Get the free Mutual Holding Company - gpo

Show details

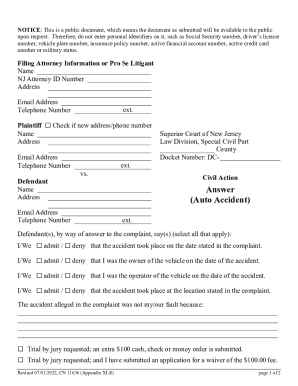

This document requests public comments and provides details on the application process for forming a mutual holding company, including the required information for compliance and regulatory review

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual holding company

Edit your mutual holding company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual holding company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual holding company online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mutual holding company. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual holding company

How to fill out Mutual Holding Company

01

Gather necessary documents such as the company’s articles of incorporation and bylaws.

02

Ensure compliance with state regulations regarding mutual holding companies.

03

Prepare a detailed plan of conversion that outlines the process and rationale.

04

Hold a meeting of company members to discuss the conversion and obtain their approval.

05

File the plan of conversion and supporting documents with the appropriate state regulatory authority.

06

Notify existing policyholders and stakeholders about the changes and their implications.

07

Establish governance structures and elect a board of directors for the mutual holding company.

08

Complete any required financial disclosures and reports to maintain transparency.

09

Finalize the conversion process by adhering to any remaining regulatory stipulations.

Who needs Mutual Holding Company?

01

Financial institutions looking to enhance their capital structure.

02

Insurance companies seeking to provide more flexible ownership options.

03

Investors interested in a model that blends mutuality and stockholder benefits.

04

Companies aiming for a more stable financial footing while maintaining customer loyalty.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a holding company and a regular company?

To sum it up, a holding company is a parent company that owns and controls other companies and in many cases does not produce any goods or services or conduct business operations of its own. Holding companies and operating companies are used by businesses of all sizes and in all industries.

What are the disadvantages of a mutual insurance company?

Disadvantages of a Mutual Insurance Company Here are some of the main cons: A mutual insurance company relies on its policy premiums as their main source of income. This means that if they're unable to raise enough funds they could be put out of business.

What are the benefits of a mutual company?

As a mutual owner of the company, you will share in its success. If the company meets or exceeds its financial goals for the year, it will often return a portion of its profits back to its policyholders in the form of dividends, similar to how a stock company pays dividends to its shareholders.

What are the disadvantages of a holding company?

A holding company is a parent company—usually a corporation or LLC — whose purpose is to buy and control the ownership interests of other companies. The companies that are owned or controlled by a corporation holding company or an LLC holding company are called its subsidiaries.

What are the disadvantages of a mutual insurance company?

The disadvantages are: Complexity: Managing multiple subsidiaries increases organizational complexity. Regulatory compliance: Requires adherence to diverse regulatory frameworks. Cost: Higher administrative and legal costs due to multiple entities.

What is a mutual holding company?

Disadvantages of a Mutual Insurance Company Here are some of the main cons: A mutual insurance company relies on its policy premiums as their main source of income. This means that if they're unable to raise enough funds they could be put out of business.

How does a mutual holding company work?

A thrift holding company that is owned by shareholders but controlled by the depositors of the subsidiary thrift. A mutual holding company holds a majority of the voting stock of the subsidiary thrift, while the remaining 49.9% of the thrift's stock can be sold to outside investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mutual Holding Company?

A Mutual Holding Company is a type of financial institution, particularly in the insurance and banking sectors, that is owned by its members (policyholders or depositors) rather than shareholders. It operates for the benefit of its members and aims to provide financial services without the pressure of delivering profits to external shareholders.

Who is required to file Mutual Holding Company?

Entities that are structured as Mutual Holding Companies and wish to maintain their status must file required documents with regulatory authorities, including federal and state insurance or banking regulators, depending on their specific industry.

How to fill out Mutual Holding Company?

To fill out Mutual Holding Company paperwork, one must provide detailed information about the company’s structure, ownership, financial status, and compliance with applicable regulations. This often includes providing financial statements, member lists, and descriptions of the company's purpose and operations.

What is the purpose of Mutual Holding Company?

The purpose of a Mutual Holding Company is to serve its members by providing them with financial products and services while allowing for more flexibility in capital management compared to traditional stockholder-owned institutions. It prioritizes member interests over corporate profits.

What information must be reported on Mutual Holding Company?

Information that must be reported includes member demographics, financial statements (such as balance sheets and income statements), governance structure, performance metrics, and any changes in ownership or capital structure that may affect membership.

Fill out your mutual holding company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Holding Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.