Get the free Quarterly Survey of Public Pensions - gpo

Show details

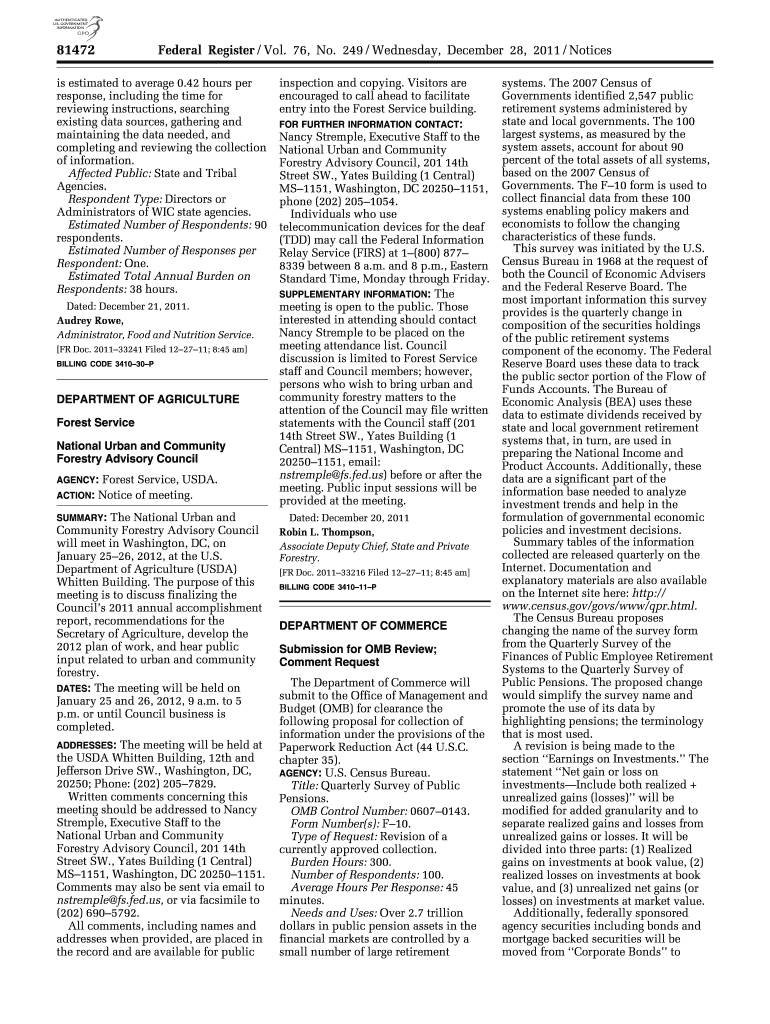

The document outlines the collection of financial data from public pension systems administered by state and local governments to track investment trends and support economic policy formulation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly survey of public

Edit your quarterly survey of public form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly survey of public form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quarterly survey of public online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit quarterly survey of public. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly survey of public

How to fill out Quarterly Survey of Public Pensions

01

Gather necessary financial data from pension funds for the quarter.

02

Review the specific reporting requirements outlined in the survey instructions.

03

Fill in the general information section, including pension fund name and contact details.

04

Complete the asset and liability sections with accurate financial figures.

05

Ensure all calculations are accurate and supported by documentation.

06

Review your responses for completeness and correctness.

07

Submit the survey by the specified deadline.

Who needs Quarterly Survey of Public Pensions?

01

State and local government pension fund administrators.

02

Financial analysts and researchers in public pension management.

03

Policy makers interested in public pension data.

04

Government agencies requiring consistent pension fund reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is the census Employee Assistance Program?

The U.S. Census Bureau Employee Assistance Program (EAP) is a voluntary, confidential program for all employees, supervisors, and managers. The EAP is a benefit that offers professional counseling, resources, management consultation, appropriate referral information and work/life programs.

What is the pension census?

The Quarterly Survey of Public Pensions is a quarterly survey that provides national summary data on the revenues, expenditures, and composition of assets of the largest defined benefit public employee pension systems for state and local governments.

Where does public pension money come from?

Some people believe that taxpayers fund the total cost of public pensions. This isn't true. The largest contribution comes from CalPERS' investments, with additional funding from employer and employee contributions. Some workers currently contribute up to 17% of their paychecks to help fund their own pensions.

What is the difference between a private pension and a public pension?

Compared to public pension funds, private pensions have more legal protections. By law, private companies must make sure their pension funds have adequate funding. Also, they must ensure their pensions by paying premiums to the Pension Benefit Guaranty Corporation.

How much is the pension amount?

The amount of pension is 50% of the emoluments or average emoluments whichever is beneficial. Minimum pension presently is Rs. 9000 per month.

What is a retirement census?

This document will contain information for each employee of the company including: Name. Date of birth. Date of hire. Compensation and amounts contributed to the 401(k) plan during the year.

Are public pensions guaranteed?

Group pension plans provide guaranteed, monthly income for life, enhancing retirement security for those who have them. COLAs help protect the value of the benefits retirees have earned. Pensions are the most economically efficient way to fund an adequate retirement, making them a good use of taxpayer dollars.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Survey of Public Pensions?

The Quarterly Survey of Public Pensions is a report produced by the U.S. Census Bureau that collects financial data from state and local government pension systems on a quarterly basis.

Who is required to file Quarterly Survey of Public Pensions?

State and local government pension systems that manage retirement funds for their employees are required to file the Quarterly Survey of Public Pensions.

How to fill out Quarterly Survey of Public Pensions?

To fill out the Quarterly Survey of Public Pensions, respondents should gather financial data for the quarter, complete the provided forms accurately, and submit them through the online portal or by mail as per the instructions provided by the U.S. Census Bureau.

What is the purpose of Quarterly Survey of Public Pensions?

The purpose of the Quarterly Survey of Public Pensions is to provide timely and accurate financial information on public pension funds, which helps in assessing the financial condition and performance of these pension systems.

What information must be reported on Quarterly Survey of Public Pensions?

The information that must be reported includes details on contributions, benefits paid, investment earnings, and other financial transactions related to public pension funds for the reporting quarter.

Fill out your quarterly survey of public online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Survey Of Public is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.