free

People Also Ask about

What are savings and loan holding companies?

A Savings and Loan Holding Company (SLHC) is a company that owns or controls one or more savings association subsidiaries. The Board of Governors is responsible for regulating and supervising SLHCs.

What is the savings and loan association?

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans.

What governs the practices of savings and loan associations?

The regulations of the Comptroller and the policies of the Comptroller and the Corporation governing the safe and sound operation of savings associations, including regulations and policies governing asset classification and appraisals, shall be no less stringent than those established by the Comptroller for national

What is the difference between savings and loan associations and savings banks?

However, unlike most banks, savings and loan associations focus on mortgages and savings accounts, and retail (individual) clients: They are limited in the extent of the commercial lending they can do. By law, 65 percent of their assets need to be in consumer loans or products.

Who regulates savings and loans associations?

We Regulate & Enforce The OCC is the primary regulator of banks chartered under the National Bank Act and federal savings associations chartered under the Home Owners' Loan Act.

Who owns savings and loans Associations?

Also known as savings banks, thrift institutions or just thrifts, S&Ls typically are private institutions owned by customers or shareholders, though some are publicly traded companies.

Who regulates savings associations?

National banks and federal savings associations are chartered and regulated by the Office of the Comptroller of the Currency.

Which federal agency regulates savings associations?

Share This Page: The Office of the Comptroller of the Currency (OCC) is an independent bureau of the U.S. Department of the Treasury. The OCC charters, regulates, and supervises all national banks, federal savings associations, and federal branches and agencies of foreign banks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

General Reporting and Recordkeeping refers to the regulatory requirements for savings associations and savings and loan holding companies to maintain accurate records and submit reports to ensure compliance with federal and state regulations.

Who is required to file General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

Savings associations and savings and loan holding companies that are chartered at the state or federal level are required to file General Reporting and Recordkeeping.

How to fill out General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

To fill out General Reporting and Recordkeeping, institutions must gather relevant data, follow specific instructions provided by regulatory authorities, and ensure that all information is accurate and submitted by the designated deadlines.

What is the purpose of General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

The purpose is to ensure transparency, accountability, and compliance within the financial sector, facilitating oversight and maintaining the stability of the financial system.

What information must be reported on General Reporting and Recordkeeping by Savings Associations and Savings and Loan Holding Companies?

Information required typically includes financial statements, compliance with regulations, transaction records, and any additional disclosures required by regulatory authorities.

Fill out your general reporting and recordkeeping online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Reporting And Recordkeeping is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.