Get the free Large Trader Reporting for Physical Commodity Swaps - gpo

Show details

This document outlines the final rule on large trader reporting for physical commodity swaps, detailing compliance requirements, definitions, and the framework for data submission and recordkeeping

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign large trader reporting for

Edit your large trader reporting for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your large trader reporting for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing large trader reporting for online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit large trader reporting for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

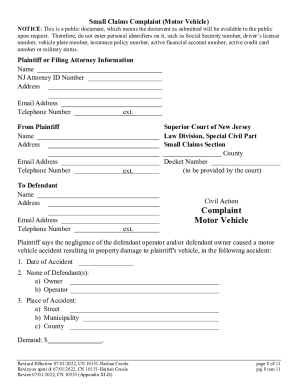

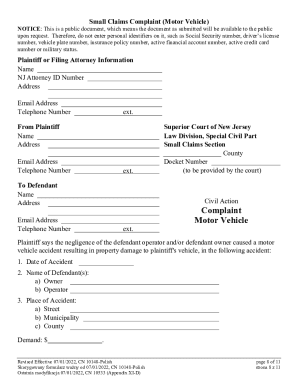

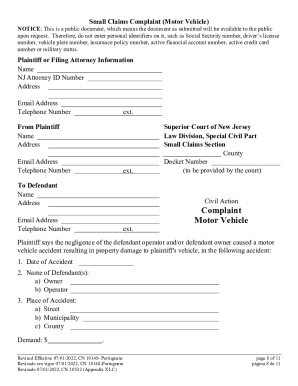

How to fill out large trader reporting for

How to fill out Large Trader Reporting for Physical Commodity Swaps

01

Obtain the Large Trader Reporting Form from the regulatory authority.

02

Review the definitions and requirements for physical commodity swaps as outlined by the regulations.

03

Gather necessary trading data including transaction details, counterparties, and positions.

04

Fill out the form with accurate trade data, ensuring to categorize each swap correctly.

05

Double-check the calculations for notional amounts and other relevant fields.

06

Submit the completed form by the regulatory deadline through the required electronic submission system.

Who needs Large Trader Reporting for Physical Commodity Swaps?

01

Large traders who engage in physical commodity swaps and exceed the reporting threshold set by the regulator.

02

Entities involved in commodities trading that may impact market stability or transparency.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to report to the CFTC?

Who Must File a Form 40 – Every person who holds or controls a reportable position must file a CFTC Form 40, Statement of Reporting Trader. (See section 18.04 of the regulations under the Commodity Exchange Act.) Persons include individuals, associations, partnerships, corporations, and trusts.

Are FX swaps reportable?

FX swaps and FX forwards are nonetheless subject to SDR reporting under CFTC Regulations, Part 45, and business conduct and anti-evasion requirements. purchase from an affiliate, a guarantee for the benefit of an affiliate or similar bona fide commercial transactions with an affiliate.

Are FX swaps regulated by CFTC?

As a result of being exempted or excluded from the definition of “swap” Window FX Forwards and Package FX Spot Transactions are not subject to most of the CFTC's swap regulations. These products are not required to be traded on a registered exchange or cleared through a registered clearinghouse.

Are FX swaps subject to mandatory clearing?

Because FX Swaps and FX Forwards are not defined as “swaps,” they are not considered when determining whether a fund is an “active fund” (a fund which executes 200 or more swaps per month) for purposes of complying with future mandatory clearing requirements.

How do you physically trade commodities?

Contracts form the backbone of physical commodity trading, establishing an agreement between two parties to buy and deliver a specific commodity. While the contracts can be tailored to meet the individual needs of the parties involved, they often use a standard template from a leading company.

What is swap dealer reporting?

Swap data reporting is a US obligation on swap dealers and end-users to report over-the-counter derivatives transactions to swap data repositories.

What are the risks of FX swaps?

The top risk with foreign currency swaps is currency risk. Currency risk arises from fluctuations in exchange rates between two currencies involved in the swap. When companies or financial institutions enter into a swap, they agree to exchange cash flows in different currencies at future dates.

Are FX forwards considered swaps?

CFTC Clarifies that FX Window Forwards are Not “Swaps” | Regulatory & Compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Large Trader Reporting for Physical Commodity Swaps?

Large Trader Reporting for Physical Commodity Swaps refers to the regulatory requirement for certain traders to report their swap trading activities involving physical commodities to regulatory authorities. This reporting is designed to provide oversight and transparency in the commodities market.

Who is required to file Large Trader Reporting for Physical Commodity Swaps?

Entities or individuals who engage in substantial trading activities in physical commodity swaps, typically those whose positions exceed a specified threshold defined by the regulatory authority, are required to file Large Trader Reporting.

How to fill out Large Trader Reporting for Physical Commodity Swaps?

To fill out Large Trader Reporting for Physical Commodity Swaps, traders must collect relevant trading data, complete the required forms as specified by the regulatory authority, and submit the report by the deadlines set forth in the regulations.

What is the purpose of Large Trader Reporting for Physical Commodity Swaps?

The purpose of Large Trader Reporting for Physical Commodity Swaps is to enhance market transparency, monitor trading activities, prevent market manipulation, and ensure compliance with regulations that protect market integrity.

What information must be reported on Large Trader Reporting for Physical Commodity Swaps?

Information required for Large Trader Reporting typically includes the trader's identity, details of swap transactions (such as dates, quantities, and prices), as well as the types of commodities involved and any other relevant trading metrics as designated by the regulatory authority.

Fill out your large trader reporting for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Large Trader Reporting For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.